- GOOG, MSFT, AAPL, FB and AMZN on deck

- Which of the five most likely at risk

- S&P 500 is set to re-test critical Feb/March lows

This week more than 35% of the total S&P 500 market cap report earnings.

Of that – 25% comprise just 5 names:

- April 26: Alphabet and Microsoft

- April 27: Meta Platforms; and

- April 28: Apple and Amazon

It could be “make or break” for the market… pending how these names hold up.

But as we know – sentiment has shifted substantially when it comes to tech / growth.

It’s no longer growth and ‘any’ cost – it’s growth at a resonable price (GARP)

For example, Netflix’s print last week was a warning shot.

The streaming giant can no longer command a “50x type” forward multiple.

That’s gone.

Today, Netflix is fighting to defend just 20x forward PE.

And SNAP’s earnings did very little to get investors excited about online social advertising.

So how will that bode for FB?

And whilst tech valuations have been reset – has it been enough in the face of a US 10-year now trading close to 3.0%?

Let’s explore…

Will Big Tech’s Fundamentals Hold?

When it comes to metrics like earnings quality, balance sheet strength, cash flow… very few are better than the FMAGA complex.

However, the question is what premium do you pay?

Put another way, what is “GARP”?

For example, “30x plus forward earnings” was acceptable a few months ago.

Not now…. not even for the highest quality names.

Let’s start with a quick review of some of the more popular valuation metrics for these market leaders:

April 22 2022

Note: Forward PE’s are adjusted for cash per share held (Row 3).

For example, Google has $140B in cash or $211.28 cash p/share. This reduces their unadjusted forward PE from ~20x to just ~18.2x.

So what stocks (if any) stand out from this table?

A few observations:

- Forward Price-to-Earnings (PE): Meta is the cheapest at 12.5x (net of cash held); Amazon looks expensive (as it always has)

- Price to Sales: Amazon the cheapest at 3.2x sales revenue; however Microsoft looks expensive.

- 5-Year Growth: Amazon is the fastest growing (by far) the next 5-years – at 36%; Meta the most at risk in terms of growth

- Price to Earnings Growth: This is one of my favourite metrics (i.e. what price are you paying for quality growth). Google appears to be “best value” at just 0.91x; Meta also good value at 1.25x. Apple looks on the expensive side (i.e. you’re paying a lot for just 11% 5-yr avg growth)

- Price to Free Cash Flow: Meta is exceptionally cheap at just 13.4x; Amazon burnt cash last quarter

- Free Cash Flow Yields: Meta is very good value here; as is Google and Apple.

It’s difficult to just anchor on one metric.

In fact, when I value these stocks my preference is on a discounted cash flow basis.

And if using DCF – most (not all) of the above look like value.

But I think fundamentally – it’s difficult to look past both Alphabet and Meta.

That said, I think Meta is in for a difficult 12 months ahead given the changes to the company.

Apple seem ‘fairly’ price based on its growth profile (but certainly not cheap); and Amazon might be stretched given the appetite for “50x PEs’.

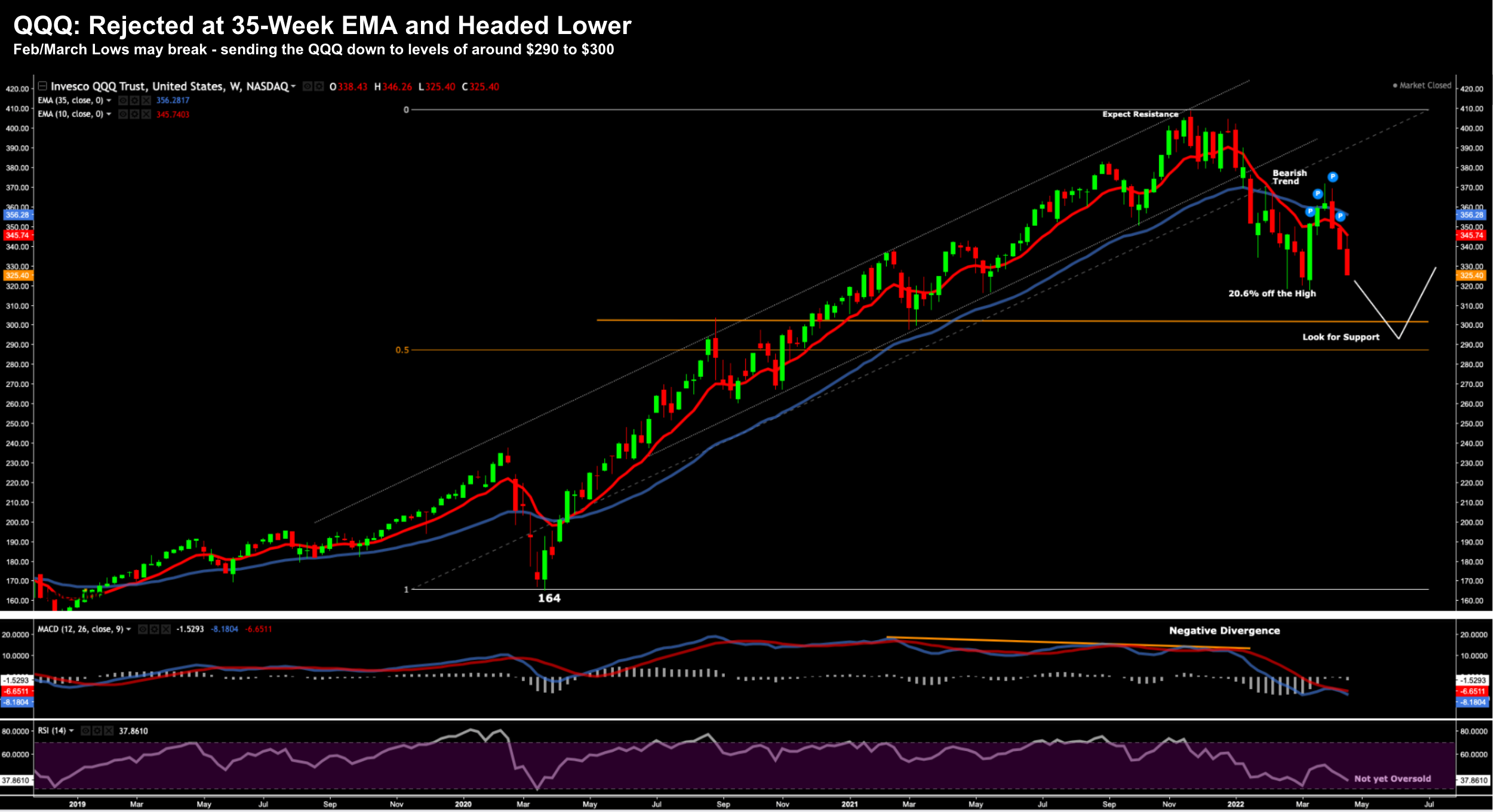

Where Will QQQ Find Support?

Perhaps the biggest surprise to me the past two or so weeks has been Alphabet (my largest position)

Watching this fall ~17% over 13 sessions deserves attention.

What’s more, Microsoft has also traded poorly of late, all the way back to the bottom of its range.

I call these two names out because the highest quality names are generally the last to be sold.

Lower quality names are sold quickly. But when the “top-shelf” stocks go – you are getting closer to capitulation.

The question is what is the last domino to fall?

I think that could be Apple.

If that goes – goodnight market.

But let’s check in with the QQQs.

Needless to say, the price action of late isn’t filling me with a great deal of confidence. However, it also does not come as a surprise.

For example, when I issued this post “Things Trading per the Script” on April 11 – I said

“The QQQ remains in a weekly bearish trend (i.e., the 10-week EMA is below the 35-week EMA).

The ETF rallied to the 35-week EMA (after being down ~22% off its high) before finding selling pressure. We are now looking at strong rejection from this zone… where probabilities suggest there’s more downside.

My best guess is we retest the lows of March 2021 – which could be in the realm of 12% lower. If true, this will be a heavy drag on the broader market – especially if the likes of Apple, Amazon, Microsoft and Google roll over.

However, if we do see a level of around 300 for the tech-heavy ETF (i.e. 26% off the high) – I would be a buyer for the long-term”

So are we any closer to that $300 target?

April 22 2022

It’s coming!

So far, the chart has moved the way probabilities suggested.

The QQQ was rejected at the 35-week EMA whilst in a weekly bearish trend – and now looks set to test the next level of support ~$300.

But here’s something else:

Also sketched in the 50% retracement level from the rally starting March 2020 (pandemic low) to the peak November 2021

That level is just below ~$290

That’s my target for the QQQ post earnings this week; i.e., the zone of $285 to $300

And I think the stock to potentially ‘sink the ship’ isn’t Apple…. it might be Amazon.

Is Amazon About to Break?

Earlier I mentioned the market’s appetite for high-multiples names is starting to wane.

With Amazon trading at a forward PE of 53x – expected to grow at 36% – they will need to deliver another knock out number April 28th

Let’s take a look at the weekly chart in advance:

April 22 2022

From a technical lens – its plausible that the stock will retest the lows of Feb / March at ~$2,700 per share (a level where I added to my existing long position)

However, if that fails, it could get ugly.

Two (possible) support levels which come to mind:

- The long-term 6-year (2016) rising trend line which suggests a level of around $2,400 (17% lower); and

- The previous level of resistance held b/w 2018 and 2020 of ~$2,050 (31% lower)

A move to (1) feels more likely on any news of a bad quarter and/or soft forward guidance.

But if Amazon really disappoints (e.g. like Netflix) – we could a massive flush all the way down to $2,050

And if we did – I would be adding to my existing long-term position.

Putting it All Together

March 30th I said to readers they should “Be Wary of this Near-Term Rally”

I didn’t trust it – something was off.

In fact, the speculation and call buying felt a lot like 2021

Here was the chart I offered from a few weeks ago:

March 30 2022

My recommendation was to either:

(a) get rid of higher multiples names (eg. ARKK ETF stocks); or at least

(b) reposition (or even lighten) your portfolio.

The second re-trace I was looking for was likely to retest the lows of Feb/March.

I think that’s now very much in play… as the S&P 500 lost 5.2% after Powell’s 50 basis point comment just two days ago.

But let me close with this…

I think bond yields have further to go yet.

I say that because bonds currently assume the Fed will get inflation under control within 5 years.

Why?

Because if I look at the 5-Year TIPS yields – they are trading at just 3.5%

That’s a huge leap of faith in the Fed.

And I hope they are right…

But if they are wrong (and they could be) – then bond yields and rates will continue to rise.

Equities (at this point) have yet not priced that in.