Words: 1,500 Time: 6 Minutes

- Tariffs now tied to solving migration, health and security issues

- Trump will look to leverage (highly lucrative) access to US consumers

- ECB’s Chief Lagarde recommends Europe “buying more U.S. made goods”

Trump’s proposed tariffs on countries such as Canada, Mexico and China (starting Jan 20) are dominating financial headlines.

Here’s Reuters – which captures much of the widespread sentiment:

“Officials from Mexico, Canada and China and major industry groups warned that U.S. President-elect Donald Trump’s threat of hefty tariffs on goods would harm the economies of all involved, cause inflation to spike and damage job markets“

And maybe they will – but that’s still premature.

I say that because I see Trump’s initial position on imposing tariffs as a starting point in a broader negotiation.

And pending the outcome of these discussions – it’s quite possible no tariffs are imposed.

Let’s explore why tariffs are not simply about economic benefits…

🤔 Deciphering Trump’s Strategy

- Bringing more manufacturing back to the U.S. (in turn delivering jobs);

- Reducing the flow of illegal immigrants;

- Creating a level playing field for trading partners (notably China); and

- Lowering prices for non-discretionary items (energy, food, housing)

Whilst none of these policies will take effect until January 20 – we’ve already seen several countries start making contingency plans.

Consider South Korea…

They are a significant trading partner of the U.S – exporting more than $23B of cars alone last year.

Other major exports include electronics (e.g., Samsung) and various auto parts and accessories.

South Korea boasts the seventh-largest trade surplus with the U.S. — something Trump will be keen to reduce.

One pathway is via tariffs.

However, South Korea understands Trump is a deal maker.

Therefore, rather than engaging in traditional tit-for-tat trade negotiations – they shifted their focus on increasing its imports of American energy products, such as liquefied natural gas (LNG).

By purchasing more American energy – this will reduce the surplus – but would also help Trump achieve his goal of boosting American energy exports.

This move could see South Korea avoiding tariffs on its cars, electronics and other goods to sell to the US.

And it’s not just South Korea…

European Commission President Ursula von der Leyen suggested they may also consider buying more U.S. LNG – as a gesture of goodwill to prevent new tariffs on Europe.

Again, this measure would help reduce any trade deficit the US has and avoid excessive tariffs.

In addition – we also heard European central bank chief Christine Lagarde – who urged Europe’s political leaders to buy more US-made goods to help the region avoid a trade war that risks global growth and prosperity.

In her first interview since Trump’s victory, she recommended that Europe deploy a “cheque-book strategy” to work with the president-elect, in which it agrees to buy specific items from the US, such as liquefied natural gas and defense equipment.

Lagarde challenged Trump’s claims that tariffs would help “make America great again”, as he claims, saying they would reduce global demand.

“How do you make America great again if global demand is falling?” she said.

Describing Europe’s current economic challenges as a “big awakening,” she called for swift action on long-discussed reforms like a Capital Markets Union and unified supervision of EU capital markets.

“We should have one single supervisor” that “operates like the Securities and Exchange Commission”, Lagarde said.

She also flagged potential risks from the potential dumping of cheap Chinese goods into Europe due to US tariffs, saying policymakers need to monitor such a “rerouting scenario.”

It is up to us now — the Europeans — to transform that threat attitude of ours into a challenge that we have to respond to”

Finally, Mexican officials were working to limit the flow of Chinese imports into the U.S. to avoid accusations of enabling Chinese goods to bypass U.S. tariffs via their border.

What’s the theme?

These countries are focused on economic considerations and trade imbalances, aiming to either reduce surpluses or increase purchases of U.S. goods to avoid potentially damaging tariffs on their exports to the U.S.

They also know that the U.S. is their largest consumer of goods. Any damage to this relationship would be devastating to their economy (and growth)

Trump understands this position of (great) leverage and will use it.

I think it’s premature of the media to jump to the conclusion that Trump’s tariffs will “… harm the economies of all involved, cause inflation to spike and damage job markets” (quoting Reuters)

To be clear, that’s a risk however it’s yet to eventuate.

For now, they are a strong negotiation tool to help achieve a broad range of objectives.

⚠️ More than Just Economic Issues

Trump’s win didn’t just run on greater economic benefits.

His win was also centered on increasing security and health concerns (e.g., reducing the flow of fentanyl coming across the border).

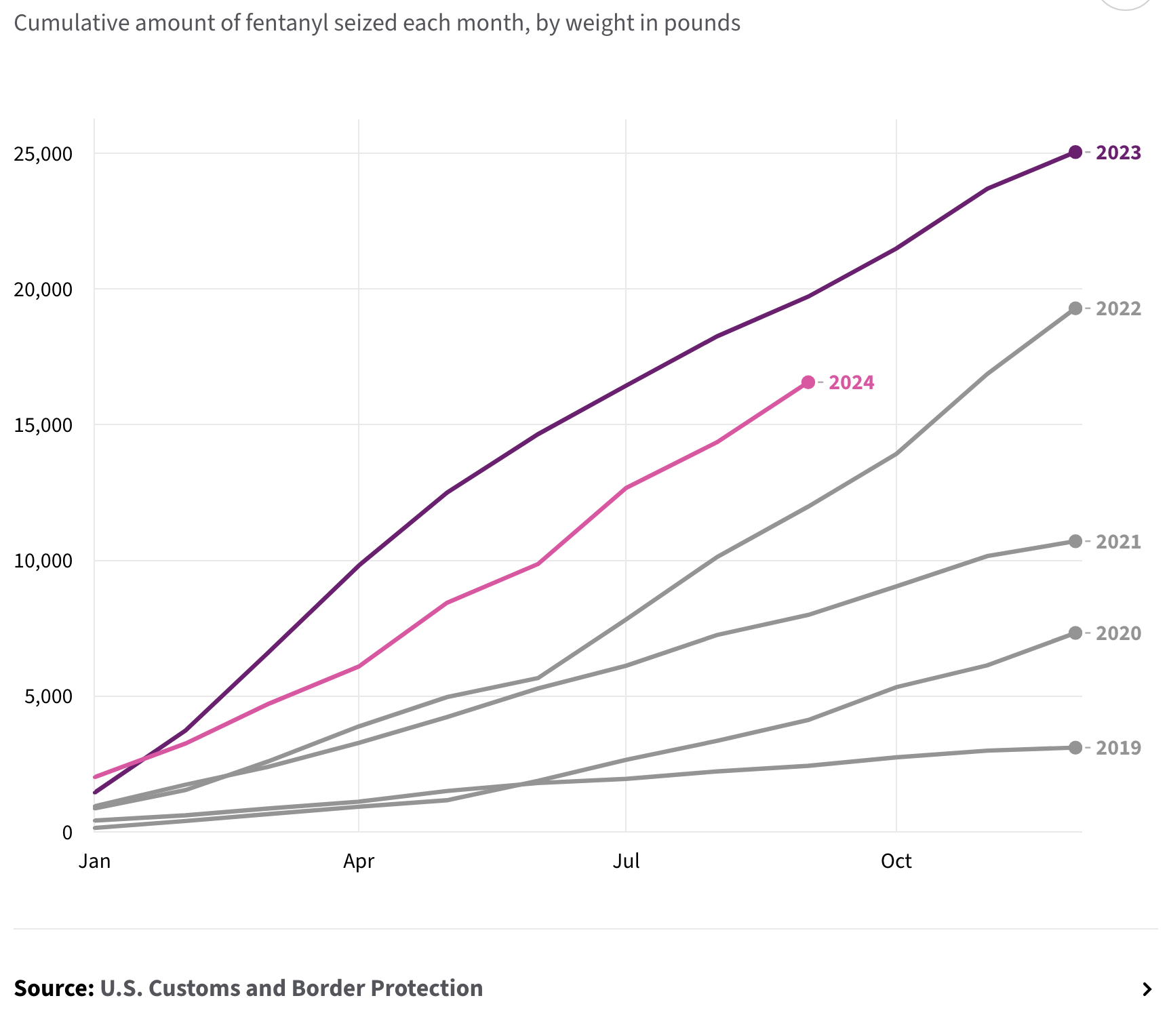

For what it’s worth, the flow of the deadly synthetic opioid has surged from levels in 2019.

Bookmark the site and revisit it in 4 years to see if these policies work.

For example, when Trump tweeted that “25% tariffs” on Mexico and Canada – and “10%” on China effective Day 1 – these were not framed as unfair trade practices or market imbalances (which appears to be the focus of most mainstream headlines).

In this case, tariffs are being being leveraged to address security and health objectives (where he feels these trading partners can help)

But this approach is not new…

In 2019 Trump threatened to impose tariffs on Mexico in response to illegal immigration issues – however they were never implemented.

Mexico came to the party – where both illegal immigration and drug trafficking slowed (as the chart shows).

Trading partners to the US need to go beyond traditional economic issues when negotiating with Trump.

What’s more, they should consider what they can easily ‘give’ the US at relatively ‘little cost’ (e.g., swapping energy supply from Russia to the US)

Prior to the election – Trump announced his objectives. They were blunt.

It’s clear he is going to (once again) leverage tariffs as a key negotiating tool as part of larger strategy.

And that strategy is squarely aimed at redefining U.S. relations with its major trading partners across areas such as improving health; security; trade and any number of other imperatives.

🏛️ Role of U.S. Foreign Policy

In a similar vein – perhaps the same can be said for Trump’s pick for Treasury Secretary, Scott Bessent.

Shortly after his nomination – Bessent argued that the international trading system needed a complete overhaul, one that aligned trade policy with U.S. security objectives.

He suggested that nations like Western Europe, Japan, and South Korea, which were considered security allies of the U.S., should be granted access to American markets in exchange for greater contributions to “our collective security.”

At the same time, these nations would be expected to adjust their economies to reduce trade imbalances with the U.S. over time.

“As a lifelong champion of Main Street America and American industry, Scott will support my policies that will drive U.S. competitiveness, and stop unfair trade imbalances, work to create an economy that places growth at the forefront, especially through our coming world energy dominance,” Trump said.

This idea of linking trade access to security contributions was part of a broader vision to reshape the global trading order.

Bessent suggested that the U.S. might move toward creating a core group of nations that would benefit from special trade privileges in exchange for strengthening their security commitments, while countries outside this circle—such as China—could face increased isolation.

In particular, Bessent singled out Germany, urging it to increase domestic demand as a way to reduce trade imbalances with the U.S.

And I noted earlier – the European Central Bank Chief was very quick to respond.

This vision of a “security-based” international trading system posed significant challenges for countries that were heavily dependent on U.S. trade access — but also sought to maintain their own economic and security policies.

A similar sentiment was echoed by Jamieson Greer, Trump’s nominee for U.S. Trade Representative.

Greer framed China as a “generational challenge” to the U.S. and argued for a strategic decoupling from the Chinese economy.

In his testimony before the U.S. China Economic and Security Review Commission — Greer acknowledged that such a decoupling might lead to short-term economic pain — but insisted that the long-term costs of failing to address China’s rise would be far greater.

💥 Putting it All Together

From mine, this is not a new approach from Trump.

He’s willing to use access to (lucrative) U.S. markets as strategic leverage to include broader objectives.

However, this is a major departure from the previous administration.

Echoing Lagarde’s comments – trading partners will now need to dig deep into how to avoid (new) tariffs.

In closing, any potential tariffs on US trading partners are not simply centered on economic imbalances (that’s part of it)

They form an integral part of a larger strategy to reorient global trade relations around issues such as greater security, immigration and health priorities.