- US economy added 315K jobs – with wages up 5.2% YoY;

- S&P 500 third consecutive losing week – tech leading the downside;

- Earnings estimates are yet to price in recession risks

Today we received the all-important monthly job additions for August.

And there was good news…

315,000 jobs were added to the US economy last month – a very strong result.

History shows that only 10% of the time do we see this number exceed 300K in any one month.

But…

Wage growth continues to climb – where average hourly earnings were up 5.2% from a year ago.

That will not be missed by the Fed.

Now what you decide to take away from this report will be a function of your own lens.

For example, you could easily argue the jobs market remains strong – with far more open job roles than people available to fill them. And on that basis, some might say the Fed could “land the plane softly”

That said, employers are still having to pay a lot for workers which poses a risk to stickier inflation.

Irrespective, markets initially reacted positively – as it was considered “not too hot and not too cold”

But I don’t think you can get too excited….

First, these numbers are always lagging (where one month doesn’t make a trend)

Second, wage inflation needs to come down.

If anything, a number north of “5%” only validates the Fed raising 75 basis points (bps) in September (and not the 50 many were arguing for)

Here’s Charles Schwab’s Chief Investment Strategist – Liz Ann Sonders:

“This is a unique period of time, where we still have a relatively tight labor market, where there is still job growth, but companies have started to announce hiring freezes, some companies have announced layoffs.

This could very likely be a recession where you don’t see the kind of carnage in the labor market that you see in most recessions.”

We wish them well.

S&P 500 Continues to Drop

From mine, it’s been a ‘textbook technical pivot’ for the S&P 500 the past three weeks.

The S&P 500 rallied to the 35-week EMA zone (very typical of a bear market) – where it was met with resistance.

From there, the false-break of the high at “B” indicated that we were likely to see reversal:

Sept 2 2022

None of this should come as a surprise…

However, if you chased the rally around 4200 (thinking we were headed higher) – you were caught in a classic bear trap.

My advice was to remain patient.

With prices rallying hard to the 35-week EMA – it was not a “pitch you wanted to swing on“

That’s still ahead…

If I were to guess, markets are likely to test the 3800 zone before potentially catching a bid.

However, I still maintain we are going to re-test the June lows.

I think you can start adding to quality around 3600 — but don’t be surprised to see the market head lower again.

And if 3636 breaks, I will be looking for a quick move to 3200.

I saw that because there is very little in the way of technical support between 3600 and 3200 (going back to Sept 2020)

And if we’re fortunate enough to see 3200 (fingers crossed!) – that’s an area to ‘load up’ for the long-term.

Estimates Still Need to Come Down

I cited a research note from Morgan Stanley’s Mike Wilson – who suggested something similar.

Repeating a portion of the post:

“P/E multiple is wrong not because the Fed is going to be hawkish, but because the equity market is being too optimistic about the earnings outlook. The multiples will start to come down as earnings get cut and then somewhere in the middle of that earnings cut process the market will bottom and we think that’s probably between September and December.”

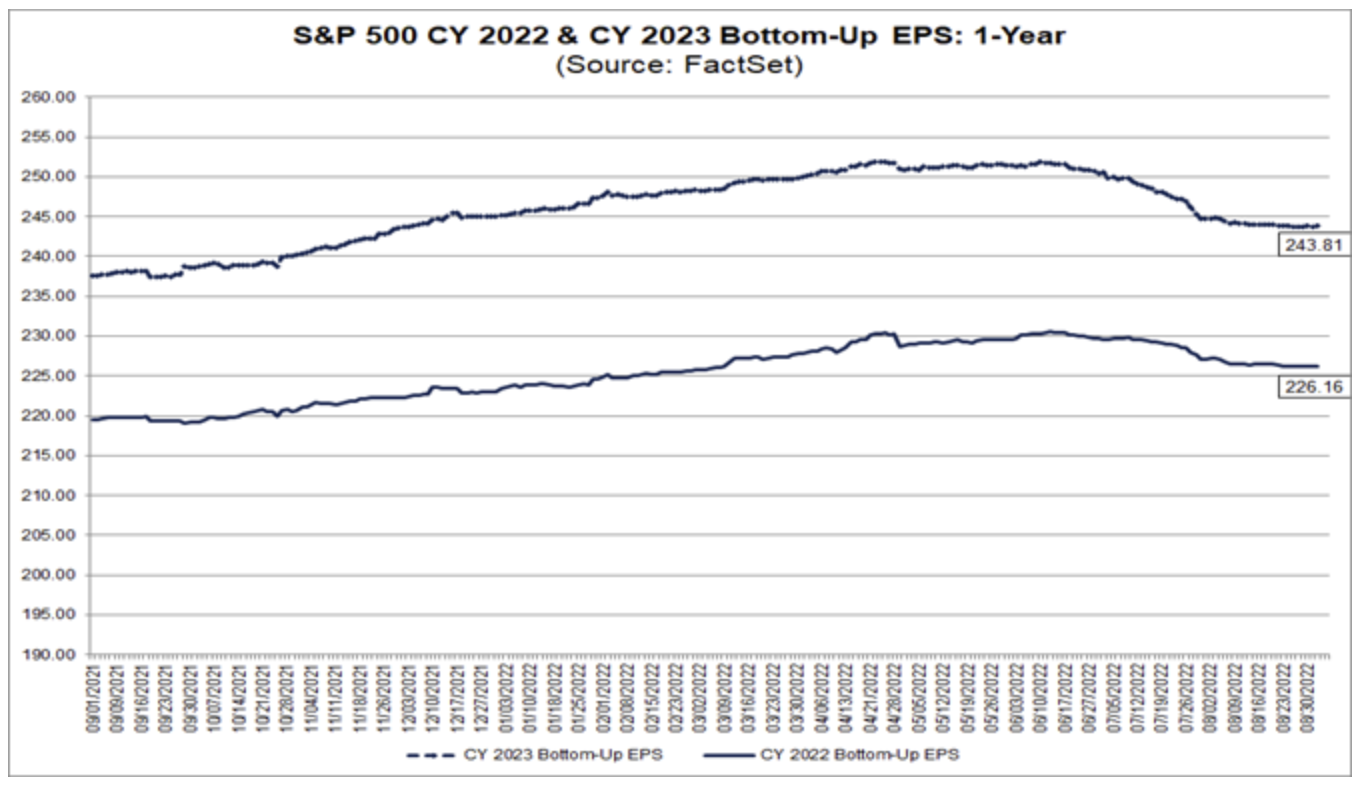

Further to this note – I read this earnings insight report from Factset.

It summarized the ‘mild’ earnings cuts starting to come in. Below is their preface:

Given the decline in U.S. GDP in the first quarter and the second quarter, are analysts lowering EPS estimates more than normal for S&P 500 companies for the third quarter?

The answer is yes. During the months of July and August, analysts lowered EPS estimates for the third quarter by a larger margin than average.

The Q3 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for Q3 for all the companies in the index) decreased by 5.4% (to $56.21 from $59.44) from June 30 to August 31.

Analysts lowered earnings estimates for CY 2023 during this time, as the bottom-up EPS estimate for CY 2023 decreased by 2.8% (to $243.68 from $250.61) from June 30 to August 31.

It is interesting to note that the forward 12-month P/E ratio for the S&P 500 has increased to 16.7 from 15.8 since June 30, as the price of the index has increased by 4.8% while EPS estimates for CY 2022 and CY 2023 have decreased during this time.

From mine, CY2023 EPS forecast of $243.81 in the face of a likely recession feels optimistic.

As outlined in my previous post – recessions will typically see earnings slashed by as much as 20% or more.

Today these revisions are barely 5%

Don’t be surprised for these expectations to fall sharply over the coming months.

Remember:

The Fed’s hikes (and forthcoming QT) are yet to be felt. They will take time to take effect.

Putting it All Together

My takeaway from Friday’s jobs number is it will only give the Fed resolve to go 75 bps in September.

Remember, Powell said to expect “unusually large hikes and prepare for pain”.

There was nothing painful in this jobs report.

But here’s something else:

Today the market remains overly fixated on rate hikes (and the Fed) – echoing a point made by Mike Wilson.

That’s dangerous.

For example, are we ignoring risks such as (but not limited to):

- 15% to 20% earnings revisions in the event of a 2023 recession (and subsequent multiple contraction)?

- A surging US dollar on any impact on multinational profits?

- “Black swan” events out of Europe – with the region crash landing into a recession coupled with soaring inflation (Note – Russia’s Gazprom cut gas supply as of today)?

- The rapidly slowing US housing market (1 in 5 homes have reduced prices to sell)? and

- The US government’s ban on AI chip sales to China this week; and an increasingly ‘warmer war’ with China?

Any one of these events could act as a meaningful catalyst for downside…

And yet all we hear about are the risks of “higher rates“?

Yes, the market will always climb the wall of worry… that’s what it does.

However, most of the time we have central banks as a tailwind opposite things like ‘falling house prices‘ or ‘growth slowing’.

Not this time.

Today it’s a case of central banks targeting demand destruction.

They want to see wages, rents and housing prices all fall.

That’s by design.

The risks are to the downside with better buying opportunities ahead.

Stay patient.