- Big tech crushed – but I think it goes lower

- October’s strong job gains gives Fed no reason to pause

- Need to see “peak yields” before the market bottoms

And so comes the end of another volatile trading week…

Never a dull moment!

I trust you are not getting killed in the chop.

I am not a day trader (not my thing) – but I tip my hat to anyone who can consistently pick the direction of the market on a regular basis.

Good luck!!

Very few day traders I know make money… but their brokers love them.

After the reality of the Fed sunk in (if it wasn’t already clear after Jackson Hole) – we were treated to October payrolls.

The data showed 261,000 job additions last month.

That’s a green light for the Fed… or a reason to not hit pause.

However, unemployment ticked slightly higher to 3.7%.

A sign of things to come?

The Fed hopes so.

Next Thursday we get the all-important CPI for October.

Expect it to be high; e.g., high 7’s or low 8’s.

Irrespective, it will do nothing to change the path of rate hikes.

Chairman Powell told us they will need to see several consecutive months of declines before they even consider a pause (let alone a cut).

And right now the monthly ‘count’ is zero.

Big Tech Crushed…

It’s often said that in a bear market – the highest quality names are last to be sold.

Maybe we’re closer to reaching that point?

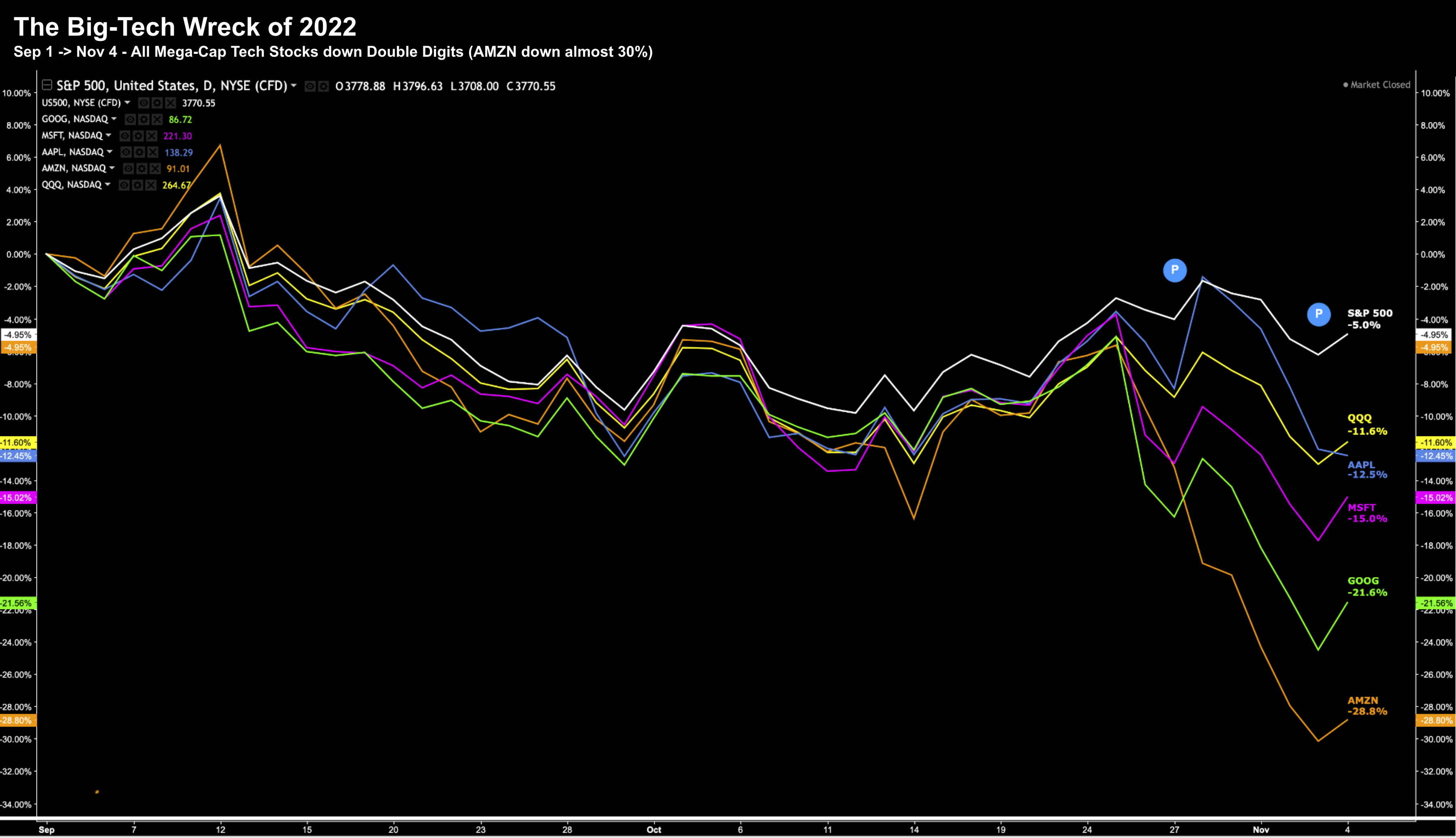

For example, the so-called “5-star generals” of the S&P 500 – Apple, Amazon, Microsoft and Google – are showing that even they are not immune from the mounting macro headwinds.

Here is how “mega-cap tech” (Facebook is no longer part of the group) has traded against the S&P 500 (white) over the past 8 weeks:

Nov 04 2022

Post earnings – each of these names has fallen off a cliff.

And whilst most posted results largely in-line – guidance was miserable (when offered).

Now I’m sure this feels painful for some (I own each of these stocks and have for many years) – however it’s also part of the bottoming process.

Tech multiples were still too high – trading as much as 24x forward early September.

I felt they needed to come down… below is my language from two months ago:

“With respect to the S&P 500 – if we assume earnings in the realm of “$230” per share (which I think is ~10% too high) – we’re trading ~17.5x forward. However, in terms of tech, the premium jumps to nearly 24x forward earnings. What has some investors excited is this is down from ~27x forward last year (around August)… but there’s more to go”

Here’s the headline, chart and forecast I shared 2 months ago… it would appear that things are “trading per the script”:

Nov 4 2022

Amazon is down a staggering 29%; and Google is down ~22% over the past eight weeks.

Even “recession proof” Apple has given back ~13% the past two months (most of that post earnings).

What’s more, each of these names are likely to trade lower (e.g., I see Apple testing $120 the next few weeks – maybe subject for another post)

Higher Yields = Lower Tech

It’s not difficult to explain why tech is under pressure…

Look no further than what we see with higher bond yields.

The higher yields trade – the more the future cash flows of these stocks will be discounted.

But let’s first revisit the relationship with bond yields.

For example, yesterday I shared this chart (the source of all the pain):

For those less familiar – the yield on the 2-year treasury tells you where the Fed is headed.

Bonds dictate terms to the Fed… not the other way around.

Today the 2-year is trading just under 4.70%… and likely to trade around that level (or higher) over the coming weeks.

Again, keep an eye on the 2-year post the CPI print next Thursday.

Now when I contrast the 2-year yield (white) with ETF QQQ – we see the inverse relationship:

Nov 4 2022

The exodus started when the 2-year yield started to rise late 2021.

That was when the Fed dropped the term “transitory” when describing inflation.

And as the 2-year continued to ascent – longer-duration assets (e.g. tech stocks) were crushed.

Now I’ve read that some economists see the US 2-year trading as high as 5.50% next year.

And that’s possible…

However, anything above 5.0% could push the economy (and market) to breaking point.

As I explained a couple of days ago post the Fed’s statement – leading financial indicators are starting to roll over.

Things are slowing (which the Fed acknowledged) and financial conditions have certainly tightened.

For example, look no further than what we see with the mortgage market… it has fallen off a cliff.

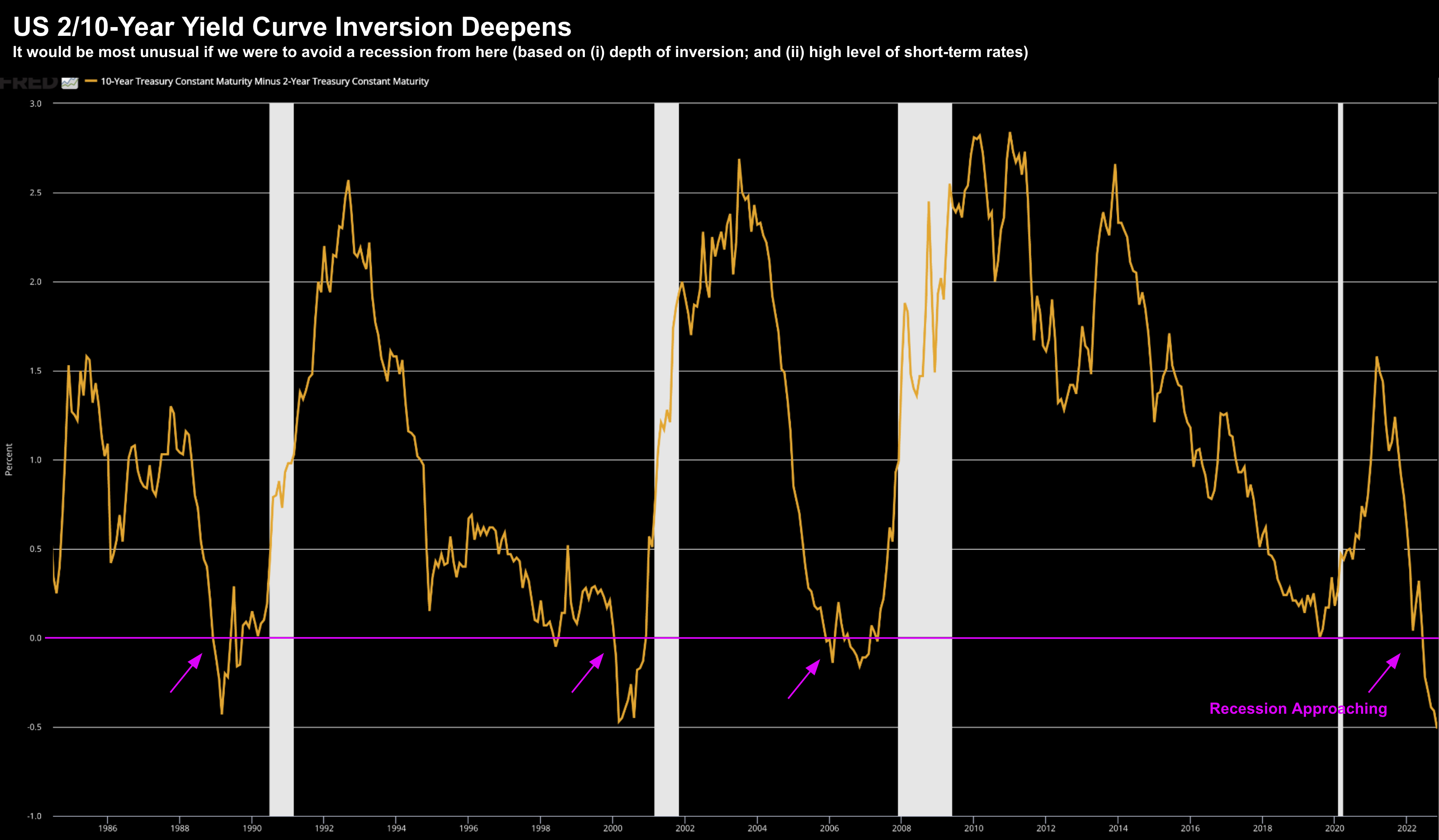

Now yield curve inversions also have a very good track record of preceding recessions.

And an inversion of 50 bps on the 10/2 is as deep as we have seen in 40 years…

The Fed will not be blind to these indicators….

But they also said the cost of not getting inflation under control far outweighs near-term pain.

If we are to plunge into a recession next year (which is my base case) — this will be good for bonds as rates will likely come down.

Note – this is why I am long TLT (via short puts)

But until we have a definitive peak in yields – tech will remain under pressure.

We are not quite there yet… but my best guess is it’s coming in 2023.

Navigating a Challenging Market

The reaction post Powell’s November Fed statement has been swift.

The S&P 500 saw its worst rout on a Fed decision day since January 2021.

Any possibilities around a pause or pivot are buried (or should be!)

But this remains a choppy market… very much determined by what we see with yields and the dollar.

For example, the dollar eased today which saw stocks (and gold) catch a small bid.

But I would not read too much into it.

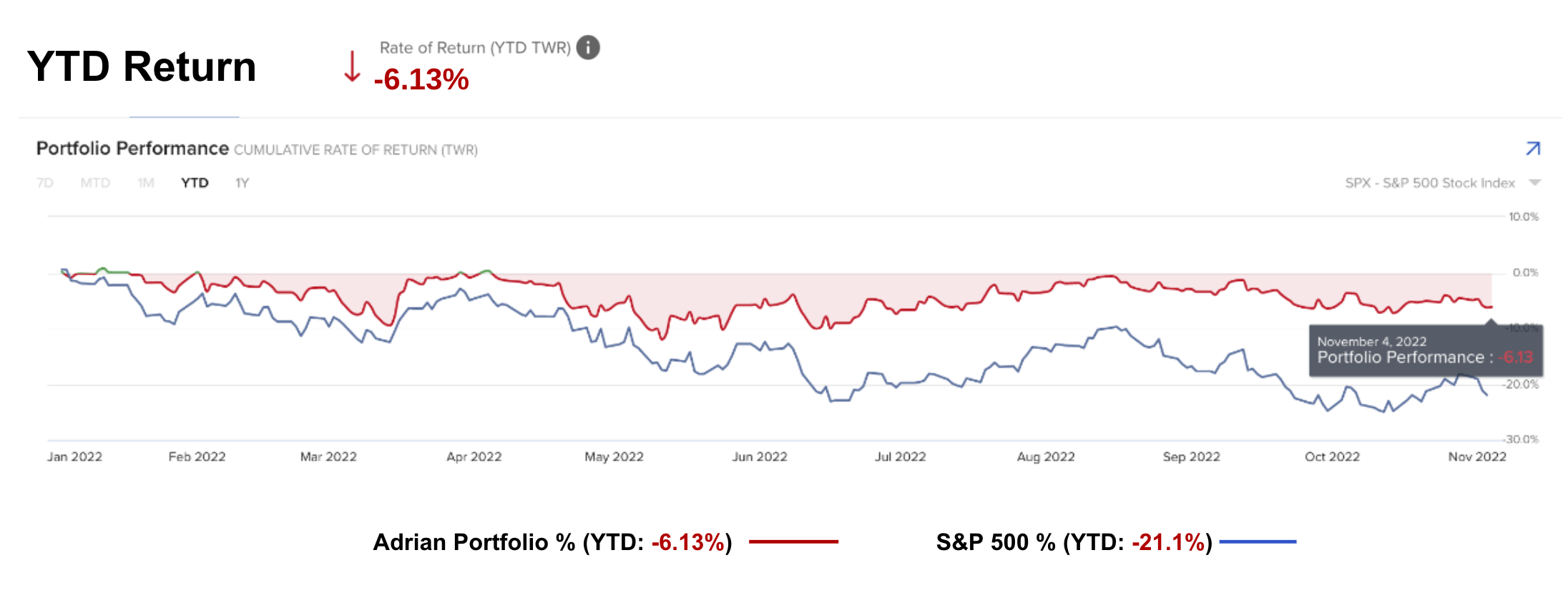

Now I mentioned I remain long large-cap tech.

And it’s been painful watching these trade lower — causing red-ink in part of my portfolio..

However, through a combination of lowering my overall exposure (and hedging positions through selling calls) – year-to-date my portfolio is down 6.13% vs the S&P 500 down 21.1%

A Race to the Finish for 2022

But I expect more pain in these long positions… especially tech.

I say that because you are going to see further earnings revisions… and multiples have room to move lower.

Earnings will contract during a recession – they won’t expand (as the market assumes)

That said, I think profitable large-cap tech stocks with strong moats and free cash flows – are exceptionally well positioned when bond yields inevitably reverse course.

My expectation for that is in the second half of 2023.

But in between now and then… I don’t think the lows have been made.