- Success comes from “buying things well”… not “buying good things”

- The Fed meets at Jackson Hole – expect more on QT as a policy tool

- S&P 500 is not good risk/reward between 4200 and 4400

That was my sentiment earlier this week.

My thesis was to expect overhead resistance around the zone 4200 – also mindful the market could push as high as 4400.

From mine, things were stretched both technically and fundamentally.

For example, from a fundamental lens, a forward PE in the realm of 18x plus is not what I deem good risk/reward given:

(a) the various risks to growth and earnings; and

(b) an increasingly tightening monetary environment (more on this below)

Let’s start by recapping the weekly chart – with major indices losing ground for the first time in five weeks.

S&P 500 – Ready to Take a Pause

If we refer to the weekly chart below – you will find the lines I pencilled in showing:

(a) the anticipated move down to ~3600

(b) the expect bounce to the zone of 4200; and now

(c) the forthcoming retrace (TBD)

Aug 19 2022

A couple of technical observations:

- Despite the 18% rally off the June lows – the S&P 500 remains in a weekly bearish trend. That is, the 10-week EMA (red line) remains below that of the 35-week EMA (blue line). Probabilities tell us to expect strength will be sold in this formation.

- Selling is typically in the zone of the 35-week EMA (where we are today)

- The VIX (grey shaded line) is only trading at 20.6. This tells me we have an extremely complacent market given the magnitude of risks ahead.

- This also supports my thesis that the market is now extended; and to expect a volatility spike soon.

However, the question I have is how far?

For example, can we put in a “higher low” above that of the 3636 from June?

The jury is still out on that.

For example, it would be remiss of us to rule out another test of the June lows.

And whilst it seems unlikely given how ‘uber bullish’ market sentiment has been the past two months – I am not ruling it out.

As I’ve demonstrated recently – both 2000 and 2008 saw very similar v-shaped rallies only to make lower lows.

What’s different this time?

Now pending what we see in terms of:

- Q3 earnings and revisions;

- Structural inflation (e.g., wages and rents); and

- Resultant monetary policy from the Fed…

I believe the risks are high however equities are complacent.

Mindful of how the Pendulum Moves

“When things are going well and prices are high, investors rush to buy, forgetting all prudence. Then, when there’s chaos all around and assets are on the bargain counter, they lose all willingness to bear risk and rush to sell. And it will ever be so” — Howard Marks

Consider what we have seen so far this year….

For the first 6 months, you might say the pendulum swung all the way to the ‘far left’; i.e., chaos as assets were sold.

In June, the S&P 500 has crashed ~24% making its worst start to years since 1970. However, among the fear it traded ~15x forward earnings – where I was stepping in a buying quality assets at a fair price.

Fast forward to the past 8 weeks….

The pendulum has swung all the way to the other side where (to borrow Marks’ language) – “prices are (once again) high, investors rushed in to buy, and (arguably) ignored prudence”

What’s fascinating about markets is how frequent (or perhaps dependable) this behaviour is.

As Marks says, investor psychology seems to spend much more time at the extremes than it does at a “happy medium.”

Below is a quote from his book “The Most Important Thing” (a book I love to re-read):

“In my opinion, the greed/fear cycle is caused by changing attitudes toward risk.

When greed is prevalent, it means investors feel a high level of comfort with risk and the idea of bearing it in the interest of profit.

Conversely, widespread fear indicates a high level of aversion to risk. The academics consider investors’ attitude toward risk a constant, but certainly it fluctuates greatly.

Finance theory is heavily dependent on the assumption that investors are risk averse. That is, they “disprefer” risk and must be induced— bribed—to bear it, with higher expected returns.

Reaping dependably high returns from risky investments is an oxymoron.

But there are times when this caveat is ignored— when people get too comfortable with risk and thus when prices of securities incorporate a premium for bearing risk that is inadequate to compensate for the risk that’s present”

QT: Arguably the Biggest Risk

Whilst the risks to earnings declines and persistent (sticky) inflation cannot be overstated – I want to spend a moment on Fed policy ahead of this week’s summit Jackson Hole.

And whilst not a policy setting meeting – their language will be closely watched.

So far, the Fed has used their forward guidance to pull market rates forward to good effect. For example, if we look at the 2-year yield as a proxy, it implies a further 110 bps in hikes in 2022.

However, if we then look further out, bond markets see the Fed cutting rates in 2023 – as inflation trends lower towards its 2% objective over the next few years.

Another way of reading this — the bond market believes the Fed is making a policy mistake.

That is, the market is saying the Fed will continue to hike aggressively in the near-term however the cost will be a recession.

Again, this is best evidenced by the deepening of the (inverted) yield curve.

But what’s interesting (to me) is whilst the bond market is saying to expect this outcome – it remains at odds with equities (for now).

For example, if we go back to the equity volatility index (VIX), it would suggest participants are very comfortable with the outlook.

A VIX at just 20 implies that investors don’t see many ‘bumps’ in the road.

I think that’s overly optimistic (even during the best of times).

Now if I turn to the ‘smart money’ – fixed income volatility has been moving sharply higher.

And this makes sense…

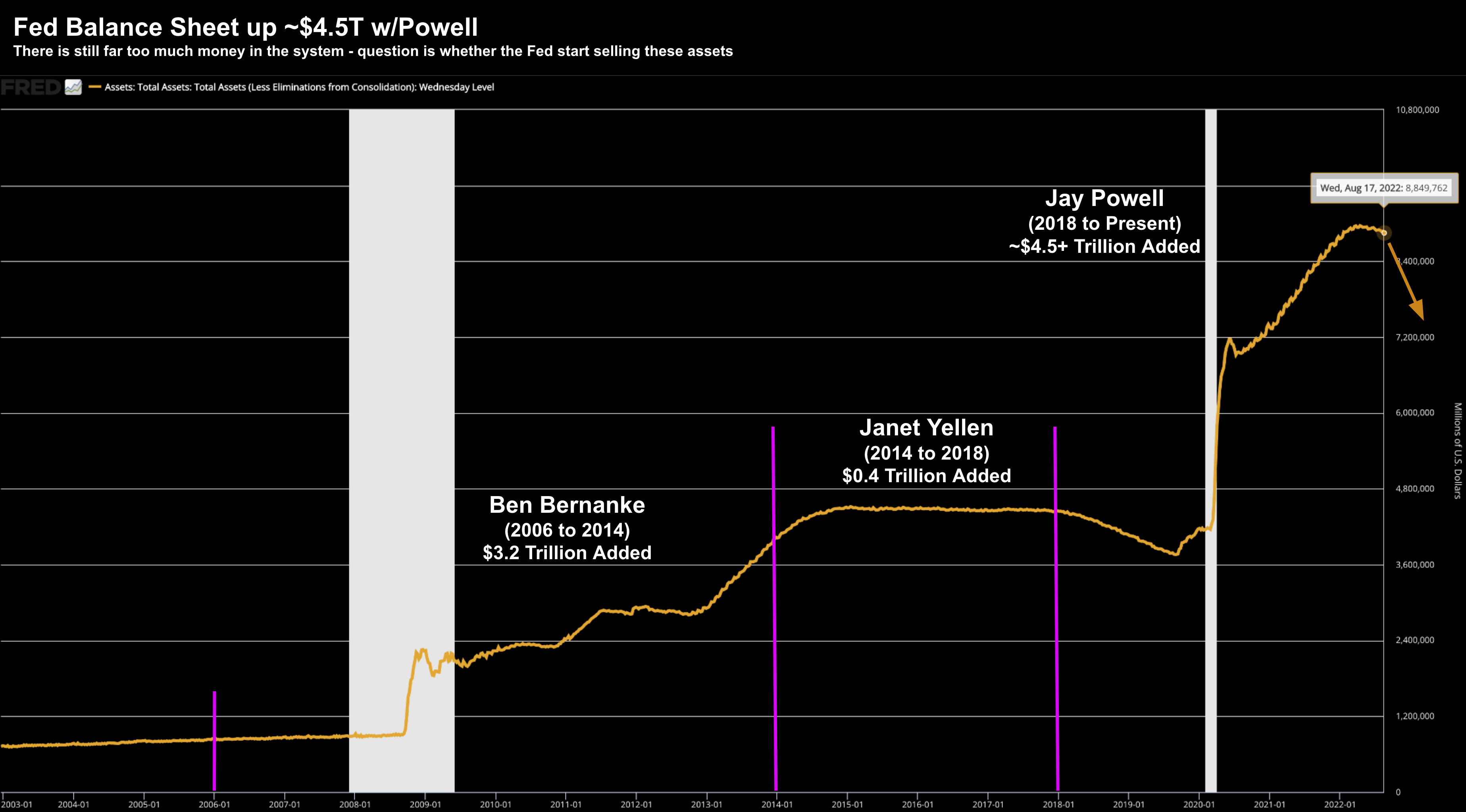

For example, the Fed has only just started its quantitative tightening (QT) program in June.

And in September, we will see QT increase to $95B per month in assets rolling off their balance sheet.

Which brings me to what could come from Jackson Hole…

Whilst mainstream media focus (almost exclusively) on the pathway of interest rates – less time is spent analysing how the Fed will use their balance sheet as an effective policy tool.

For example, with respect to hiking short-term rates – this has the effect of hurting the demand side of the equation. Money becomes more expensive therefore we should expect less of it (i.e., Econ 101)

However, on the supply side, there is still far too much money out there to bring down inflation.

Below we see the $4.5 Trillion the Fed has created post the pandemic which is yet to come down in any meaningful way (n.b., not helped with the government announcing new massive spending bills – which will require funding)

Aug 19 2022

The Fed has said publicly they don’t intend to hold mortgage debt on their balance sheet… but they are yet to take action.

I think this is something investors need to be aware of.

What’s more, QT has done very little to sway the (bullish) sentiment of the market.

Again, this flies in the face of the Fed’s objective.

My thinking here is don’t be surprised to hear more about their intent to use the balance sheet as an inflation fighting policy tool.

Again, their primary objective is to take money out of the system (not add to it).

That’s how you reduce inflation (i.e., less money chasing more goods)

One important step in this process could be a commitment to start selling mortgage-backed securities.

For me, this poses a meaningful downside risk to the market.

Putting it All Together

And it doesn’t matter if that asset is a house, stock, bond or precious metal.

I often say that anyone can post one, two, three or even four good years in a row.

Equally, it’s not hard to find a few winners which go up several hundred percent.

But that doesn’t make you a good investor.

More likely it meant you were lucky.

For example, even the poorest decisions can turn out well.

Don’t confuse that for thinking you made a good decision.

What makes you successful is being consistent over the long-term through both bull and bear markets.

It means not losing too much money when the market corrects to the tune of 25% or more.

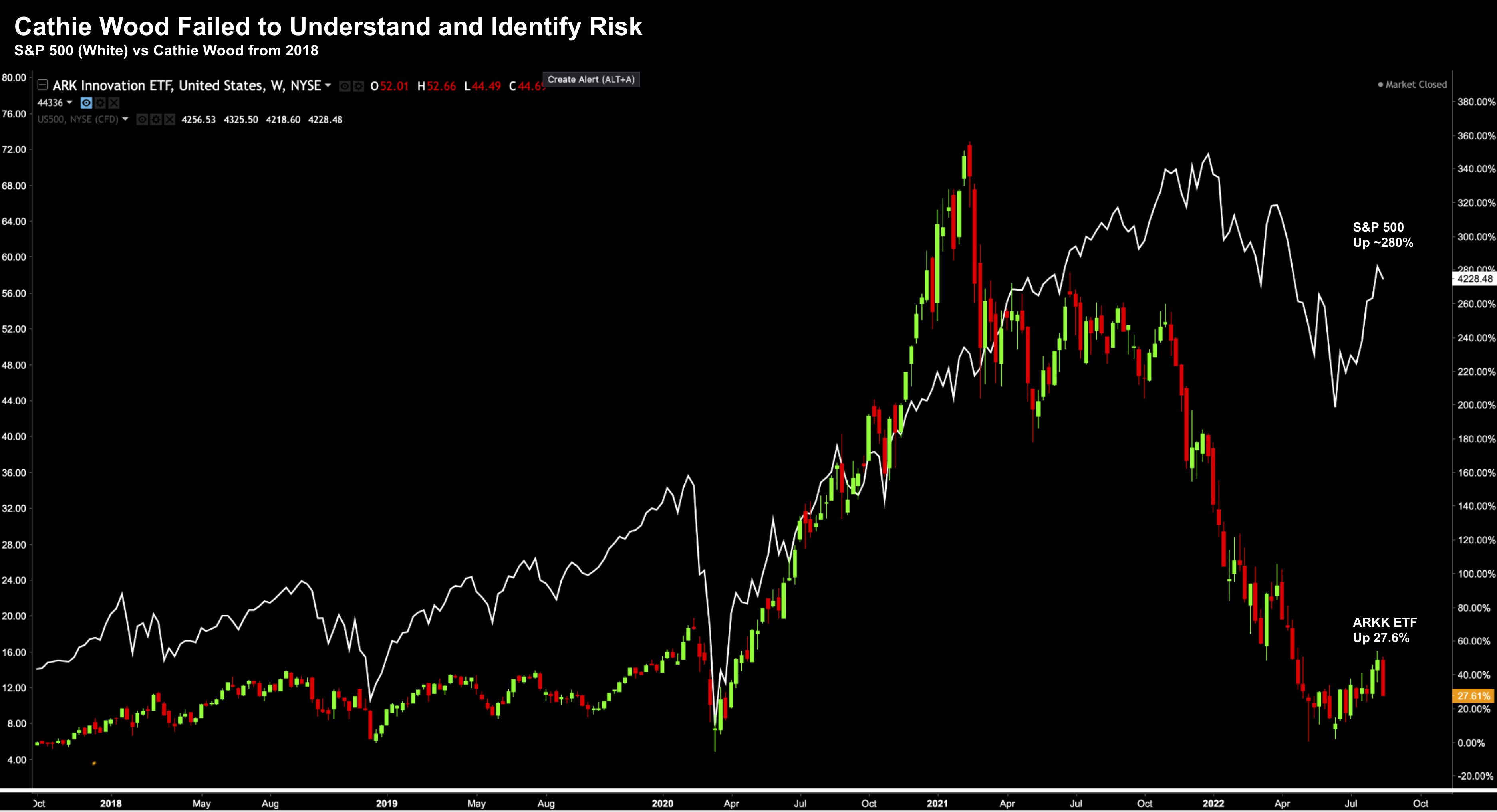

Now I don’t mean to pick on Cathie Wood – but her fund’s performance (ARKK) typifies many of the investor’s today (not to mention many “leading” hedge funds – who have seen their funds lose 50% or more this year)

These investors failed to understand, identify and control risk.

Instead, they blindly follow momentum (at any price) – thinking things will go on forever (as we see below)

Aug 19 2022

Cathie would have been wise to pay attention to economist Herb Stein’s observation that “if something cannot go on forever, it will stop”

It stopped.

So what happens to the “Cathie Woods” of the world then? What happens when market’s turns decidedly bearish? And momentum no longer works?

Here’s the thing folks:

Success in this game will not come from “buying good things” – it will come from “buying things well.”

I’m sure Cathie bought some very promising ‘good things’… but she didn’t ‘buy well’.

Stay patient. And buy well.