- The “fire” and “ice” narrative

- Q2 earnings revision cycles still in process

- S&P 500 at 3500 not off the table for this year

Here’s a stat:

If the S&P 500 were to finish the year today – it would be 6th worst annual return in 100 years.

Ouch… it’s little wonder we see headlines like this:

Tough market huh?

If these “experts” are losing money hand-over-fist… how are you doing?

Remember – these guys are paid to do this stuff!

Irrespective, the 2022 bear market which has crunched fund managers like Tiger, Melvin and Cathie Wood’s ARKK continues…

As regular readers will know – I pencilled in a possible bounce through to the 4200 to 4300 zone.

After today, things still appear to be trading per the script (with the S&P 500 chart updated for Monday’s session):

June 7 2022

I noted the market opened strong today (with tech leading the way) – however by the close we were well off the highs (evidenced by the red candle).

I think it’s important to note that bear market rallies can be quite sharp.

However, don’t be fooled.

For this rally to have any weight – it really needs to take out the previous high. In this case, it’s a level of 4600.

And that’s not something I think we will see this year in the face of (a) Fed tightening; and (b) Q2 earnings revisions.

To that end, I think our:

- Best case for 2022 would be 4600;

- Base case (most likely) is somewhere b/w 3900 to 4200; and

- Bear case is in the realm of 3400 to 3500.

Let’s explore…

Fire & Ice Narrative

Today I read a research note from Mike Wilson at Morgan Stanley.

Wilson is a noted bear with his worst case being 3,350 for the S&P 500 – a drop of ~19% from current levels. On the other hand, Wilson’s best case this year is just 4,450

Put another way, Wilson (like me) thinks the potential downside risks easily outweigh any possible upside gains in the near-term.

Morgan Stanley thinks both the tightening from the Fed (the “fire” part of the narrative) combined with a disappointing earnings season (the “ice”) is likely to keep a lid on any material stock market gains.

Regular readers will know this has been my narrative for the past 6 months… where I de-risked my own portfolio (which is down ~5% YTD)

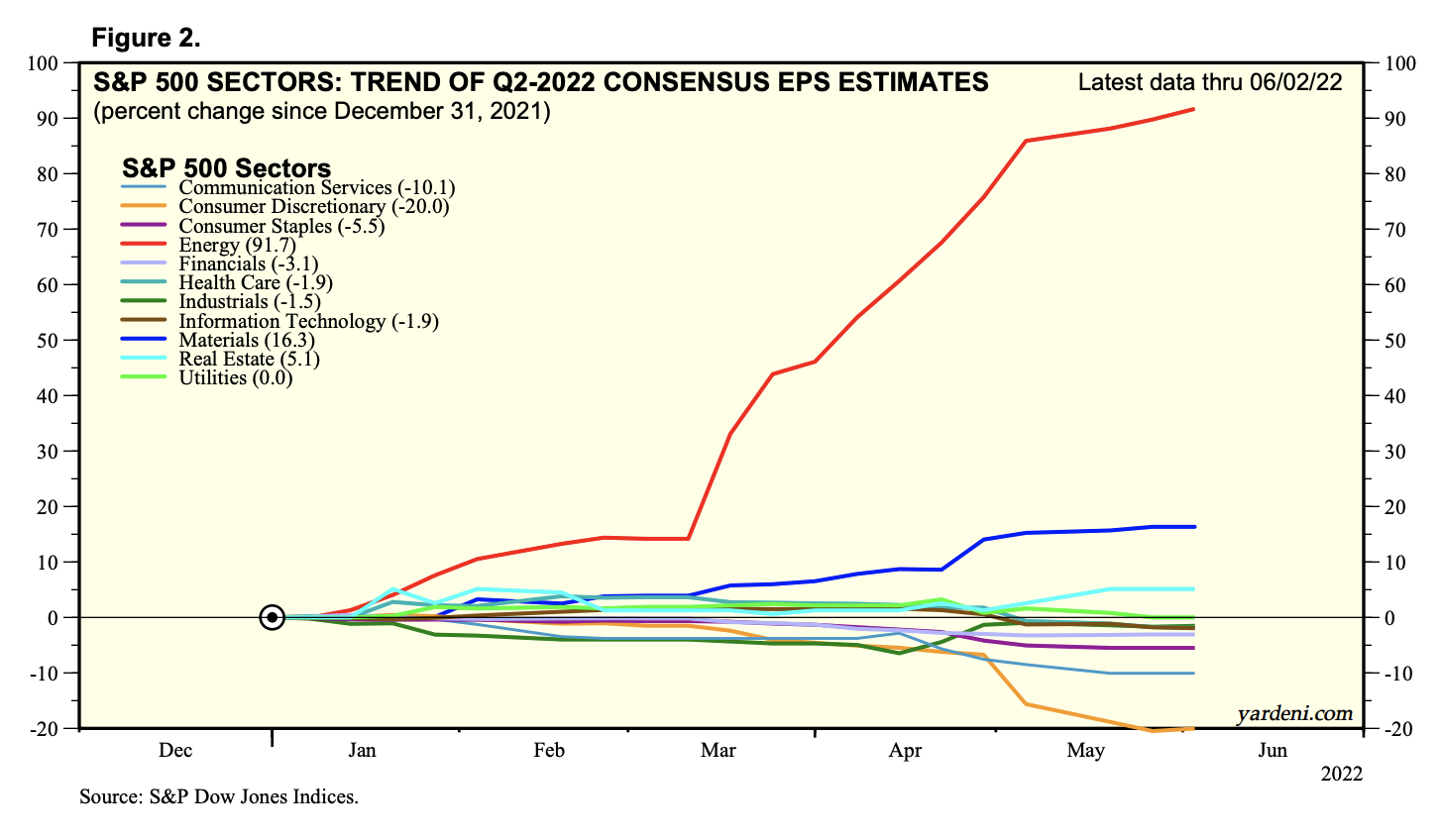

For example, if we consider the trend of earnings revisions, Ed Yardeni recently shared this research for Q2

Energy is the only standout across every sector… with materials and real-estate showing slight upward revisions.

Outside of those three sectors, all other 8 sectors are basically flat-to-negative in terms of their trend.

Consumer discretionary (for example) is lower by some ~20%

The thing is – revision factors typically take a little bit longer than the market prices in.

For example, consider what we have just seen at companies like Walmart and Target.

They received the “message” from the market extremely late.

And to that end, it can often take two-to-three quarters before something appears to “turn on a dime”

This is what we are now seeing…

That is, the process of earnings revisions kicked off in Q1 where profit margins started to peak.

From there, companies start to see their top-lines begin to slow (e.g., as SNAP warned two weeks ago).

And then finally, the market then effectively resets its expectations.

That’s the process we are still working through…

For example, as I wrote the other week, look for more Q2 earnings revision as we get closer to the end of this month.

It’s coming…

And if you put all together, things are very much “trading per the script” both fundamentally and technically.

Half-Glass Full or Empty?

A few days ago ex-Goldman Sachs CEO – Lloyd Blankfein – tweeted that the Fed may be able to land the plane softly opposite higher rates and QT:

But from mine, this is a great example of the conjecture we find in the market today.

For every “Lloyd Blankfein” out there – you will find a “Mike Wilson”

One will be half-glass-full vs half-glass-empty.

What’s your lens?

Now Blankfein is 100% correct that the economy is in decent shape.

In other words, there is very little risk of recession in the near-term (in fact almost zero chance for 2022)

I talked to this as part of my most recent missive – citing the positive (growth) numbers from both ISM PMIs:

- ISM PMI, a closely followed index of U.S.-based manufacturing activity, rose to 56.1% in May from 55.4% in the prior month, the research group said Wednesday. Any number above 50% signifies growth.

- The index for new orders rose 1.6% to 55.1% in May. Employment slumped 1.3% to 49.6%. Prices fell 2.4% to 82.2%.

What’s more, Chicago PMI was also very good.

- Chicago PMI rose to 60.3 in May versus an expected drop to 55 from 56.4 in April.

- The latest numbers align with a gradually slowing, but still robust pace of growth in the US midway through the second quarter of 2022.

But on the other hand, there is no doubt economic growth (and productivity) is slowing, as consumers start to feel the pinch.

What’s Not Priced In?

The exam question we can’t answer (with certainty) is what’s already priced in?

For example, how much lower will earnings be (“ice”)? Just last week saw a couple of major bellwethers revise expectations… expect more.

And just how far will the Fed need to go to curb inflation (“fire”)?

50, 50 and then (maybe) 50 more?

There is no doubt markets have derated stock multiples to a large extent. For example, to begin the year we traded at close to a 22x forward multiple.

That’s gone… higher rates put an end to that.

For example, today’s close, that multiple is closer to 18.5x (if we assume S&P 500 fwd earnings of $225)

But what’s the right multiple? And second, what will the “E” be in “PE”?

With respect to the former, some suggest with the 10-year now trading above 3.00% – a multiple closer to 15-16x is warranted.

Put another way, “TINA” has now pivoted to “TISA” (“There is Some Alternative”)

And with respect to the “E” – how much lower could revisions be?

5% 10%? More?

Wilson from MS believes earnings estimates are still up to ~10% too high.

My take is that number is in the realm of 5% lower – as companies have done a great job of managing their bottom line (especially over COVID).

And if we add to that $1 Trillion of planned share buybacks… the “E” might hold up a bit better than Wilson expects.

Putting it All Together

This Friday we get the latest monthly CPI print.

It’s an understatement to say how closely this will be watched.

Now getting back to Mike Wilson’s “fire” argument – if inflation is showing signs of peaking – the market could find another gear to go higher (i.e., a less hawkish Fed).

The opposite also holds true.

However, the bigger part of the stock story is more likely to be the “ice” (and earnings revisions).

Companies are still yet to revise lower.

We saw an inkling of this last week – where lower guidance is coming in the form of softer demand (e.g., SNAP), supply chain issues (e.g., RH and AAPL); and/or foreign exchange headwinds (e.g. MSFT)

Now stock multiples will usually move ahead of earnings…

In that sense, if earnings are to come down, we could see this fall to 15x or lower.

And should we see the Index trade around 3500… then the upside starts to meaningfully outweigh the downside risks over the longer-term (e.g. 3 years)

But we are not at that point yet.