- Bear market lessons from 2000 and 2008

- Is Property the next “shoe to drop” with higher interest rates?

- Powell “has all the tools” to squash inflation

Nothing rises or falls in a straight line.

Bull markets will always pause for air (for e.g., 37 corrections of 10%+ since 1950); and bear markets will typically have bursts of hope.

If you’ve been following my missives – you will know I think there is an incredible ‘once-in-a-decade‘ buying opportunity coming our way… but it’s not here yet.

In the near-term, we can expect some sharp bear market rallies.

Let’s start with the market history – as these lessons repeat time and time again.

Bear Market Lessons from 2000 and 2008

Shortly I will share the technical charts for both the crashes of 2000 and 2008.

As a quick preface, it was the stock market crash of 2000 where I paid my “tuition fees“ to allow me to trade.

I was just 5 years into my trading journey and knew next to nothing.

Needless to say I lost a lot of money thinking I understood how to trade / invest (as I fooled myself thanks to profitable years up until 2000 (not hard in a bullish market).

However, it was the best tuition money could buy (far better than my post-grad at FINSIA) I could have wished for some 22 years later.

As an aside, I like to say that one of the greatest gifts you can receive is making big mistakes early in life. All going well – it’s unlikely you will make the same mistake again.

Lucky for me, I made mistakes at just 29 and not 49 (i.e., at a time when I barely knew the difference between ‘shit and clay‘ in terms of how markets function).

Let’s examine what happened and how we can apply this today… starting with the dot.com bust:

Five key investing lessons we can glean:

- First, we experienced 7 sharp bear market rallies as the market lost 49.3% of its value (peak-to-trough).

- Second, note how the market made a series of lower highs and lower lows as it worked its way lower. It wasn’t until June 2003 until the market made a new “higher high”. And slightly earlier, we also found that the market had finally reversed its weekly bearish trend (i.e. where the 10-week EMA (red) crossed back above the 35-week EMA (blue). Only once we see a bullish weekly trend – are higher prices more likely.

- Third, with each attempt to rally, resistance was found around the 35-week EMA zone (blue line). Highlighted are 4 occasions where this happened. For those who had weaker positions or wanted to exit at a higher price – this was the opportunity. And for those who trade short, this was also the best risk/reward.

- Fourth, the VIX exceeded a value of 40 on two occasions on the way down. The first was a low of 944 (some 36% off the 2000 high); and the second was a low of 775 – which turned out to be the ultimate bottom (49.3% lower).

- Fifth, on three separate occasions the market showed oversold conditions (RSI below 30 in the lower window). Those three occasions resulted in bear market rallies of 19.3%, 21.7% and 21.2%. However, each rally formed a new “lower high” (and failed to reverse the weekly bearish trend)

Let’s now turn to a similar chart for the bear market of 2008 (which for me proved to be a lot less costly).

As you can see, the patterns are similar.

- First, we experienced 4x sharp bear market rallies as the market lost 57% of its value (peak-to-trough).

- Second, the same technical formation of lower highs and lower lows. It wasn’t until July 2009 where the market made a “higher high”. What’s more, our weekly trend reversed course in August 2009. At this point, probabilities favoured higher prices.

- Third, two strong attempts to rally to the 35-week EMA were both rejected. The third attempt was initially met with resistance however the market formed an important higher low in July 2009

- Fourth, buying the market when the VIX first moved above 45 (i.e., when fear was high) was a value of around 849 on the S&P 500. And whilst the market went on to make lower lows – ultimately this proved to be an exceptionally good long-term risk / reward entry (i.e., CAGR of 11.3% plus dividends (~2%) to this year). If you bought at 849 (the low was 666) – you had recovered all your losses within 12 months.

Why did I share these two charts?

First, you need to remain patient. We are going to see some ferocious bear market rallies in the coming weeks and months – which are likely to exceed 10-15%.

But don’t be fooled…

Looking at today’s weekly chart for the S&P 500 – I need to see the market exceed a value of 4200 (i.e., Point “B” – a new ‘higher high’) before I even consider we are on “firmer footing”.

Put another way, until the market stops making lower lows and lower highs – this remains a bear market where lower prices are more likely.

We have seen this script many times before…

Property: The Last ‘Shoe to Drop’?

Okay… let’s switch gears.

The other day, I shared a missive explaining the primary reason why markets crash.

Irrespective of whether the speculative asset in question are equities, bonds, crypto or property… the denominator is the same.

That is, the mis-pricing of risk via suppressed interest rates (typically for unnecessary length of time)

And this has led to two unfortunate consequences:

- Capital being grossly misallocated (i.e., giving rise to asset bubbles); and related

- Investors being forced (by central banks) up the risk curve (i.e. paying excessive prices)

And whilst it’s painful for investors watching their wealth disappear in bond and equity markets — it’s another thing entirely when property prices plummet.

I say that because that’s a lot closer to “home” (pun not intended) for most folks.

For example, it’s fair to say most people have the majority of their life savings tied up in property (e.g., either the place they live in; and/or property investments). And I will share a painful Australian story on that in a moment…

As a result, if housing plunges to the tune of 20% or more… that pain is widely felt throughout the entire economy (i.e. not just the ‘wealthy’ who can afford to invest additional capital into equities).

Now this week – I caught a story on Bloomberg highlighting the (debt) risks opposite housing.

Bloomberg tell us that “the most aggressive monetary policy tightening cycle in decades is slowing demand for homes, cooling prices, and in some cases already triggering material declines”

Let me just pause there with a chart showing what we are seeing with REITs.

Real Estate Investment Trusts are vehicles that are actively managed and pool together investors’ money to invest in properties

June 23 2022

If there’s one asset class above all others staring to the abyss of significantly higher rates – it’s property.

In 6 months, this REIT (like many) has plunged 20%… perhaps an earlier indicator of what potentially lies ahead.

But let’s look further… as some of ‘surface cracks’ are beginning to show.

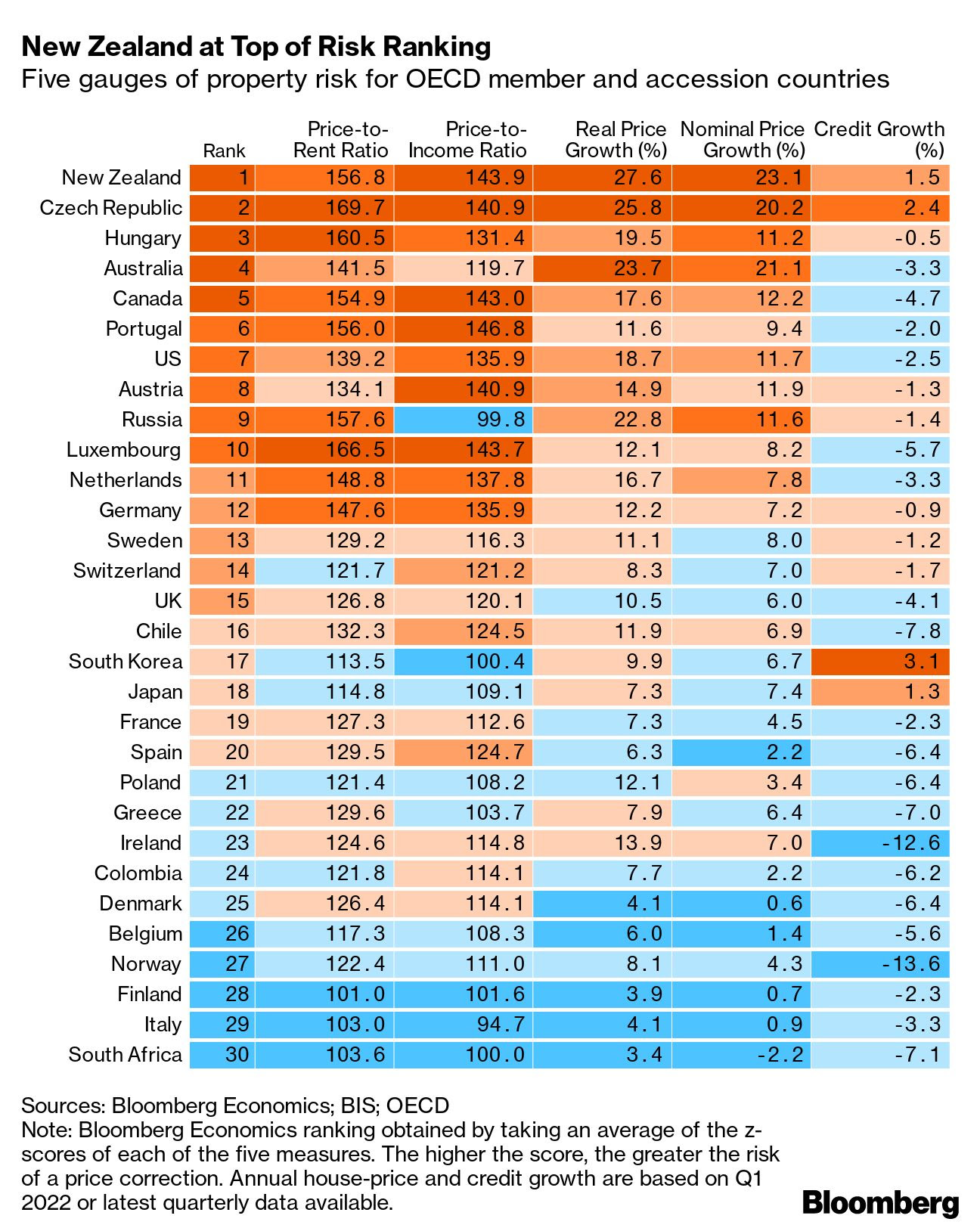

New analysis by Bloomberg Economics shows that 19 OECD countries have combined price-to-rent and home price-to-income ratios that are higher today than they were ahead of the 2008 financial crisis — an indication that prices have moved out of line with fundamentals.

Sound familiar?

First bonds. Then stocks. Now property…

New Zealand tops the ranking of the least affordable with Australia coming in 4th (more on that in a moment)

To be clear, these ratios don’t make a housing crisis a certainty.

However, what it does highlight is the obvious (consumer) vulnerability as central banks aggressively raise interest rates and mortgage repayments move higher (notwithstanding the pressure of 8.6% CPI)

Put simply, falling home prices do three things:

- Erode household wealth;

- Damage consumer confidence (already at record lows); and

- Hinder future property investment

That said, in order to try and cool unwanted levels of sustained inflation – (1) and (2) are exactly what central banks intend to do (without simultaneously sending the economy into recession).

Good luck!

For example, so-called “animal spirits” are tamed when people are faced with higher repayment costs on an asset that’s losing value.

What’s more (and especially the case with Australia) – property construction and sales are huge multipliers of economic activity around the world.

As a possible proxy for the state of US real-estate sales – take a look at the share price for broker Redfin (RDFN)

June 23 2022

Goldman Sachs economists recently wrote in a report that the signals from home sales typically precede prices by about six months, indicating that several countries are likely to see further declines in values.

“As borrowing costs rise, real estate markets face a critical test,” Bloomberg’s Niraj Shah said.

“If central bankers act too aggressively, they could sow the seeds of the next crisis.”

And if they don’t act aggressive enough… how does the prospect of 10%+ inflation strike you Mr. Shah?

Choose carefully.

Cheap Credit: Property’s Oxygen

Credit is a vital part to the functioning of today’s economy.

If it stalls (or worse contracts) – a recession is likely.

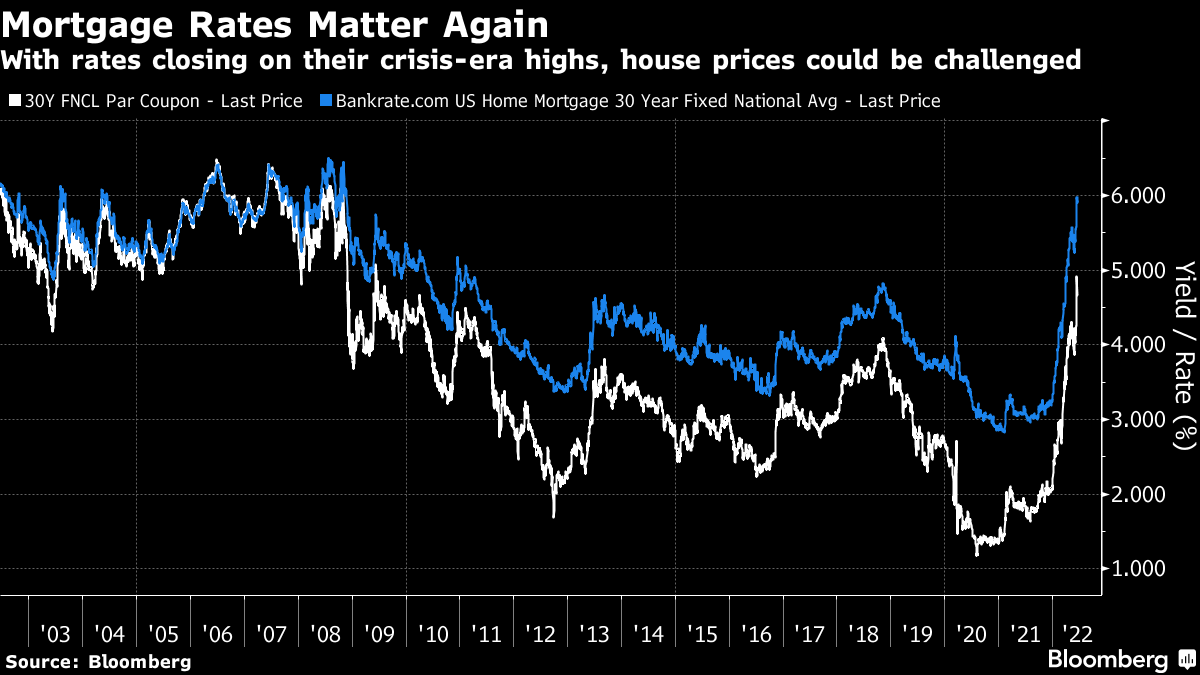

But when it comes to the property – credit is its oxygen. And if its supply is restricted (in this case, made more expensive) – the patient struggles.

And whilst there are some ‘echoes’ of the 2008 crisis (more so in terms of prices which have moved well beyond fundamentals)… there is some ‘good news’.

Mortgage lending standards have tightened considerably from over a decade ago – which means it’s unlikely major lenders will be stressed to ‘breaking point‘ should house prices correct in excess of 20-30%

However…

That doesn’t mean the pain won’t be felt on the unsuspecting consumers who took debt they may not be able to afford (as this story from the ABC explains).

My fear is this Australian home owners story is not uncommon (whether its in Australia, UK, New Zealand or the US):

Ms Ibrahim and her partner took on a home loan of more than $1.5 million in Sydney, with a deposit of 10 per cent.

They are among almost 40 per cent of Australians with mortgages who have locked in ultra-low fixed rates and will roll off them as soon as next year, and potentially face a world of financial pain.

“We fixed the majority of our mortgage for two years, and we assumed that in the next few years, they wouldn’t really go up much,” Ms Ibrahim told ABC News.

She and her husband had been saving for a deposit for years and finally broke into the Sydney property market at the end of 2019.

And therein lies the rub…

The equity that the Ibrahim’s worked so hard to save – could be wiped out within 12 months.

Ms Ibrahim says she relied on repeated statements from the Reserve Bank that interest rates would not go up until 2024.

However, the RBA has stated that the Australian cash rate will lift to 2.5 per cent and possibly more, until it can get inflation down within its target band of 2 to 3 per cent.

What the article doesn’t indicate is the Ibrahims combined income.

However, the fact they could only put down a deposit of just 10% (or ~$175K) is troubling.

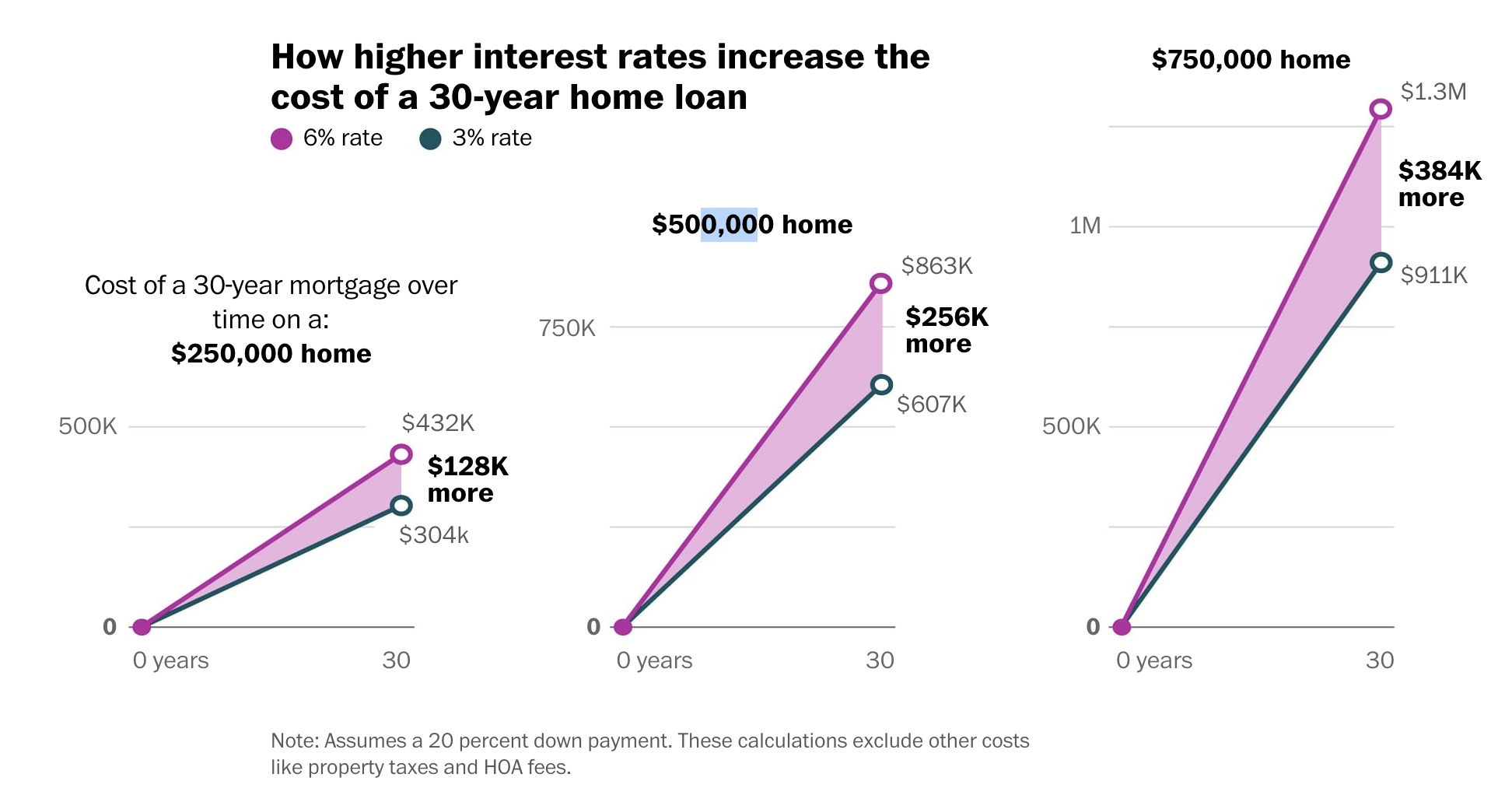

The result of borrowing a staggering $1.50M will mean a rise of almost $20,000 a year on their mortgage repayments.

As an aside, here’s a similar graphic from the Washington Post recently – using a typical US 30-year fixed rate doubling from 3% to 6% in 12 months:

A Crisis of Affordability

Bloomberg’s table of global housing affordability paints a disturbing picture.

Sadly, this is a function of reckless monetary and fiscal policy which has given rise to a bubble.

Rinse and repeat.

Put another way, if interest rates were allowed to trade at free market levels, it’s unlikely rates would ever be negative in real terms (let alone falling well below 4-5%).

But the “$1.5M borrowed” in the case of the Ibrahim’s deserves our attention.

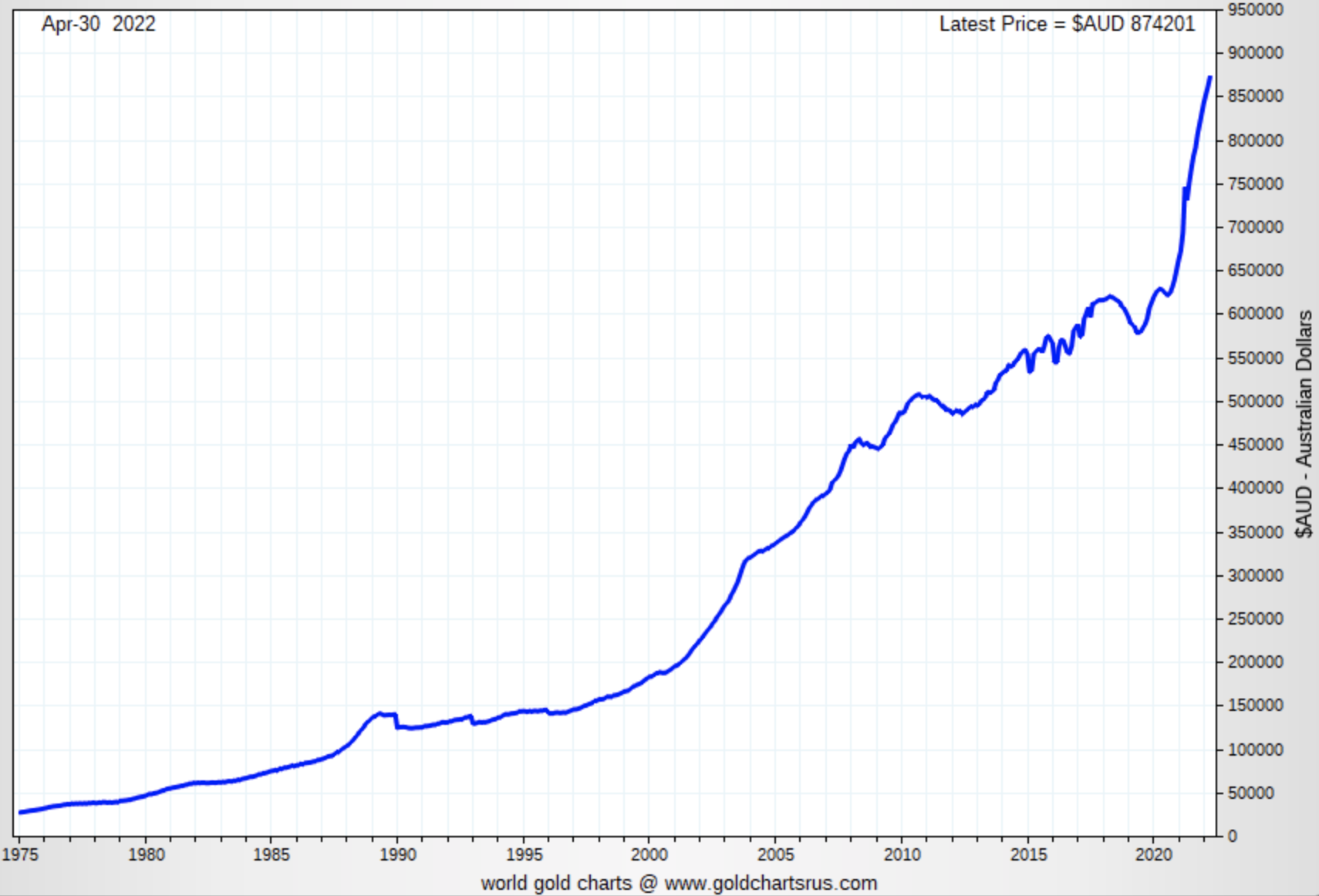

For example, according to the Australian Bureau of Statistics (ABS) – the total value of Australia’s residential dwellings has passed $10 trillion for the first time.

They add the average price of an Australian residential dwellings now stands at AU$941,900 (up from $925,300 in the December quarter in 2021)

“The median house price in Sydney rose by 16.4 per cent to $1,245,000, and by 9.4 per cent to $930,000 in Melbourne, over the 12 months to the March quarter 2022.

Meanwhile, in regional NSW, the median house price increased 29.1 per cent to $800,300 and the Victorian regions saw a rise of 17.4 per cent to $640,000″

In this case, the Ibrahim’s paid perhaps ~40% more than the average price of $1.25M for Sydney.

Below is a chart (published April 2022) which shows the ascent in Australian average prices over the past 40 years:

The 18x increase over 42 years works out to be a 7.1% CAGR (consistent with how real-estate performs over the long term)

But let’s narrow in on affordability (and further to Bloomberg’s story)… as the math is frightening.

To start, the average salary in Australia in 1980 was around $16K (inflation adjusted at 3% – about $55K today).

Now 42 years ago the average home price was ~$50,000

Quick math tells us that (on average) people were paying around 3.1x their annual income to own a house.

As an aside, this is perhaps why most families were able to have 3-4 children; pay as much as 19% interest rates; and live comfortably only on one income.

Fast forward to 2022 – where the average Aussie salary is ~$68K. (i.e., 3.51% CAGR over 42 years – slightly more than inflation).

However, with the national average home at $941K – this represents a 14x multiple to the average annual single income.

If we assume that in most cases it’s a couple buying the property – that is still 7x the average household income.

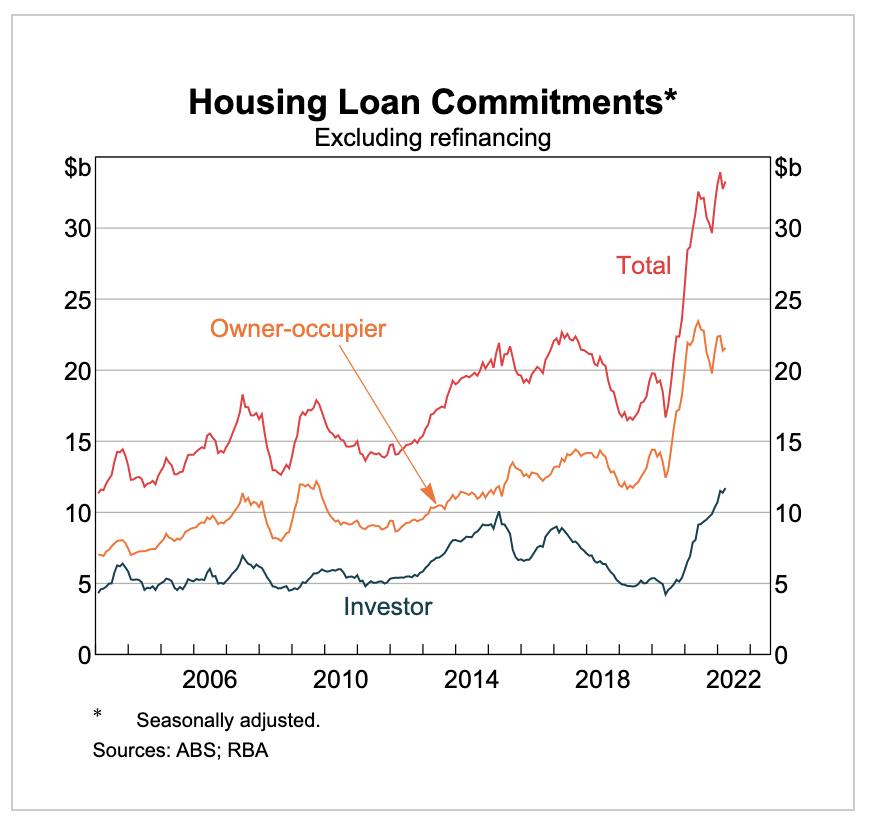

There’s your crisis…. where Australia’s housing (debt) has never been higher (doubling from ~$17B to over $35B in just 3 years):

Ms Ibrahim described herself as a “middle-class” working professional – she is a lawyer and her husband works in consulting — the couple have two daughters under the age of 10.

If we assume their gross household income is in the realm of $300K ($150K x 2) – that would represent a multiple of 6x.

Now in the March 2022 quarter, APRA data shows about 23.1% of new mortgages ($32.7B) had a debt-to-income ratio of 6x or more in dollar terms.

This was down from the record high of 24.3% ($40.6B) in the previous quarter but still almost triple the rate from March 2019, when it was $11.4B

Remember: in 1980 the average price to single income ratio was 3.1x (or ~1.5x for a household)

A Combustible Mix

Thanks to a combination of:

- Artificially record low rates for far too long; combined with

- Irresponsible levels of

excessive monetary government stimulus.

… we now have to contend with speculative asset bubbles across houses, stocks and bonds.

And those (like the Ibrahims) who have bought a home in the past 3 years potentially face the prospect of negative equity.

In other words, they could be paying off a loan which exceeds the value of the property itself.

For example, they paid ~$1.75M for their Sydney home with a 10% deposit (~$175K)

This implies a loan value in the vicinity of $1.5M.

If the value of their home falls say 20% ($350K) – the value of their home will be ~$1.40M. However, they are paying a loan which is 100K more than what the home is worth.

Put another way, “years” of painfully saving the ~$175K deposit could be evaporated within 12-24 months due to significantly higher interest rates (given the likely impact on asset values)

But it doesn’t end there…

A loss of home equity / mortgage pressure is one thing.

The other part of the story (i.e., the ‘combustible mix’) is the prospect of sustained 5-6%+ inflation over the next few years.

Here’s news.com.au (June 22):

Federal Treasurer Jim Chalmers has warned inflation is Australia’s “defining challenge” after Reserve Bank governor Philip Lowe predicted it will hit 7 per cent this year.

In a speech to the American Chamber of Commerce in Australia on Tuesday morning, the RBA boss said the board had expected an inflation peak of 6 per cent in 2022, but that the forecast had been pushed even higher since early May, when petrol prices began to skyrocket.

Now, the RBA is bracing for a peak of 7 per cent in the December quarter – up from the current rate of 5.1 per cent.

And while he said he expected it to decline by early next year, it would take a “couple of years” before inflation returned to normal.

And it’s this “one-two” punch of higher interest rates with inflation which could tip many (over-extended) borrowers to the brink.

For example, the latest data from the Australian Prudential Regulation Authority (APRA), shows that of $2.2 trillion worth of loans held in March 2022, about $9 billion belonged to borrowers who are 30 to 89 days overdue on their repayments.

In addition, as of March, there was about $10.5 billion in non-performing loans held by owner occupiers, up from $9.6 billion in March 2019 (i.e. where the bank believes the will go bad).

This is still quite small but it deserves watching in the coming months. My guess is the trend will only increase.

Further to the ABC article – Financial Counselling Australia chief executive Fiona Guthrie said:

“… a lot of people have borrowed to the “hilt” and she is shocked banks have been letting people borrow six or more times their incomes with very low deposits”

Exactly the point I made earlier.

Putting it All Together

Unfortunately for the likes of the Ibrahims (and others in a similar boat) – interest rates are headed significantly higher at least over the next 2 years.

Central bank will prioritize getting inflation down over a potential “20% decline” in asset values; and/or a likely recession.

For example, this could easily see the US 10-year note (which determines borrowing rates) could easily trade as high as 4.5% to 5.0% in the coming months (up from just 3.2% today).

With respect to where rates are headed – Jay Powell told congressional leaders today that the Federal Reserve has the resources and the “resolve” to tamp down surging inflation.

That may be true… we will see.

However, what Mr. Powell doesn’t possess is the power to drill for more oil or harvest new wheat.

Right?

That said, central banks will be instrumental in reducing the ‘wealth effect’ via driving asset prices lower.

That will in turn help cool certain prices as demand falls.

Here’s Powell’s language to Congress (which will be echoed by the likes of the RBA, BoE, BoJ, ECB etc):

“At the Fed, we understand the hardship high inflation is causing. We are strongly committed to bringing inflation back down, and we are moving expeditiously to do so”

“We have both the tools we need and the resolve it will take to restore price stability on behalf of American families and businesses.”

Unfortunately for some extended families – significantly tighter monetary conditions will remain a headwind.

Short Personal Story

Four months ago my sister was considering selling her Gold Coast home.

She had bought the house about 18 years ago – was sitting on an average CAGR of 7% – and worked very hard to pay off the debt completely in short-time (largely due to the strong advice of her loving big brother 🙂

She came to me in February and said “I’m thinking of selling… what do you think??

I said “do it”.

It was on the market for no more than 2-3 weeks and she had offers coming in. A young couple from Perth were willing to go above her asking price.

She was wondering if she should wait for a better deal and I said “no… take it”.

Quite often your first offer is your best.

I explained to her what was happening across bond markets and why Australia was about to see meaningfully higher rates in the months (years) ahead.

And if my thinking was correct – the air would likely come out of the Aussie housing bubble before long.

Now Kate (my sister) is still wanting to get back into property.

She enjoys owning the house she lives in (as many people do).

But I have told her there is plenty of time; and we can make that money work for her between now and then (safely). However she will most likely re-enter the Australian property market in the realm of 20% cheaper (i.e., saving herself $200K+)

For now, rest easy knowing that you are debt free – cashed up – an interest rates are about to surge.