- Guilty until proven innocent

- Things continue to “trade per the script’

- March 2009 the last time sentiment was this negative

Some readers are of the view the bottom is in for 2022.

Maybe they are right… but I still have a few questions.

I will share my thoughts (with charts) shortly.

But first, leading indices caught another strong bid on the back of Netflix’s “less bad” earnings report yesterday.

It was enough for tech stocks to maintain their recent momentum – leading the overall market higher.

The pivot from value to growth continues – where investors (like myself) have been adding to quality names at attractive (long-term) prices.

So is ‘the’ bottom in for 2022?

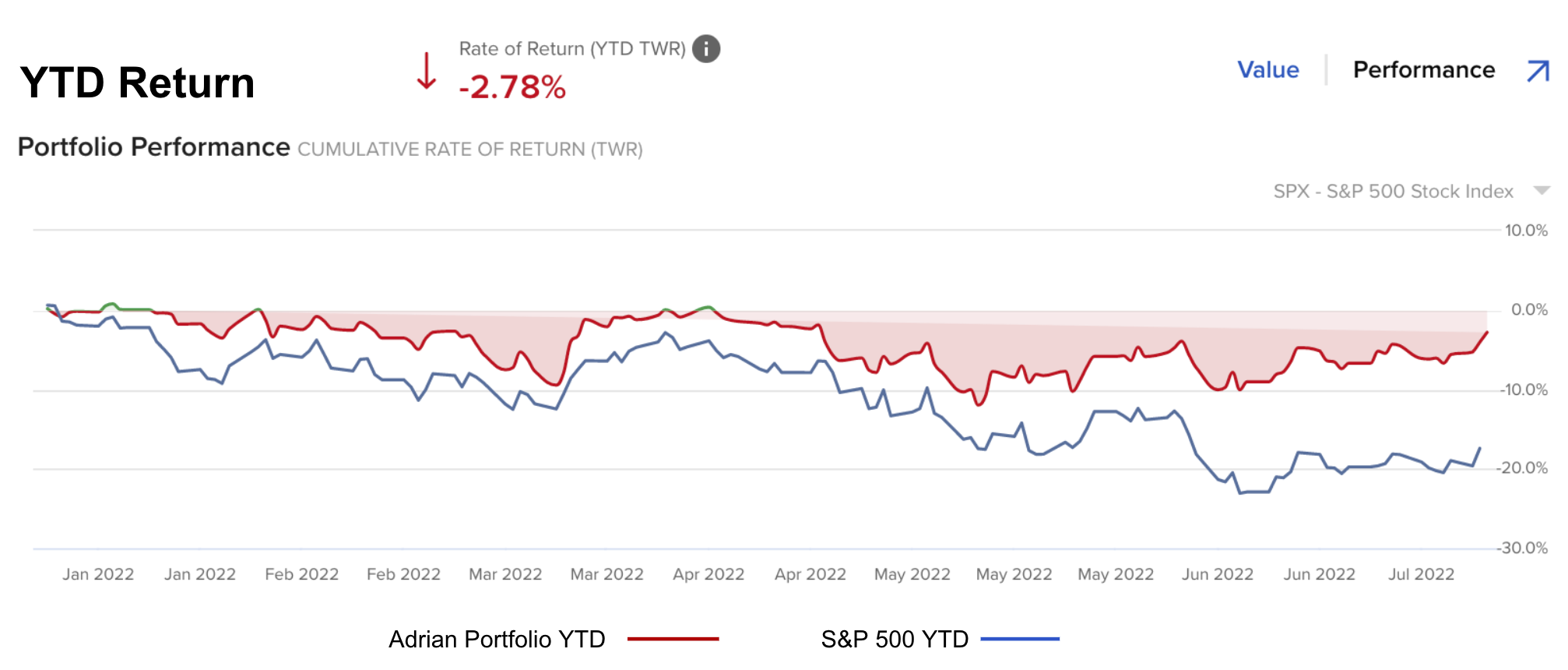

I am not yet convinced – despite being ~65% long (my YTD % return (red) vs the S&P 500 below)

Guilty Until Proven Innocent

As I say, there’s a possibility these readers could be proven correct.

I don’t think it’s probable… but it’s possible.

Granted the bulls have had a far better time of it the past 5 weeks.

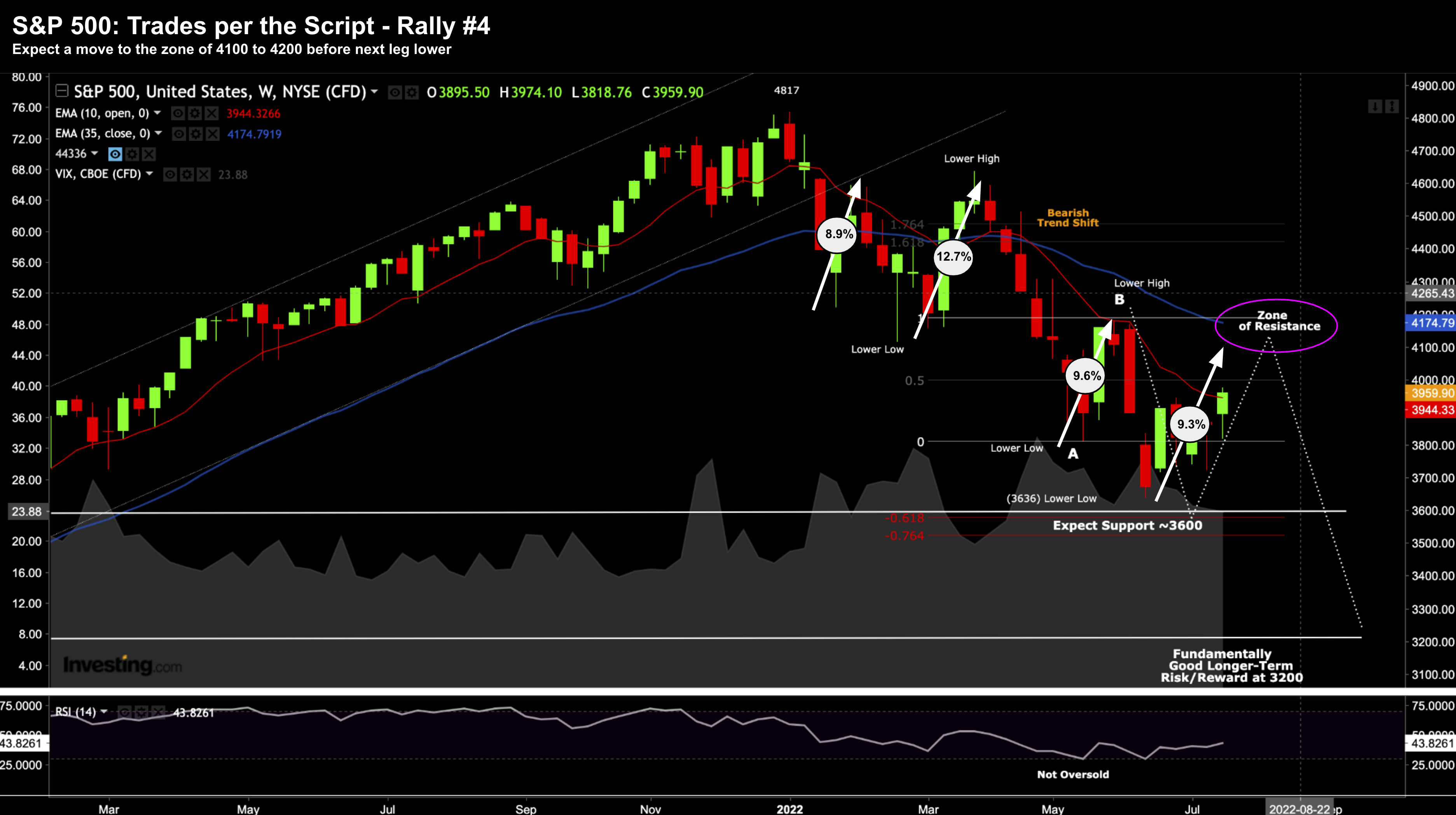

From the lows of June 6 – the market is up 9.3% and is likely to go further.

And further to my own performance chart above – I am not complaining!

But this is not the first time we have seen this kind of price action in 2022.

In fact, it’s the forth such rally of ~9% or more…

July 20 2022

Labelled are each of those sharp rallies…

But as I have demonstrated in the past, when we are working through a bear market, we should expect rallies of this nature.

The sharpest rallies will occur in bear markets.

But note what we find with the weekly chart:

- The weekly trend is bearish (i.e. 10-week EMA (red) below the 35-week EMA (blue);

- The slope of the 35-week EMA is sloping downward; and

- There is a clear pattern of “lower lows” and “lower highs”

None of this tells me we can call a bottom.

Not yet.

Now I’ve said to expect the next bear market rally to potentially challenge the zone of 4100 to 4200.

For example, June 25th I shared this post: “Market Poised to Rally… But Tread Carefully“

This was the chart (and forecast) I offered:

June 25 2022

Very little has changed from ~4 weeks ago.

So far, we appear to be following the white-dashed line to (what I feel) will be a “zone of resistance” around 4200.

And unless we exceed 4200 – and sustain that level – this remains a bear market rally until proven otherwise.

Guilty until proven innocent!

As a parallel, I dimensioned the (sharp) bear market rallies we saw in 2000 and 2008 here.

In fact, some of these rallies exceeded 20%.

Here are the two charts for reference:

And…

In each case, the bear market ended when

(a) we saw the weekly trend reverse;

(b) we saw the previous major high exceeded; and

(c) coupled with a higher major low.

And until we see that, my thesis remains this is a bear market rally.

One Possible Explanation for the Rally

Perhaps one the reasons for the current rally is how overwhelmingly negative sentiment has been.

For example, typically when sentiment is so bad… it’s good.

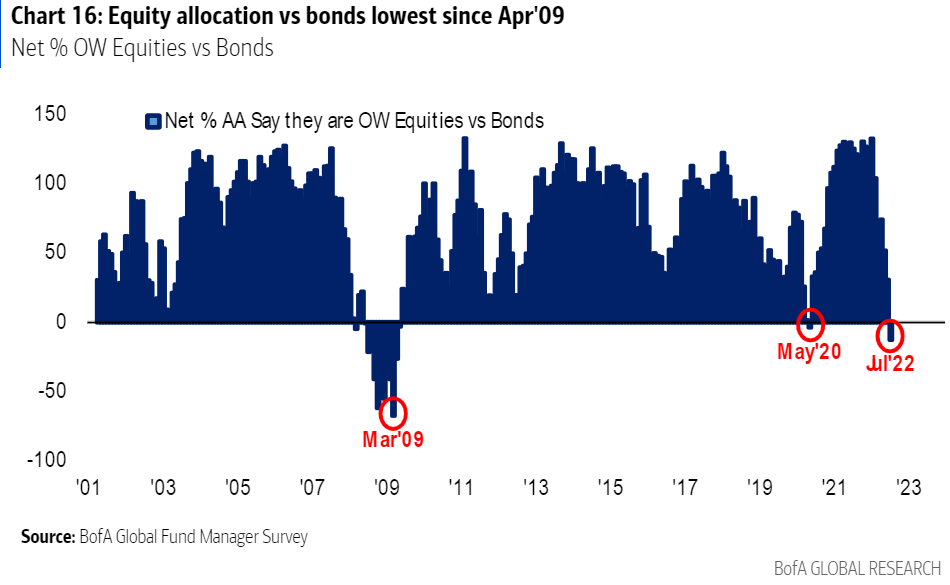

Now rarely do you find large fund managers being overweight in bonds (at negative yields) relative to equities.

But that’s where we are…

In short, it suggests unusually strong negativity about the immediate outlook for the economy.

The latest edition of Bank of America Corp.’s monthly survey of global fund managers finds that they are now more underweight in stocks than bonds than at any time since March 2009.

As an FYI – March 2009 was the month the market bottomed after Lehman Brothers collapsed:

What’s striking here is ‘smart’ people – who manage assets for the long-term (not short0-term traders) – think it’s better to lend to the government at negative real rates – than invest in say an “Apple, Google or Microsoft etc” at attractive long-term multiples.

To me that is puzzling… then again what do I know?

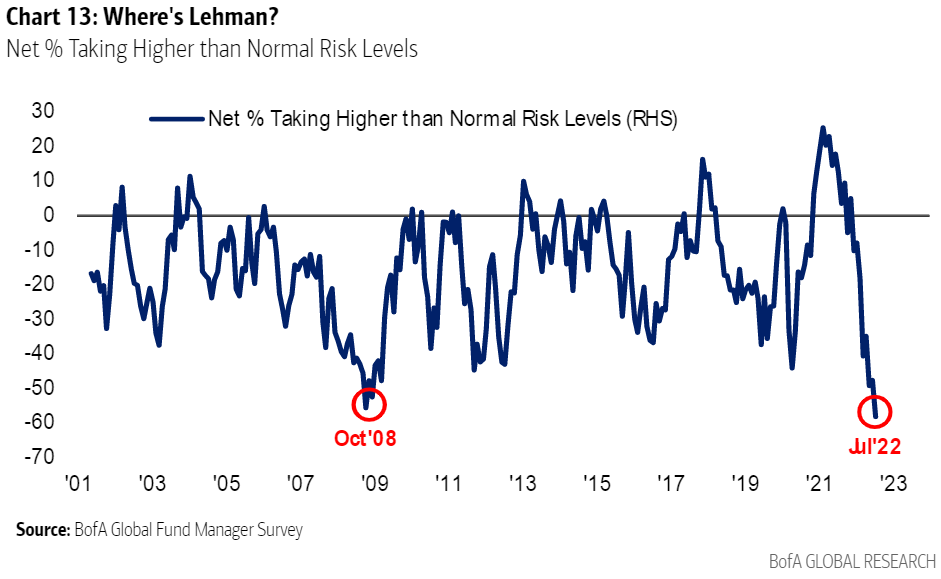

The same survey showed these money managers believe they’re taking less risk than at any time since the survey started asking the question more than 20 years ago:

Now interestingly, the previous low on this measure came five months before the final market low.

Obviously this kind of chart bodes well for readers who believe that 3636 will be the low for 2022.

And if we have seen “full capitulation” (which is what the survey could suggest) – that’s great news.

It means almost all of the sellers are now wiped out.

And when there are very few people left to sell… prices rise.

I hope they are right… but the tape (so far) says there’s more work to do.

I don’t think we have seen “full capitulation” yet.

Putting it All Together

For what it’s worth – the good news is we have priced in a lot of the market risks already.

Most of them are known.

For example, the risks opposite inflation, recession, Fed rate hikes, quantitative tightening, Russia, high oil prices etc etc (it’s a long list) is not new news.

However, the one thing still to come are analysts revisions to earnings.

They need to come down.

They are starting to slowly (for example after companies like Netflix (and Tesla) report.

But we need to see more.

Next week we will hear from mega-cap tech and the Fed.

That’s when the so-called “rubber meets the road” with earnings.

Companies such as Google, Meta, Microsoft and Apple have all been trying to get in-front of any “bad news” with announcements on slowing hiring and negative impacts from foreign exchange.

But if stocks can rally post these earnings… and exceed 4200 on the S&P 500… then maybe the 2022 lows are in.