- Snap falls 26% after disastrous quarter

- Why I think it could be a takeover target around $11 per share

- AT&T says customers taking longer to pay their bills – canary in the coal mine?

$83.84

That’s how much one share of Snapchat (Snap) would have cost you September last year.

Today you can pick it up for ~$12… maybe even less tomorrow.

More on why shortly….

The market added to its recent gains today – with the S&P 500 closing within a whisker of 4,000

Expect resistance between 4100 and 4200 (see yesterday’s missive)

But let’s get back to the talk of the tape…

Snap was the first of the tech companies to report for Q2 and it wasn’t great. Here’s the TL;DR:

- They missed on both the top and bottom lines

- Authorized a stock repurchasing program of up to $500 million; and

- Plans to “substantially slow hiring, as well as the rate of operating expense growth.”

Funny.

A $500B buy-back when (a) you have negative cash flow; and (b) you’re EPS negative (which will only make it greater)?

I digress…

So what to make of this train wreck?

If you recall, it was only ~60 days ago (May 20) when CEO Evan Spiegel warned of lower Q2 revenue.

It sent a shock wave through the social advertising market – and the stock lower by some 25%

Today the 32-year old CEO fell well short of his guide lower… something Wall St. does not take kindly to.

The stock is down ~26% after hours… and likely to trade even lower.

Three things takeaways from today:

- First, Spiegel was late to heed the warnings of a slowing economy earlier in the year. He had an opportunity to get in front of opex (like Uber did in May) however didn’t act. And whilst Snap might have been the ‘first to report’ – they are also ‘one of the last’ to advise of hiring reductions and other cost measures

- Second, if you’re going to guide lower 2 months before announcing earnings, you had better come close to that guide. But going from an expected 18% YoY revenue growth to flat is unacceptable; and

- Third, telling the market it’s too difficult to guide is actually the right thing to do. Sure, it won’t give the market a lot of confidence but if you do not have visibility… then say so. That’s acceptable.

But the primary takeaway (for me) is Spiegel was late to the party… he didn’t see what was coming.

And now it feels like Snap is having a very difficult time navigating several headwinds.

Let’s explore…

The Messy Details…

Spiegel advised revenue growth for the 11-year old social media company would be flat.

That’s a long way from the 50% revenue growth they have delivered the past 5 years.

But it’s more than that…

- Quarterly losses were more than double than previously guided;

- Free cash flow was negative (-$147M); and

- Average Revenue Per User (ARPU) fell from $3.57 last quarter to just $3.20 (10% lower than the guide)

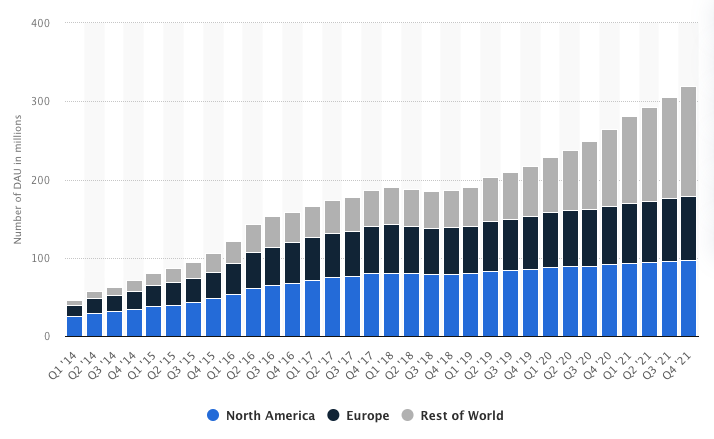

The ‘good news’ is the added 15M DAUs last quarter – bringing the total to 347M and growing to 365M in Q3.

Regardless, valuations for SNAP are quickly coming down.

Consider earnings (or lack of):

Snap trades something like 143x trailing earnings (a forward EPS isn’t possible as there are none!)

But compare that with say Meta (aka Facebook) – which trades at just 13x forward.

Now for the most part, Snap has always commanded a very high multiple (largely opposite its 50% revenue growth).

But the moment you:

- stop producing a track record of consistent revenue growth;

- post negative free cash flow; and

- cannot demonstrate a very strong competitive (or market) position

… then your stock will be brought back to earth.

But let’s compare Snap with that of Meta (which is now trading about 6% lower in sympathy)

- ~3B MAUs (size and scale) with 10M+ advertisers;

- ~13x forward PE and 8x EBITDA

- Price-to-Sales 4x; and

- Free cash flow of $24B

What’s more, they have diversity across Instagram, Facebook, WhatsApp and now Oculus (its VR headset).

As a further comparison – consider Google.

The search engine giant trades at 20x forward earnings (less if you add back cash per share); ~20% revenue growth and free cash flow of ~ $70B per year.

Which one would you rather?

Now both Meta and Google will trade lower tomorrow given the cyclical downturn in advertising spend.

Makes sense.

But the valuations for Meta and Google are not unreasonable (e.g. at 13x and 20x forward).

What’s more, given their billions of daily users – the diversity of offerings – both are positioned to weather the cyclical storm of lower ad spend.

Snap is a different value proposition.

It delivers a niche experience targeted at a very narrow demographic (i.e., those primary under the age of 30)

Spiegel is yet to lead a company through a recession – one where monetary conditions are tightening sharply and ad spend will contract.

He’s only 32…. so we will see how he goes.

Stock Could Easily Fall Below $10

Looking at Snap’s weekly chart – it looks more like the Burj Al Arab!

July 21 2022

Let’s run through our ‘technical’ checklist:

- The stock entered a bearish weekly trend with the price ~$50

- The previous major low of June ’21 was broken October last year; and

- The 10-week EMA has acted like a “rail of resistance” on the way down (including this week)

None of this suggests taking an aggressive long position.

And if you took a speculative position at all – expectations should be for lower prices.

So far so good…

But at some point the stock will start “basing”; i.e., the falling knife will plunge into the ground.

However, it won’t be this week!

From mine, if we see the stock trading ~$8… and with almost 400M users… it could start looking like a takeover target.

Some back-of-the-envelope math:

- Assuming price to sales of 3x (currently trading 5x)

- Assume sales revenue of $4.4B (i.e. flat)

- Acquisition price around $13B to $15B

- 32% discount to current price or ~$11 per share

When you consider they will have close to 365M users… that’s ~$39 per user (where ARPU today is $3.20)

Reasonable?

Well by way of reference, Spiegel knocked back $3B from Zuckerberg in 2013 when they had less than 40M users (i.e. ~$75 per user)

But who would buy it? And more importantly – who would the SEC allow?

You can eliminate Google and Meta immediately… as the SEC would see it as too much ‘influence’ on social (e.g. Google with YouTube)

Maybe Amazon for a social play on eCommerce? That seems like a good fit.

Or perhaps Microsoft as a pure social play (incremental to LinkedIn)?

Nonetheless… I am sure the sharks will circle around $11 per share.

Putting it All Together

With Snap’s stock falling 26% post earnings – the market has zero tolerance for this kind of performance.

For example, if you miss Q2 earnings you will be punished.

And what’s more, if you miss a revised lower guide – you will be hung, drawn and quartered.

But beyond Snap – these are the earnings revisions that are coming.

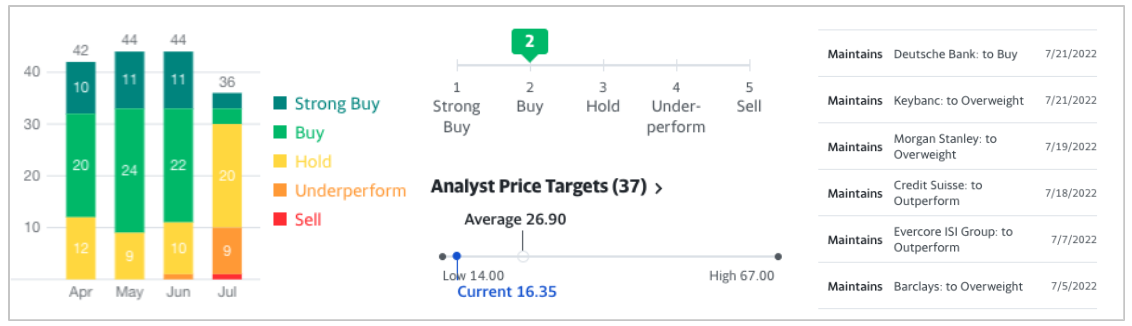

Analysts (always very late to party) will take the guillotine to Snap’s growth estimates. For example, look at how wrong they were:

Source: Yahoo! Finance – June 21 2022

The lowest estimate is $14.00 per share. One analyst is as high as $67!

And there is only 1 sell rating.

What analysts failed to see what the broad slowing of the consumer and the impact on ad-spend.

For example, I listened to AT&T’s earnings today.

It’s not a stock I wish to own (not at the current price) but it is one I listen to to get a read on the consumer.

Their CEO told us that consumers are taking much longer to pay mobile and internet bills.

Isn’t this the last thing you forget to pay?

It’s akin to not paying the electricity or water right?

This has led AT&T to revise their free cash flow significantly lower by $2 billion.

One questions whether it puts their dividend at risk.

From Bloomberg today:

“I’m not surprised to hear consumers are paying bills more slowly; they are already struggling with higher food and energy prices,” said Wolfe Research analyst Peter Supino. “I’m not worried so much for AT&T as I am for the broader consumer economy. You wonder if this is the canary in the coal mine.”

Normally I would not comment on AT&T – but Supino has a point.

Unfortunately for a company like Snap – who exclusively rely on ad-spend – they will be on the receiving end of AT&T’s ad-spend cuts.

Avoid this one – but start taking a look ~$8 per share as a highly speculative position.