- US economy adds 263K jobs in Sept; wages up 5% YoY;

- Fed’s ‘green light’ is a ‘red light’ for stocks; and

- History shows Fed is hiking straight into a recession

This time last week the S&P 500 closed at 3585.

Just two days into October – and the S&P 500 had piled on ~6.2%

“The lows for 2022 are in” cried the bulls.

Not so fast.

As market’s closed Friday – almost all of the 2-day ~6% rally had evaporated.

The reason?

A robust monthly jobs report suggest the Fed has little reason not to continue their path of aggressive rate rises.

Maybe “75 is the new 25” for the Fed?

Here’s CNBC:

Friday’s jobs numbers showed the U.S. economy added 263,000 jobs in September, slightly below a Dow Jones estimate of 275,000. However, the unemployment rate came in at 3.5%, down from the 3.7% in the previous month in a sign that the jobs picture continues to strengthen even as the Federal Reserve tries to slow the economy with rate hikes to stem inflation.

“While the data was about as expected, the drop in the unemployment rate is seemingly what the markets are obsessed with because of what it means for the Fed,” said Bleakley Financial chief investment officer Peter Boockvar.

“When combined with the low level of initial jobless claims, the pace of firing’s remains muted and this of course gets the Fed all fired up about continuing with its aggressive rate hikes.

Consistent with previous missives – there’s no reason yet for the Fed to ease off the gas.

There will be at some point next year – but that’s still a distance off.

Just on this, we will hear from three Fed Presidents next week.

On Monday we hear from both Charles Evans and Lael Brainard (Vice Chair).

And on Tuesday it will be Loretta Mester – who recently said she is willing to hike rates through a recession to get inflation back to 2%.

Don’t expect any to hear the words “pause or pivot” – this will be a chorus of “full hawk“:

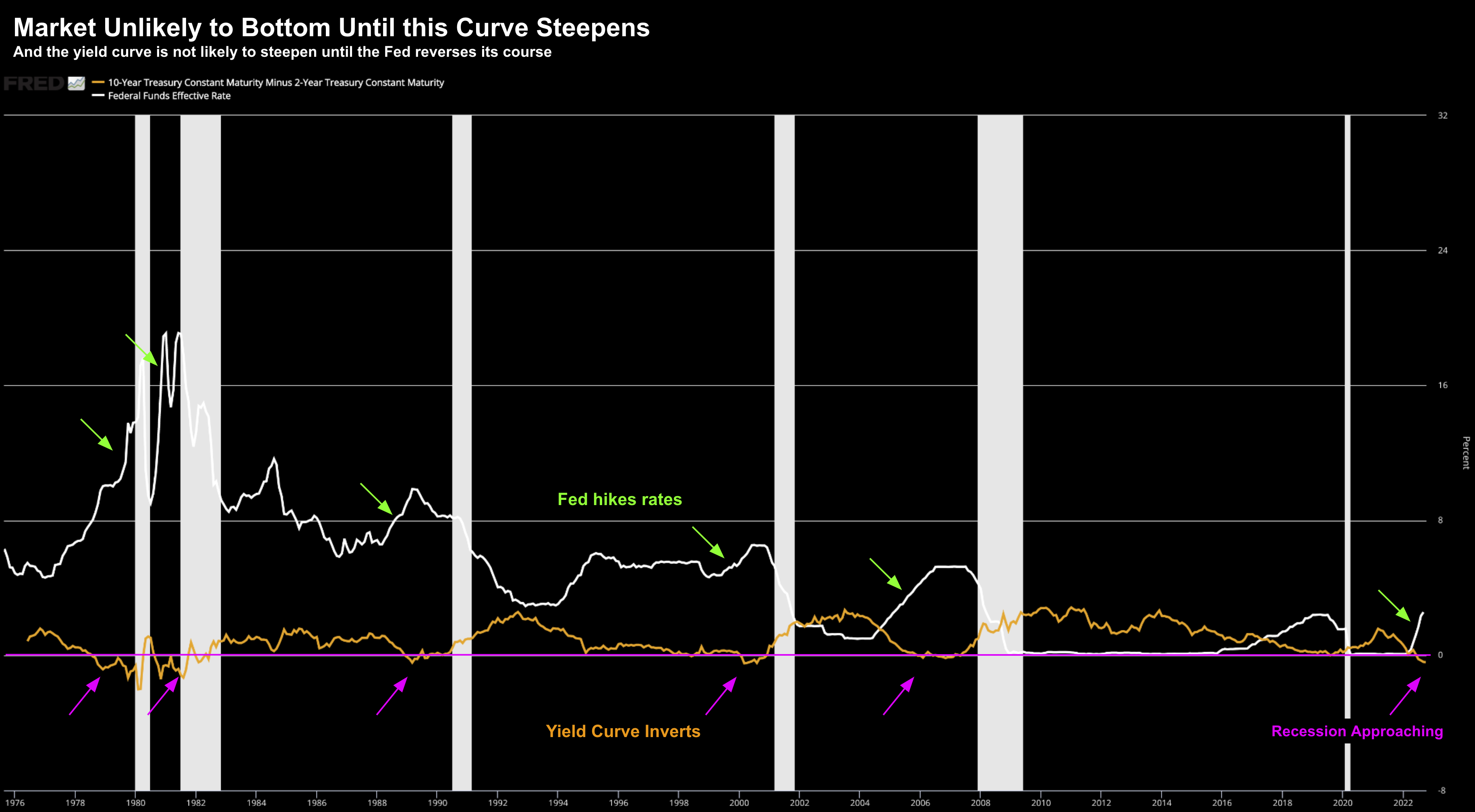

On the back of September’s job gains – both the US dollar index and bond yields rallied.

These are two primary macro headwinds for equities.

For example, it’s my view that until we see a definitive peak in these assets (and sustained down trend) – it’s premature to say we have seen a bottom for equities.

October 7 2022

Hiking into a Inverted Yield Curve

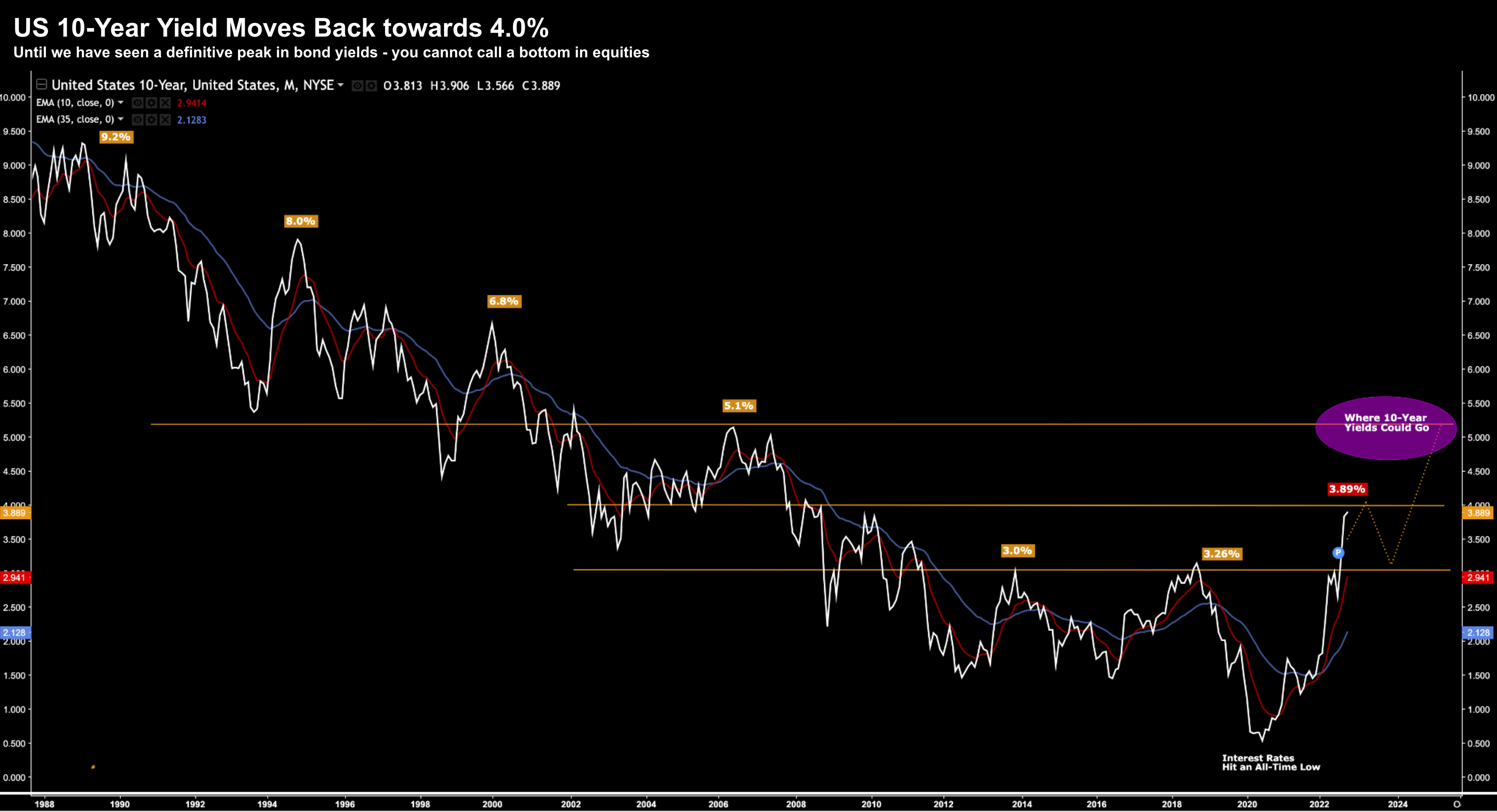

Opposite the Fed’s resolve to squash inflation – something worth demonstrating is how Fed are hiking into a negative sloped yield curve.

As history shows – this has always ended in “pain”. For example, below is a 40-year chart comparing:

(a) 2/10 year yield curve (orange); vs

(b) the effective short term Fed funds rate (white)

October 7 2022

Here we see the repeated pattern of rates moving higher (green arrows) as the curve inverts (pink arrows).

In each case, a recession was soon to follow.

From an equity perspective, the market will only start to form a bottom (and subsequent rally) once this curve starts turning upwards.

And whilst it can still be negative – the direction needs to change.

Obviously that will only happen when (not if) the Fed changes course. And as we know, don’t expect that anytime soon.

Sales, Margins & Earnings all Coming Down

Further to my sentiment that earnings are coming down – this week it was AMD’s turn.

Before I continue, AMD is one of the best managed / highest quality semiconductor chip names in the market.

In short, they have eaten Intel’s lunch.

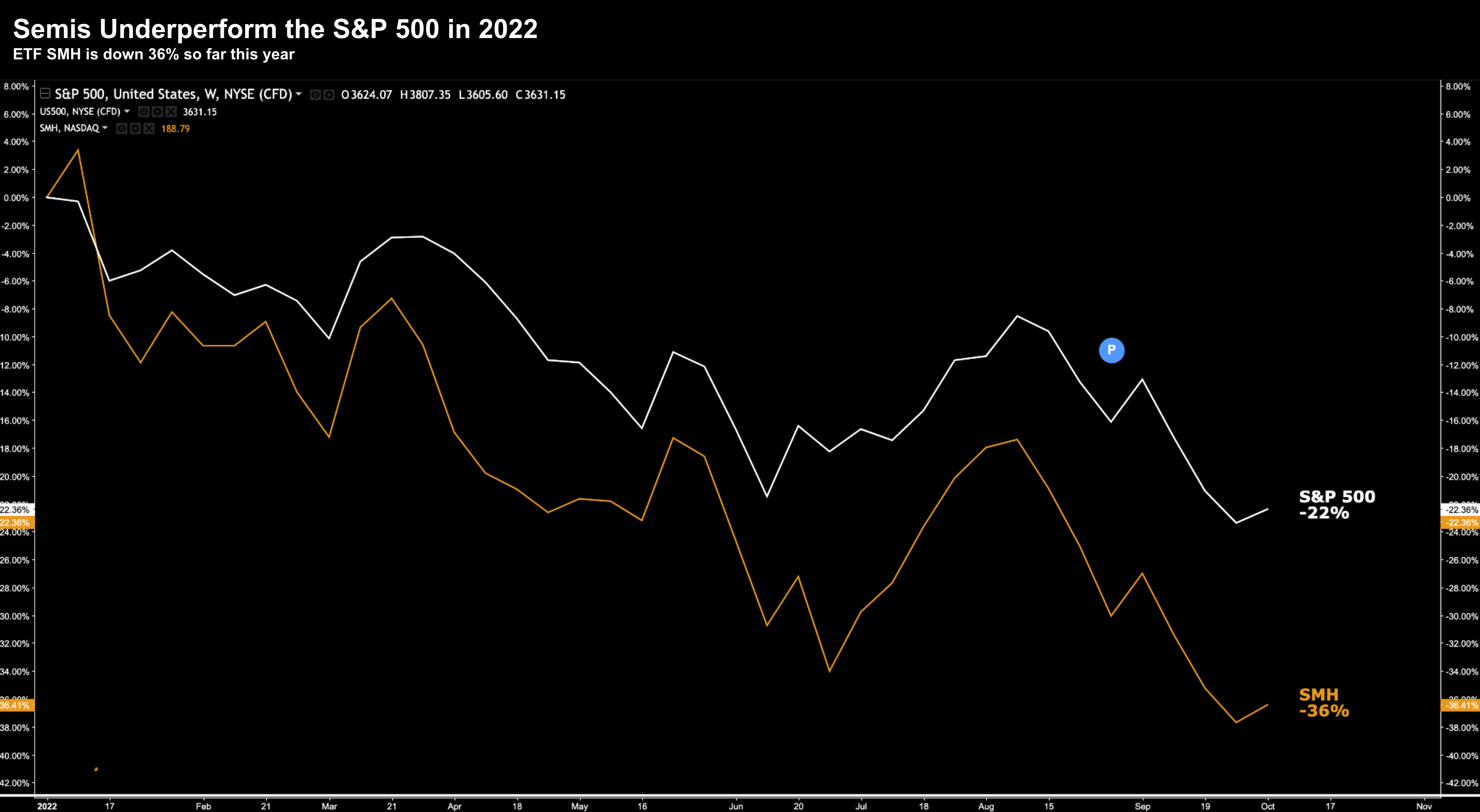

Irrespective, “semis” are having a terrible year (being a cyclical industry). They are down ~36% this year vs the S&P 500’s ~22% decline

October 7 2022

Names such (not limited to) Intel, NVIDIA, AMD, TMC, QCOM etc have been slammed opposite:

- strong downturn in consumer demand;

- rising interest rates; and

- excessive inventory gluts (post COVID).

To make matters worse, the US government are now bringing in new export controls to prevent companies like AMD and NVIDIA selling to China for national security reasons (despite ~90% of their business being consumer based electronics)

All 25 components in the SMH ETF are lower this year.

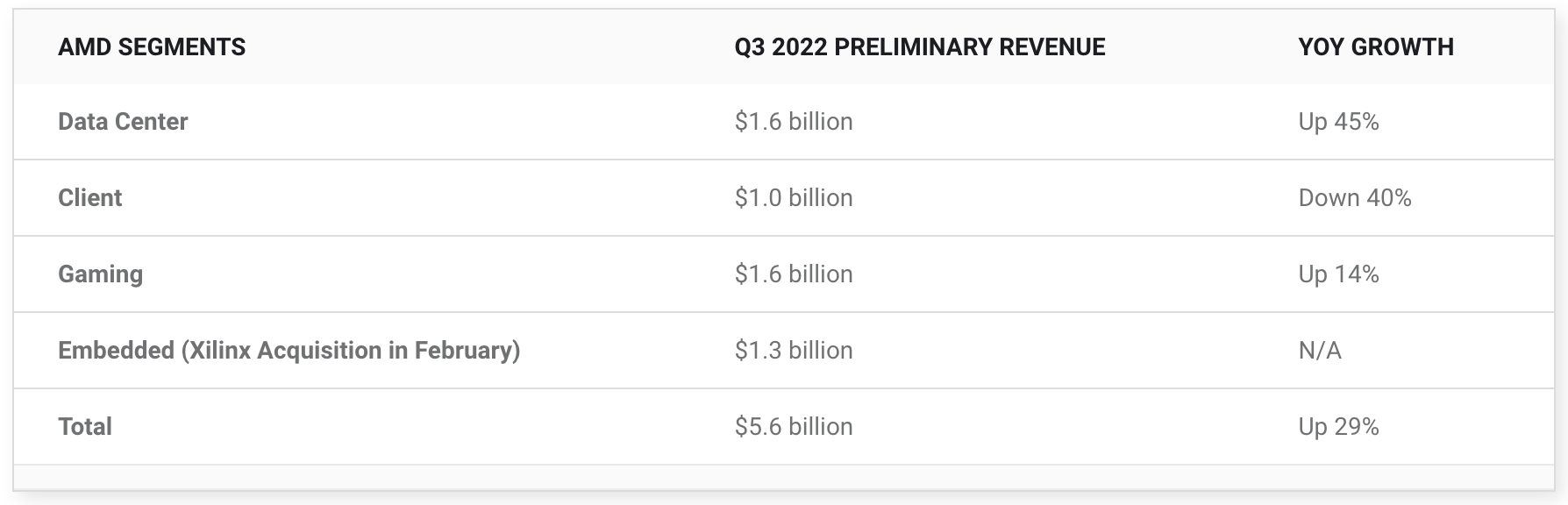

AMD told us today that:

- Preliminary Q3 revenue will be lower by ~16%; and

- Weaker than expected PC market and significant inventory correction actions across the PC supply chain

But this isn’t new news… it was just late coming.

What’s more, earlier this week we had Samsung’s warning as demand (and earnings) sink:

The obvious question is will we hear something similar from Apple?

We might get a clue next Thursday when we receive earnings (and guidance) from Taiwan Semi (TSM) – Apple’s largest supplier.

But the narrative is a consistent one:

Excessive inventory will inevitably lead to discounting -> in turn impacting margins.

Case in point, Amazon is holding not one – but two Prime days this year. Walmart are also bringing forward their holiday sales.

Inventory will be cleared at distressed prices – means margins (and earnings) are coming down.

In the case of the semis – the above average demand from COVID was not incremental sales – it was demand pulled forward.

Unfortunately, 2022 “sell-through” has been compounded by a much weaker consumer (opposite inflation / higher rates etc).

For example, prior to COVID, PCs were a consistent ~260M unit volume market per year. However, during COVID – volumes spiked to 340M as people used stimulus checks to buy at-home computing equipment.

The market is trying to simply get back to the ~260M unit volumes pre-pandemic. This has hurt Intel, Micron and now its hurting AMD (note: Intel flag the pain earlier)

But here’s the thing:

In my experience, the first revision lower is not typically the last. We will most definitely see weaker Q3 earnings — however expect this to extend well into Q4.

Markets End on a Sour Note

Much of that enthusiasm was erased by Friday – as markets grappled with the fact the Fed has little reason to ease rate hikes:

Oct 07 2022

Here we can see the “long tail” with the most recent candle.

In short, the bulls were unable to sustain the highs.

Repeating the sentiment of yesterday’s missive – investors should pay attention to:

(a) the VIX; and

(b) the weekly RSI (middle window)

Despite the sell-off today, the VIX barely moved.

It’s still only trading at 31.4 – slightly higher than yesterday. We want to see this above 35.

Second, the weekly RSI is trading at 37. That’s not oversold. We want to see this below 30.

From mine, a VIX above 35 and a weekly RSI below 30 will suggest we are closer to putting in a market bottom.

Now it may not be the bottom when we see those values – but that’s how we get to the low.

There’s more work to do.

Putting it All Together

In summary, we know that multiples will come down to 14x or 15x

That’s typical of a recession.

We also know that the “E” in PE will work its way down from today’s assumed $240 per share (implying 8% YoY growth) for the S&P 500.

AMD and Samsung gave us a window what that looks like this week. FedEx also said that revenue will be 24% lower this quarter.

Before I close, this headline hit my inbox from Factset today:

Dollar headwinds, waning demand, inventory overhang, higher input costs, higher rates, and discounting — are all reasons why companies like (not limited to) Nike, FedEx, AMD, Micron, Target (it’s a growing list) are warning on impacts to sales, earnings and margins.

At some point earnings revisions will come down.

Stay patient folks – I think there’s better risk/reward ahead.