- Cycles always prevail in the end

- Forecasting is futile; however preparation is critical

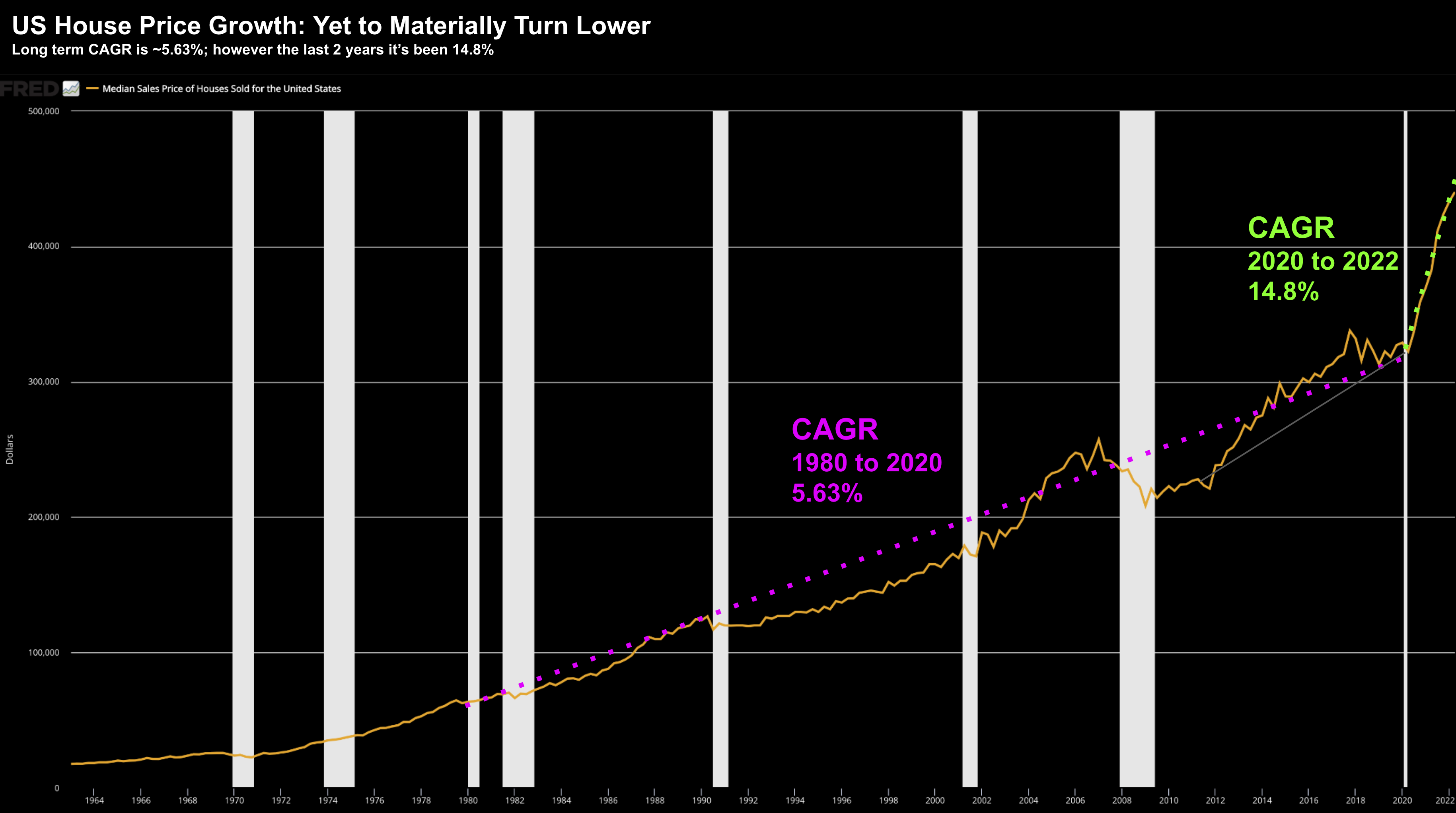

- US housing could be the next ‘shoe’ to drop

Death and taxes are two.

But what about the inevitability of cycles?

Ultimately we find that cycles always tend to prevail.

However, what remains difficult is their timing.

Some cycles are short; others are longer.

That said, nothing goes in one direction forever.

Trees never grow to the sky. And seldom do things go to zero.

But there are things we can observe when the ‘tree has stopped growing’.

One of the more common (grave) mistakes investors will make is extrapolating what you see today well into the future.

Typically that proves costly.

Appreciation for Market Cycles

For example, I know that it’s impossible to predict the future with any certainty (if only we could!)

However, what I can do is prepare based on what I know to be true.

The last quarter of 2021 was a recent example.

At the time, I shared a series of missives on how the Fed had meaningfully changed their language.

They admitted their inflation judgement error – indicating tighter monetary conditions were necessary for longer.

And if it still wasn’t clear – last Friday Powell reinforced how much ‘pain’ still lies ahead.

Despite the Fed’s cues – the S&P 500 traded in excess of ~22x forward earnings.

“Trees growing to the sky” which told me risks were more to the downside.

It seemed investors were happy ‘paying any multiple’ for assets — irrespective of whether they had a business which made money (Cathie Wood comes to mind).

And whilst trends will often go longer than you expect – it was prudent to prepare for an inevitable shift.

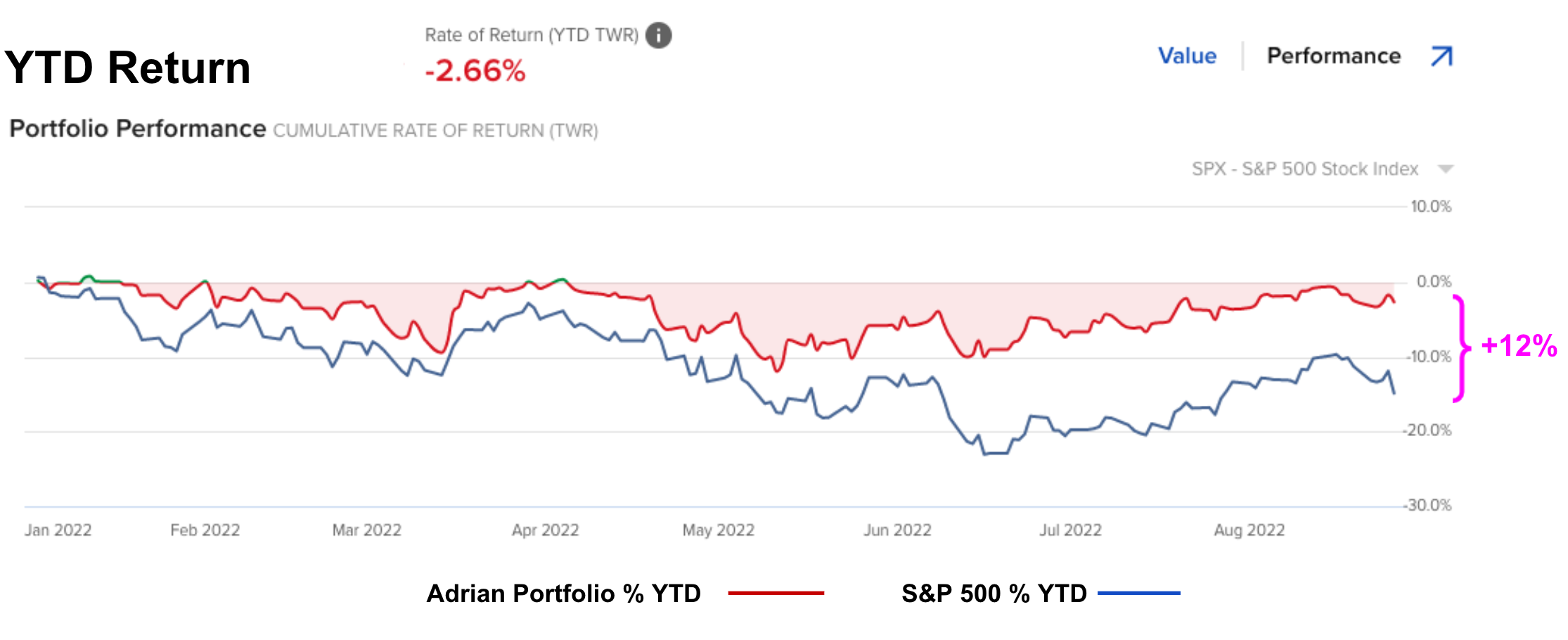

I was fortunate.

The cycle turned early in January (before the Fed’s hikes in March) – enabling me to avoid some (not all) of the downside.

What’s more, with a high concentration of cash – it allowed me to take advantage of quality stocks at more attractive prices in June.

This is equally if not more important.

It’s one thing to be defensive against risk of downside.

However, it’s only “half’ of the investing equation (albeit extremely important).

A great investor also needs to prove strength with “offense” to capitalize on the upside when (not if) it returns.

This means buying good things ‘well’ (not just buying good things!)

Now in full disclosure — I didn’t know that the market was about to shed 24% in ~6 months. But it was not ‘shocking’ to see the market retreat to ~15.5x forward earnings.

I attempted to understand the range of possibilities and positioned my portfolio (taking risk off the table)

Howard Marks’ emphasizes the importance of (credit) cycles in his book “The Most Important Thing”

And Bridgewater’s Ray Dalio explains cyclicality in this 30-minute video.

Marks’ holds these two things to be true:

- Most things will prove to be cyclical; and

- The greatest opportunities for gain (and loss) come when other people forget rule number one.

Marks’ reminds us that progress is always followed by deterioration.

Things advance and then they retreat.

Take a look at the stock market over the long-term… is it in a straight line?

Hardly.

It looks more like the zig-zag of a Christmas tree.

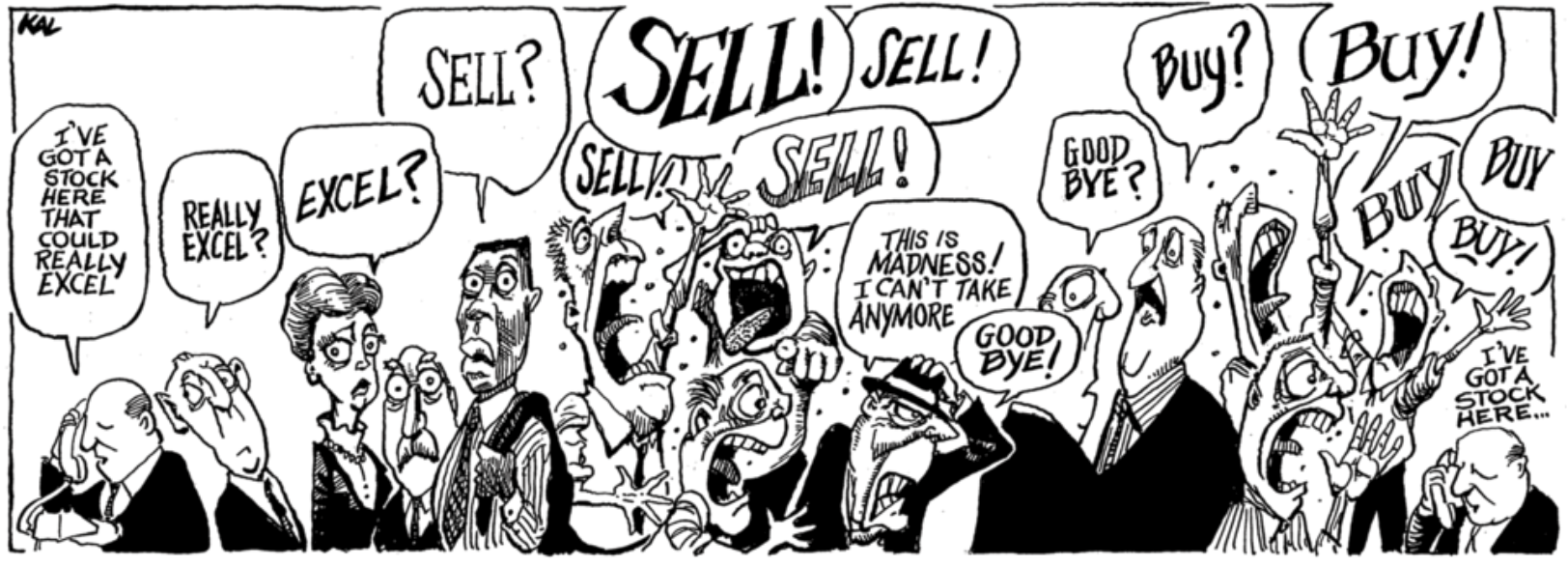

And in bear markets – early signs of deterioration gradually build to panic selling.

So what causes this to happen?

Well as the cartoon suggests… look no further than basic human emotion.

If we were all machines – things would go in a linear fashion.

But when you introduce powerful emotions like fear and greed – results will be variable and cyclical.

Think about how confidence works:

When people feel good about their personal finances – they tend to spend more and save less. What’s more, they use money they don’t have (credit) to increase their enjoyment; and/or garner profits through investments.

And whilst this can also make their financial position more precarious (typically not front of mind at the time) – they’re often happy to pay more for current value or a piece of the future.

But as we know – sentiment can change quickly.

How the Cycle Turns

Two observations:

- 1980 to 2020 – the long-term CAGR for US housing sits around 5.63%

- 2020 to 2022 – CAGR skyrocketed to ~15%

Here’s what happened:

The cycle generally starts with the enablers of credit (i.e., the central bank)

In this case, the Fed Reserve added ~$4.5 Trillion in liquidity to the economy (slashing nominal rates to zero).

From there, the typical risks associated with lending waned and banks capitalized.

Investors saw a lower probability of risk – and were willing to pay substantially more for their ‘slice of the future’ (at any price).

Banks satisfied the increased demand by expanding their business— providing even more capital at competitive rates (as they compete for market share)

But as the old saying goes “… the worst loans are often made at the best of times”.

Eventually this frenzy gives rise to the next phase of the credit cycle….

Everything I outlined above is reversed.

Central Banks move to cool the economy by withdrawing liquidity and increasing the cost of capital.

Banks see higher risks associated with lending; and investors feel less confident about borrowing and spending decisions.

And after a period of tighter credit – we start to see capital destruction.

The cost of capital starts to exceed the return on capital. And in the worst case, some investors experience a loss of capital.

But this process can take time…

However, there are ample signs that this next phase in the credit cycle is taking hold.

US House Prices Decline…

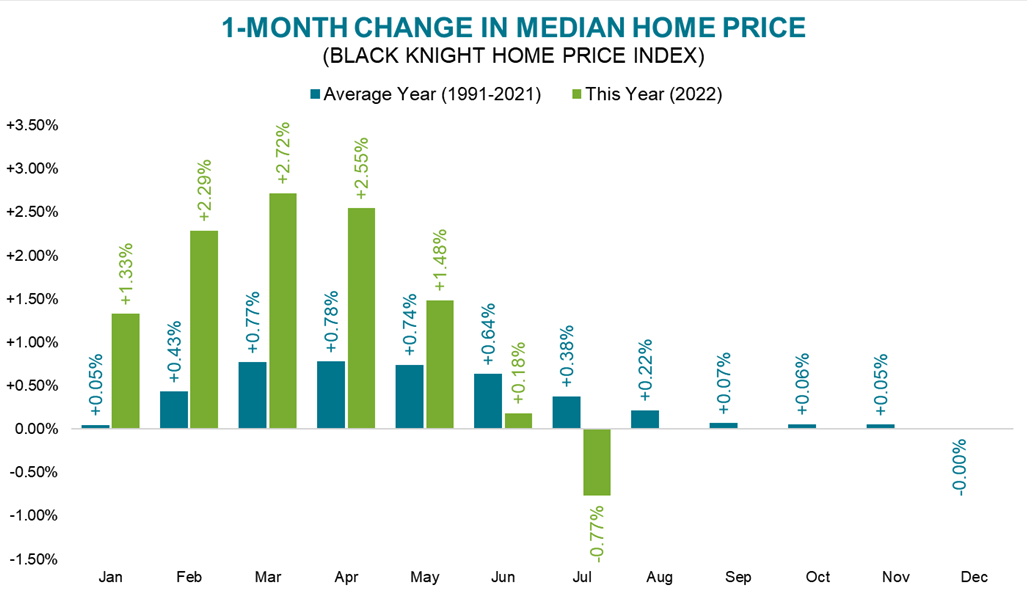

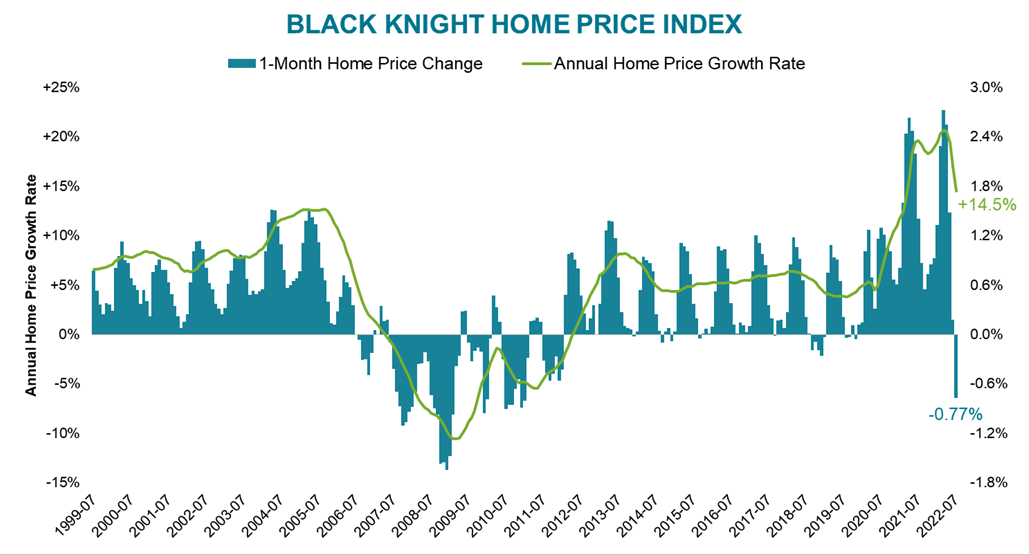

According to this article, the latest data from the Black Knight Home Price Index shows signs of an inflection point for the US market.

And whilst July is often noted as a softer month… there are large (broader) macro factors at play.

For the first time in 32 months, US home prices saw a month-over-month fall last month, as growth didn’t just slow… prices went into decline.

Annual home price growth still clocked in at 14.3% – more than three times the long-run average – but most of that appreciation occurred in the last months of 2021 and earlier this year.

Such strong annual growth rates can hide underlying weakness. Month-over-month data gives us a much clearer picture of just how much – and how quickly – the housing market has shifted.

The median home price fell by 0.77% in July, the largest single-month drop since January 2011. On a seasonally adjusted basis, July’s dip ranked among the 10 largest monthly declines on record, dating back more than 30 years

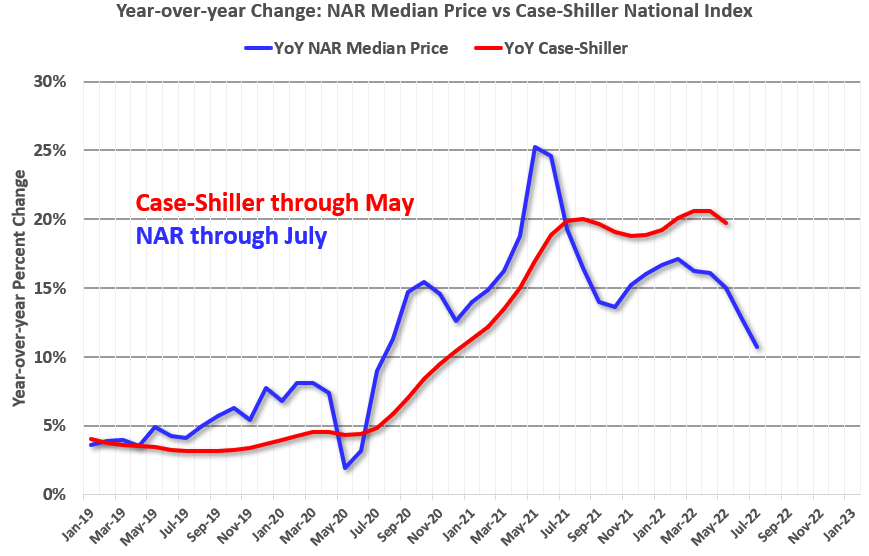

CalculatedRisk offers two charts:

Note that the Case-Shiller Home Price Indices is a 3-month average of March, April and May closing prices.

Therefore, one should expect a meaningful lag in the values.

- This is good news for the Fed and inflation looking ahead (as lower house prices will eventually lead to lower rents); however

- It could be painful for speculators (and potentially some lenders)

Does this suggest prices are headed higher or lower?

Putting it All Together

But it’s not without merit.

Pain is typically associated when the credit cycle tightens and asset prices fall.

During this phase of the cycle – cost of capital starts to exceed the return on capital.

And for those who bought poorly – they could experience a loss of capital.

In that sense, markets are far from efficient as people will always make decisions based on the emotions of fear and greed.

FOMO is real.

Cycles will never stop occurring. And trees never grow to the sky.

However, my taking the time to understand where we are in the cycle can often lead to the best opportunities.

Put another way, it’s not enough to just buy good assets… you need to buy well.