- Will the Fed target positive real rates in 2023?

- Why the 10-year yield could easily exceed 4.0%

- And if so – what multiple will investors pay; and what will earnings be?

The market continued its descent lower today – adding to last week’s losses.

From mine, probabilities favour lower prices ahead.

And whilst the tape has served us exceptionally well this year (not always the case) – tonight I’m putting it to the side.

I want to explore the range of macro possibilities which could augur for further downside.

But as a caveat, trying to forecast macro variables such as interest rates, bond yields and actions from the Fed are near impossible.

They can turn on a dime pending any number of inputs.

Before you know it – everything has changed.

With that, let’s explore:

(a) my thesis for what could lie ahead for rates and bond yields; and

(b) why a re-test of the June lows cannot be ruled out.

And if anything – might go lower.

#1. Nominal Rates to Exceed 4.0% in 2023

Question:

How far does the Fed need to hike rates to get inflation back to their target of 2%?

The short answer is we don’t know.

But we do know the Fed will not stop until that objective is achieved (whatever the cost).

Now the answer to “how far” depends on a host of moving targets.

For example, these might include (not limited to) employment, wages, rents, oil prices, sentiment etc etc.

That said, we know there’s a high probability the nominal Fed funds rate will be at least 3.50% by year’s end.

That’s a further 100 basis points (1.0%) above today’s rate.

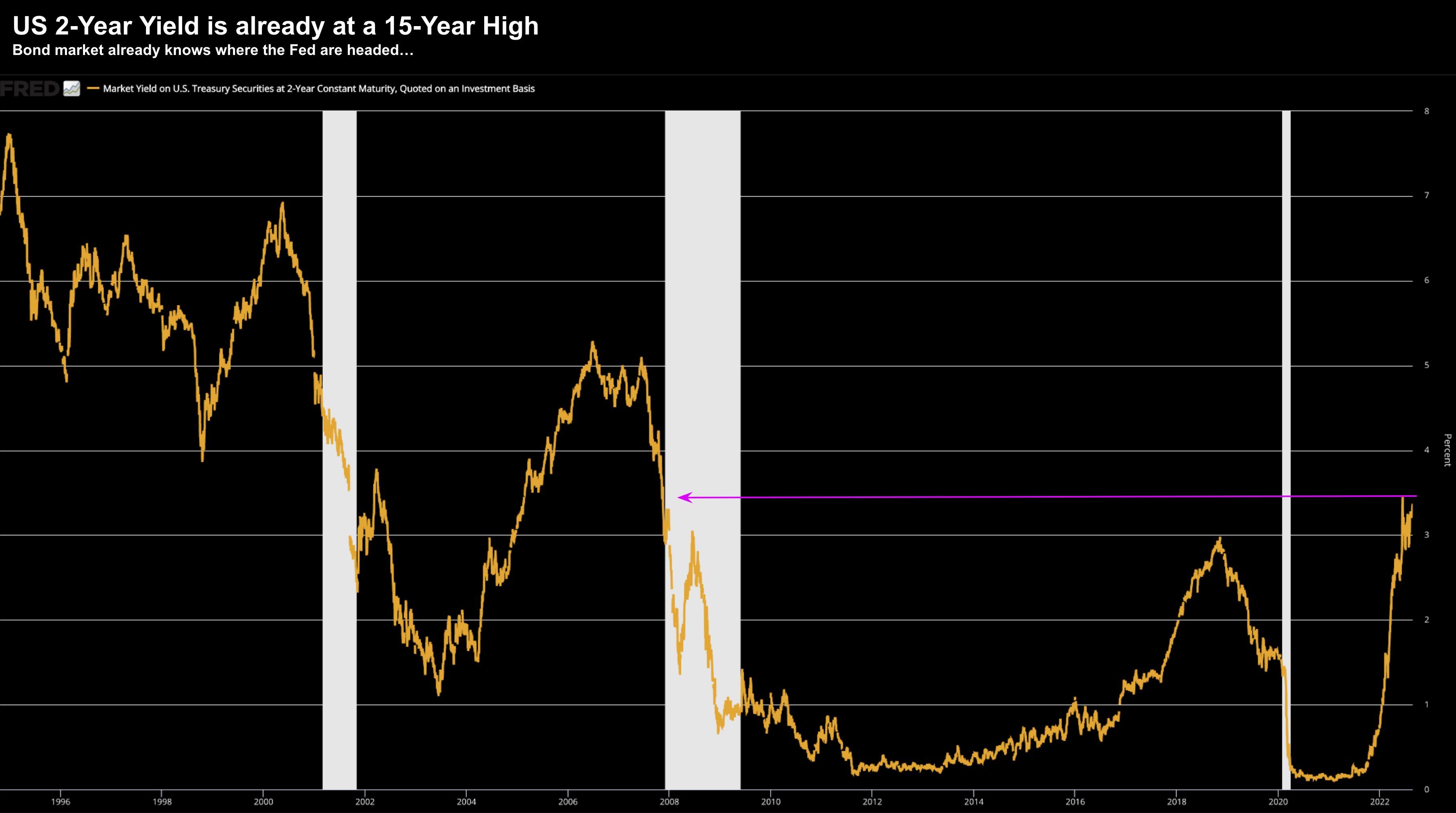

And the bond market has this fully priced in (based on what we see with the US 2-year yield – now at a 15-year high)

Aug 29 2022

It remains to be seen whether a 25 or 50 bps will immediately follow into the mid-term elections.

But here’s the thing:

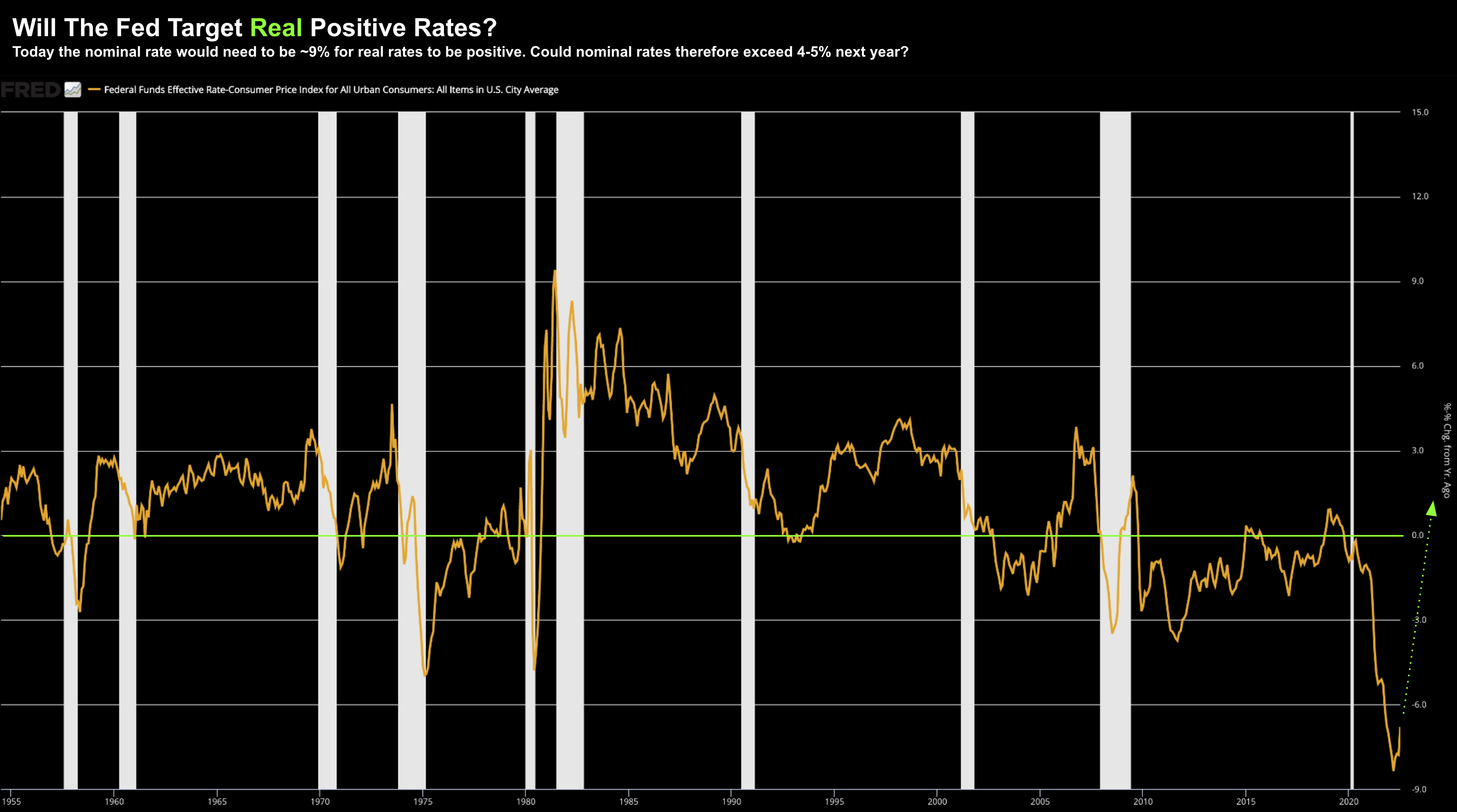

With consumer price inflation (CPI) at 8%+ year-on-year – should the Fed raise rates to 3.50% — real interest rates will still be negative.

But as the Fed knows, negative real rates are inflationary (i.e., your cash is trash)

Now if the Fed are to adopt a “restrictive policy stance” – it will likely mean the Fed start targeting positive real rates (as Volcker did in the early 1980s)

Quoting Jay Powell from last Friday:

“Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely against loosening policy”

Aug 29 2022

The good news is (expected) lower inflation the coming months will do a lot of the Fed’s heavy lifting.

For example, CPI is likely to fall to ~6.0% by year’s end (pending what we see with wages, rents and oil)

If we also assume the Fed hikes rates to 3.50% at the same time – the real rate would be in the realm of negative 2.50%

The challenge for the Fed will come when CPI stalls around 5.0% due to “stickier” inflation.

For example, with wages still rising ~5% YoY and rents comprising one-third of CPI (with an 18-month lag to house prices) — it’s probable the Fed will need to continue hiking to turn the real rates positive.

Failing that, they could shift their benchmark target of 2.0% to something like 3.0% (that would not surprise me)

On that basis – my assumption is the Fed’s nominal rate could challenge 4.0% to 5.0% next year.

And I think that’s the ‘pain’ Powell referred to last week.

Pain for consumers and businesses alike.

Which leads to the next consideration… bond yields.

#2. 10-Year Yield to Stay Above 3.0%

Aug 29 2022

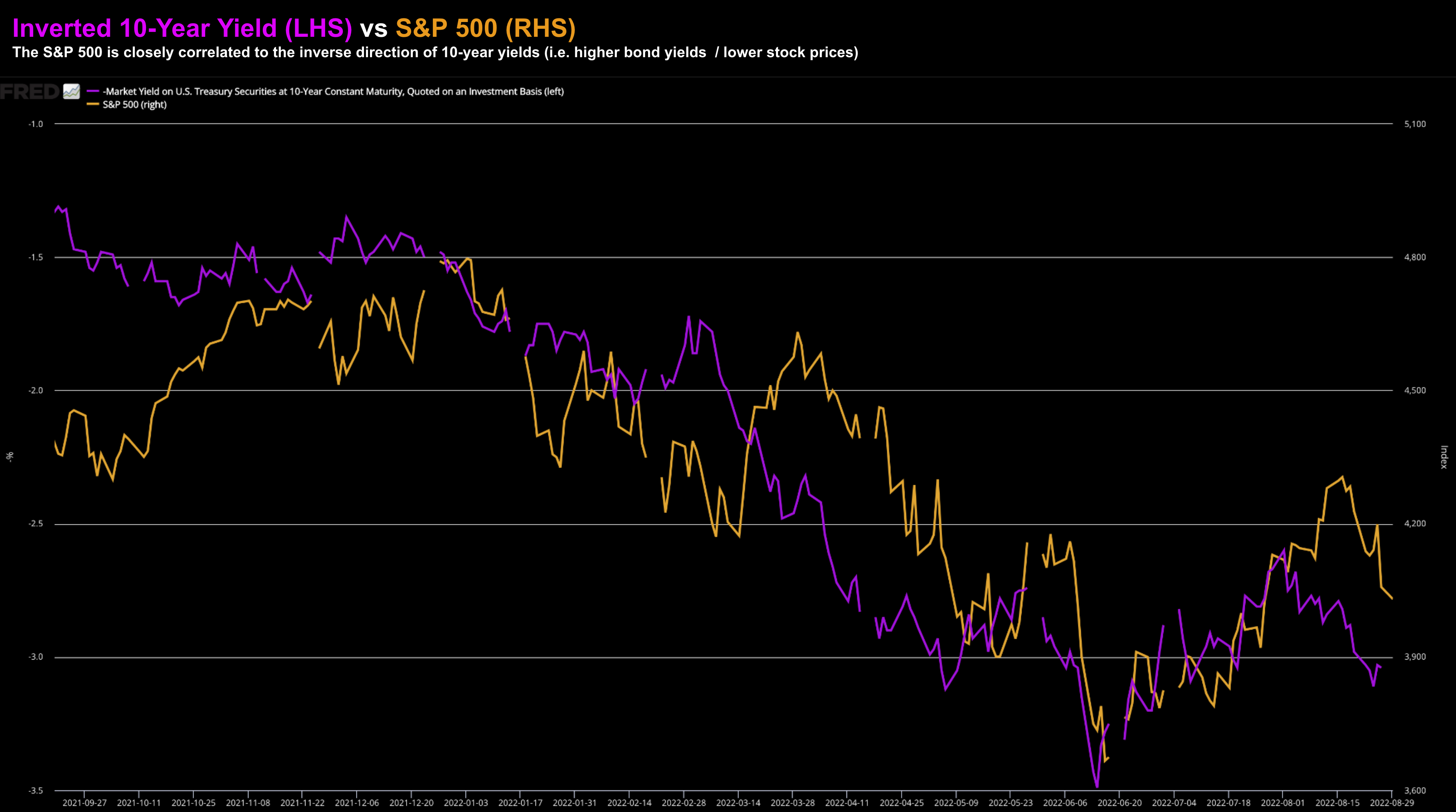

The orange line (right-hand axis) shows the S&P 500.

The purple line (left-hand axis) shows the US 10-Year Yield inverted

No surprises…

Higher bond yields typically means lower stock prices.

The short explanation is the risk free rate of return on bonds starts to compete with (higher-risk) stocks.

But the pertitent question to ask (as investors) is where the 10-year will trade in 2023?

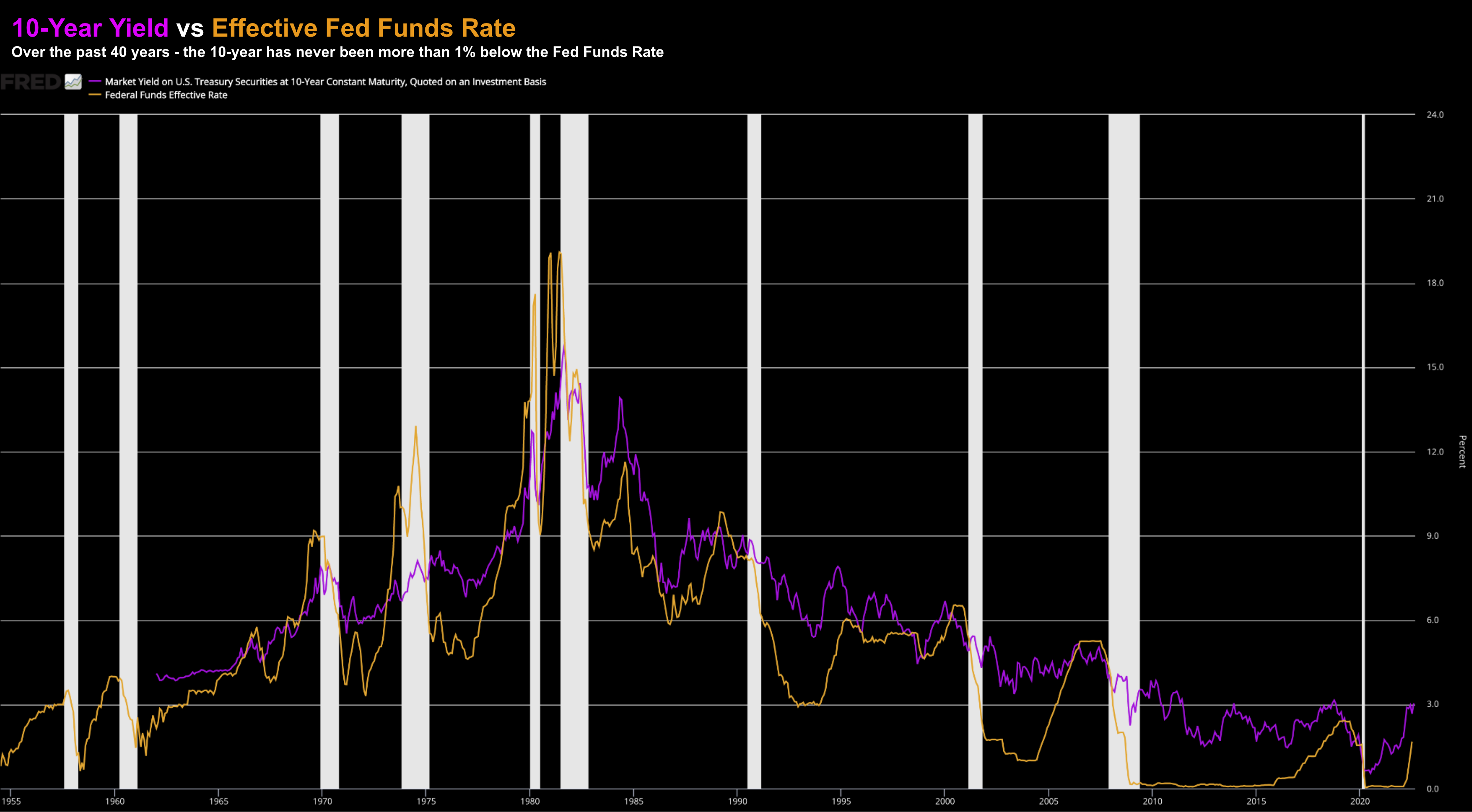

To answer this we need to briefly circle back to the Fed funds rate (and history)

Based on the previous discussion, I believe there’s a high probability the Fed will target a positive real rate (4.0% or above).

Now looking back over the past 40 years – we see how the 10-year yield trades relative to the Fed funds rate:

Aug 29 2022

Therefore, it’s feasible this sets a “floor” for how low these bond yields will fall.

In addition to the above – the other variable to influence yields will be any reduction in the Fed’s $9 Trillion balance sheet via quantitative tightening (QT).

QT is intended to send bond yields higher.

(Note: QE is where the Fed buys bonds in turn suppressing yields. QT is the opposite function)

Put together, it would be remiss of us to believe the 10-year yield will fall below 3.0% next year.

What’s more, the 10-year has the potential to ‘run’ above 4.0% (again, pending where we see the Fed’s nominal rate)

From mine, higher 10-year yields will not bode well for equities.

#3. Valuations at Higher Rates

If nominal rates are expected to be in the realm of 4.0%+ in 2023 – how will that impact valuations?

First, a snippet I shared from this post last week: “Don’t Fight the Fed”

The average earnings decline for 1990, 2000, 2020 recessions was a 26% from peak to trough.

The 2008 recession saw earnings decline by 57% from peak to trough.

Now I don’t think we will see anything like 2008… but you never know.

I think it’s reasonable to assume a 15% to 20% decline – which would put us in the realm of $190 to $200 per share.

As a benchmark – below is where markets bottomed on a forward PE basis over the past three recessions:

- October 1990: 15.3x

- October 2002: 20.0x

- March 2009: 17.1x

Assuming that forward earnings do not fall from today’s expected $240 per share) – at 4100 that’s a forward PE of ~17x

But as we know, the average 40-year multiple for the S&P 500 is ~15x forward.

Put another way, 4100 is not a discount.

Now when rates are artificially low – it’s expected to see multiple expansion.

For example, investors are happy to pay 20x forward (at 4800 we hit ~22x forward)

But does 20x forward offer investors a compelling risk/reward with rates at 4.0% or more?

Not for me.

For what it’s worth – when the Fed hiked rates to 3.0% in 2018 – forward PEs dropped to 14x.

However, once the Fed pivoted to an easing stance, multiples began to expand.

In closing, if applying a 15x forward multiple to $240 EPS – we get 3600 on the S&P 500.

However, 3600 assumes earnings do not decline (which is optimistic given the Fed’s objective).

On the basis we see an average 15-20% recessionary decline – it’s not unreasonable to think the June lows will be tested.

From mine, 3200 on the S&P 500 should be in your “range of possibilities”

Putting it All Together

Growth will be below trend.

And “pain” will be coming to both consumers and businesses.

Pain could be any number of things – however it’s expected that people will lose their jobs.

This is the trade-off the Fed is ‘forced’ to make by aggressively hiking rates and reducing liquidity.

But how much of this ‘pain’ is priced in?

I do think the market has priced in a Fed funds rate of 3.50% (as we see on the 2-year yield).

But does it expect:

- a 10-year yield above 4.0% next year?

- the possibility the Fed will continue to hike until real rates are positive?; and finally

- to what extent could the Fed reduce their balance sheet with QT?

“Some of the pain has been priced in at 4100… but is it enough?

Are the risks here to the upside or to the downside?

Are earnings likely to rise next year or fall in the event of recession? And what multiple is “value given nominal rates could easily exceed 4.0%?

From mine, don’t rule out the possibility we could see the market re-test the levels we saw in June.