- Google and Microsoft revenue hit stall speed

- How much upside left in this bear market rally?

- JP Morgan cuts EPS growth for 2023 to zero

Yields and dollar down… stocks up.

That’s been your trading script for 2022.

It’s macro driven… but micro.

Lower yields means higher prices for stocks (for now at least). Put another way – earnings are taking a back seat

As forecast in recent missives – bond yields and the dollar have eased in recent weeks.

It was a case of too far too fast (see this post for both charts)

But how much further can this equity rally go?

10%? 15%? More?

My guess is not much more than ~5%… it’s getting closer to the end.

Don’t overstay your welcome!

The Rip Before the Dip

I’ve been calling it the “rip before the dip”

I was looking for a ‘10% type‘ rally before we face stiff selling pressure.

At its low – the S&P 500 traded at 3490. Today it pushed as high as 3863

That’s 10.7%

Impressive in just 3 short weeks.

And whilst there might be a ‘few more points’ in it — things are looking more expensive.

Oct 25 2022

- Our weekly trend remains bearish. For those less familiar, this means the red line (10-week EMA) is below that of the blue line (35-week EMA). This implies two things: (i) rallies are generally short and very sharp; and (ii) strength is generally sold around the 35-week EMA zone

- Three key support areas to highlight: (i) the previous major high of Sept 2020 (white horizontal line); (ii) 61.8% outside the distribution labelled A-B; and (iii) the 200-week EMA (purple line). Put together, technically this felt like it was going to act as a major area of support on any selling. We got it.

- The VIX (grew shaded area) has pulled back from levels of close to 35 to just 28 today. This tells me the market is feeling a little better about things however not quite in the clear.

- My final noteworthy observation is the purple shaded ellipse “zone of resistance”. This is where I think the current rally will exhaust itself. For example, if it can rally to around 4100 that is ~6% of upside (not much). In other words, if you are trying to catch this rally now, it’s too late. However, if you have long positions on that you are looking to reduce – between today’s close and 4100 is a good area to lower exposure.

For what it’s worth, my estimates above may be completely wrong.

I certainly don’t pretend to know how high the market will go over the coming few weeks.

Who does?

I don’t have a crystal ball and get plenty of things wrong!

It could rally another “20%” – for example we saw bear market rallies of that magnitude in both 2001 and 2008. But I think the probabilities are low.

Not only technically does the chart look bearish (weekly timeframe) — fundamentally the picture continues to get weaker.

Put another way, the higher the S&P 500, the lower the risk / reward.

And at a level of around 3900 today – it’s not cheap.

JP Morgan: 0% EPS Growth for S&P in 2023

So let’s talk more to why anything around 4100 offers a poor risk / reward entry.

Today I was listening to JP Morgan’s Chief Global Market Strategist – Marko Kolanovic – on his outlook for 2023.

For 2022 full year earnings – he thinks the S&P 500 will end around $225 per share.

And based on what we have heard so far – that’s inline with consensus (despite weaker than expected earnings from Google and Microsoft today — more on this below)

However, looking ahead he’s concerned.

This echoes my sentiment of the past few weeks.

I have said I’m worried less about Q3 (and possibly Q4) earnings – however my concern is 2023.

And specifically that earnings assumptions (for 8% growth) were far too high.

Today Kolanovic has cut his 2023 earnings target to $225 from $240.

This implies flat earnings year-on-year (vs 8% growth)

As readers will know, I’ve been calling earnings to decline (not grow) – perhaps falling to the realm of $210 per share.

Now if we assume his $225 at a 15x multiple – that puts the S&P 500 at 3400.

But at today’s close of 3859 – that multiple expands to 17.1x (i.e., little room for upside)

Now up until two months ago, Kolanovic’s price target for the S&P 500 this year was 4700 (implying a forward PE of 21x).

That’s gone.

However, given the recent policy moves from the Fed Reserve (and where they think rates will go), they have lowered that target considerably.

He commented that at “some point” (later) in 2023 – we will see a Fed pivot. For example, Kolanovic thinks they will be forced to pivot based on one (or more) of the following:

- Threats to the financial system (e.g. what we see in some bond markets internationally)

- A meaningful reversal with stickier inflation; and

- Recession risks – specifically where the employment situation deteriorates sharply (e.g. 5%+ unemployment vs today’s 3.5%)

None of those things are in play today…

But are likely to gain more traction as we head further into 2023.

To that end, Kolanovic also sees rates getting closer to topping out. And whilst he doesn’t think they are there yet (and may have further go) – we are closer to the end.

I agree…. and I will offer a trade (using TLT) I placed based on this thesis shortly.

But first, earnings from Google and Microsoft today only add to Kolanovic’s sentiment.

Both reported disappointing earnings…

And this is what will “make or break” the current rally.

Microsoft and Google Disappoint

At the time of writing, stocks of these two tech giants are each down around 6%

In full disclosure, I work for Google and it remains my largest single position.

Microsoft is my second largest position.

Let’s start with Microsoft:

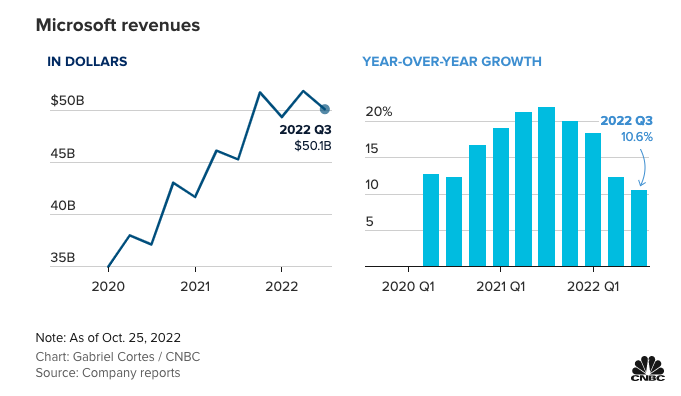

- Earnings: $2.35 per share, vs. $2.30 per share as expected

- Revenue: $50.12 billion, vs. $49.61 billion as expected

On the surface the “beats” on both the top and bottom lines look good – however it was the forward guidance which sent the stock reeling.

Microsoft sees $52.35 billion to $53.35 billion in revenue for the fiscal second quarter, which implies 2% growth at the middle of the range.

Analysts polled by Refinitiv had been looking for revenue of $56.05 billion.

What’s more, Microsoft’s implied operating margin for the fiscal second quarter was about 40%, narrower than the 42% consensus among analysts.

However, what perhaps shocked analysts was the rapid decline in PC sales and the Windows OS (which echoes what we have heard from the likes of AMD and others)

Revenue from sales of Windows licenses to device makers dropped 15% year over year, steeper than any quarter since 2015 and worse than the outlook CFO (Hood) gave in July for a decline in the high single digits.

The company said the PC market continued to deteriorate during the quarter.

On the surface, it was “less bad” quarter from the enterprise software giant.

But growth is clearly slowing – across all of its business units.

Here’s what matters:

Prior to today’s earnings call – it commanded 24x forward earnings – with revenue only growing 2% and slowing.

Microsoft deserves a premium to the broader market multiple (given the reliability (and strength) of its earnings and moat) – but 24x is expensive in a climate with nominal rates in excess of 4.50%

From mine, if you don’t have a position, start adding to Microsoft around $220 (i.e. around 21x forward).

And Google?

First the numbers reported:

- Earnings per share (EPS): $1.06 vs. $1.25 expected

- Revenue: $69.09 billion vs. $70.58 billion expected

- YouTube advertising revenue: $7.07 billion vs $7.42 billion expected

- Google Cloud revenue: $6.9 billion vs $6.69 billion expected

- Traffic acquisition costs (TAC): $11.83 vs $12.38 expected

For obvious reasons I won’t share anything that wasn’t already said publicly.

But what stood out to me is the total revenue growth of just 6% marked the weakest period of expansion since 2013.

And I think we can expect that to continue into Q4.

For example, on the earnings call, CFO Ruth Porat called out:

(a) very difficult comps YoY; and

(b) meaningful FX headwinds (i.e., strength of the dollar)

With respect to comps – this time last year Search grew at a whopping 44% YoY.

However, for the quarter just gone, Search only grew at 4%.

With respect to the strength of the dollar – Google much like Microsoft – isn’t immune to the strong macro headwinds.

But both companies are exceptionally well positioned…

For example, if we look back to Sept 2009, Google’s revenue only grew 7%

It was a difficult quarter as the economy struggled through a recession.

Fast forward 12 months to Sept 2010 – as the economy began to climb out of recession – revenue grew 26%

And between 2010 and 2015 – the average annual revenue growth was 25%

The point is Google is very much impacted by the macro.

As advertisers reduce discretionary spend – Google will earn less money.

However, the question you need to ask yourself is whether users will continue to use (useful) services like Search, Maps, Cloud, gMail and YouTube?

If you think the answer is yes – when the economy finds its footing – it’s most likely that advertisers will want to spend more of their budgets where billions of daily users are.

A Trade Idea on Rates Peaking in 2023

Before I close, I want to share a trade I placed yesterday.

It was on the TLT – iShares 20+ Year Treasury.

First the weekly chart (followed by the trade)

Oct 25 2022

The key to understanding the direction of TLT is what we see with long-term bond yields.

The lower they go – the higher this chart (TLT) trades.

Put another way – buying TLT is a bet that yields are getting closer to topping – and reversing course next year.

This echoes the sentiment of JP Morgan’s Marko Kolanovic above; i.e., next year we will likely see the peak in rates.

Now to be clear, rates will likely remain well above levels most on Wall Street expect for a while.

I talked about this as part of my last post – where in 2006 the Fed held rates above 5.0% for a year.

We could see that again if stickier inflation persists (specifically rents).

Readers will have also heard me say that we’re headed to 4.5%+ over the next three to six months.

The Fed has told us as much.

And whilst they may slow the pace of hikes to 50 basis points in December (see this post) – I believe they will get to at least 4.50%

But that’s where I think we will be closer to the end (rather than the beginning).

And if that’s true – then TLT will rally.

My Trade:

At the time of writing, TLT trades for $95.09

My thesis is TLT could easily fall another 5% or down to $90 (i.e. near the long-term bottom in 2010)

In other words, I think rates can go higher in the near-term.

But at $90… I would be a buyer (for the long-term) on the basis that yields will fall once we stumble into a recession (e.g., mid-to-late 2023)

Yesterday I sold the TLT Dec 16th $90 Put Option for $3.00

Two things happen from here on this date (Dec 16):

- TLT trades at or below $90 and I’m “put” the stock at $90 (keeping the $3 in option premium); or

- TLT trades above $90 and I keep the $3.00 for a 23% annualized return.

Calculating 23% Annualized Return:

- When I placed the trade yesterday, it had 53 days to expiry.

- I received $3.00 in premium placing the trade (committing to buy at $90).

- (($3.00 / $90.00) x 365) / 53 days = 23% annualized.

- happy owning at $90 over the next 12+ months; and

- content receiving 23% annualized on my risk capital if I’m not exercised (i.e. I don’t get to own TLT at $90)

I was willing to risk 3% of my total portfolio capital on this trade.

Important Notes:

- 1 option contract controls 100 units of stock

- E.g., if you sell 1x TLT put option contract – you are committing to buy 100 units x $90 = $9,000

- Only sell the number of contracts you can afford to cash cover.

- E.g., if you wanted to risk $30,000 on this trade, then only sell 3x contracts.