Words:1,421 Time: 6 Minutes

- Caution about market valuations

- Does the 10-year yield see inflation risks ahead?

- Some words on the fear of missing out…

- “Adrian, this market is going crazy, what are you buying?”

- “I can’t wait anymore, I’m buying the QQQs”

- “What’s the point of waiting for a “20% pullback – when the market rallies sharply only to come back to the same point?”

If nothing else, it tells me a lot about reader sentiment.

It’s the fear of missing out (FOMO). It’s typical behavior during wildly bullish markets.

I’m fortunate I don’t suffer with it (investing or otherwise).

However, for some people it’s not as easy.

They’re worried they’re missing out on tremendous gains and may not get another chance.

But they should not worry…

The harsh lessons of chasing momentum from 1997 to 2000 taught me lifelong lessons.

Fool me once, shame on you. Fool me twice, shame on me.

Now, that’s not to say trading momentum is not a valid strategy.

It can be very profitable. However, you should be acutely aware of the risks.

As I was explaining to a friend – this all comes back to your own investing philosophy.

Your philosophy and risk tolerance is likely very different to mine (and that’s okay)

For example, I target investments which meet two important criteria (the latter being quite difficult at present):

- High quality (strong balance sheet and free cash flow; growing sales and earnings; defensible moat etc); and are

- Very much out of favor (i.e., they trade at discount ratios)

My approach to successful investing is you make (serious) money based on what you pay. Put another way, it’s not only about what you buy.

Consider one of the best stocks on the market – Apple.

It’s hard to find a company with a better product, management, balance sheet, debt ratio, free cash flow and market position.

But this is not a stock which is ‘out of favor’.

It trades at 32x its forward earnings.

That’s an exorbitant price for a company growing its top line by low single digits and its earnings by ~10%.

But at some point (not in the near-term) it will work its way back to ~20x (slightly above the market average).

And those who could not wait and paid in the realm of 32x could lose a great deal of money (and/or realize sub-par returns for years to come)

But when the price is reasonable – I will take another look at the stock.

For example, consider a trader with FOMO. And let’s assume pretend that Apple rallies another “10%” next month due to some great new product release (e.g., maybe an iPad on your wall to control your home environment such as lights, heating, security, TV etc)

That trader will feel they are missing out and buy the stock – hoping for a greater fool willing pay “40x” its earnings.

And we see this script play out again and again…

There is nothing more certain than the market acting irrationally driven by fear and greed.

However, the savvy investor is aware of this and uses it to their advantage.

They play defense by retreating. The continue to build their resources – waiting to attack their target when it is weaker.

As I said recently, the greatest military generals know that it’s not only great offense that wins a war. There are strategic times to retreat and times to attack with force.

Put another way, a strategy which consists one of continual ‘head 0n assault’ is unlikely to prove successful. You will deplete resources.

But you need to know the difference…

Waiting for the Dust to Settle

Waiting for the Dust to Settle

Over the weekend, my advice to investors was to wait for the “dust to settle”

From mine, it’s too early to accurately assess the signal from the noise.

As we can see below, the post-election rally has sparked unbridled optimism about future US economic growth.

November 12 2024

This chart tells me that investors are expecting far higher growth, lower inflation, and a revitalized economy thanks to policies such as tax cuts and deregulation.

And sure, a stock market rally can be seen as a sign of confidence.

But that’s not what I am debating…

A seasoned investor will also know market’s are notoriously fickle and can often mislead.

A market rally does not guarantee future economic success.

And there are several risks that need to be considered (as I discussed over the weekend). They may (or may not) come to fruition – we don’t know.

Think of it this way… we should always evaluate what’s seen vs unseen.

That’s what economics is in its purest sense… weighing the unseen consequences.

However, most are very quick to price what’s seen….

Stocks are not a Bargain

Stocks are not a Bargain

For regular readers – what follows will not be new.

The S&P 500 trading a forward PE of ~22x (or near 6,000) – is not cheap.

For example, the 10-year average forward PE for the S&P 500 is 18x – which is 4 handles lower.

Now if we assume:

- S&P 500 forward earnings of $275 (11% YoY growth)

- A 10-year average multiple of 18x

- 18 x $275 = 4,950

That’s almost 18% lower than today’s close.

Further to my preface, a critical component of successful investing is understanding whether stocks are overpriced. You should always try to avoid overpaying.

Therefore, knowing this, it will guide you when it’s better to either retreat (and accumuate resources); or attack (i.e., add risk).

Your long term success will be mostly a function of how much you pay.

Over the past few months, I’ve called out several valuation metrics which suggest reducing risk (see this post).

For example, basic ratios such as price-to-sales and price-to-book – have surged to challenge historical peaks.

With respect to price-to-sales – it’s now at its highest level since the post-COVID boom in 2021. From Bloomberg Opinion:

November 12 2024

Similarly, the S&P 500 price-to-book ratio is approaching the levels seen during the dot-com bubble of the late 1990s.

Could these ratios expand further?

Yes! Of course.

However, we are not in the business of trying to pick “peak ratios” (or tops and bottoms).

What we are in the business of buying when these ratios put the odds in our favor for the long-term (e.g., 3+ years).

Now one of the most widely discussed metrics for assessing stock market valuation is the Cyclically Adjusted Price-to-Earnings (CAPE) ratio, developed by economist Robert Shiller.

Benjamin Graham – in his timeless book “The Intelligent Investor” – advocated something similar – taking the average earnings over a number of years (i.e., not simply the past 12 months or quarter – as many like to do).

The CAPE ratio smooths out fluctuations in the market by adjusting earnings for inflation and averaging them over a ten-year period.

As of the post-election period in 2024, the CAPE ratio stands at 38.11

This is higher than it was during George W. Bush’s presidency in 2001, following the collapse of the dot-com bubble.

What’s the key takeaway?

Excessively high valuations increase the likelihood that future stock returns will be lower, not higher.

And whilst prices could easily rally 10-20% (or more) – that simply increases the risk.

I’m not suggesting stocks are about to crash to earth – not at all – however with valuations this high – there is little room for error.

And as I stressed over the weekend – any significant economic or geopolitical disruption could cause stocks to reprice.

Watching High-Yield Spreads…

Watching High-Yield Spreads…

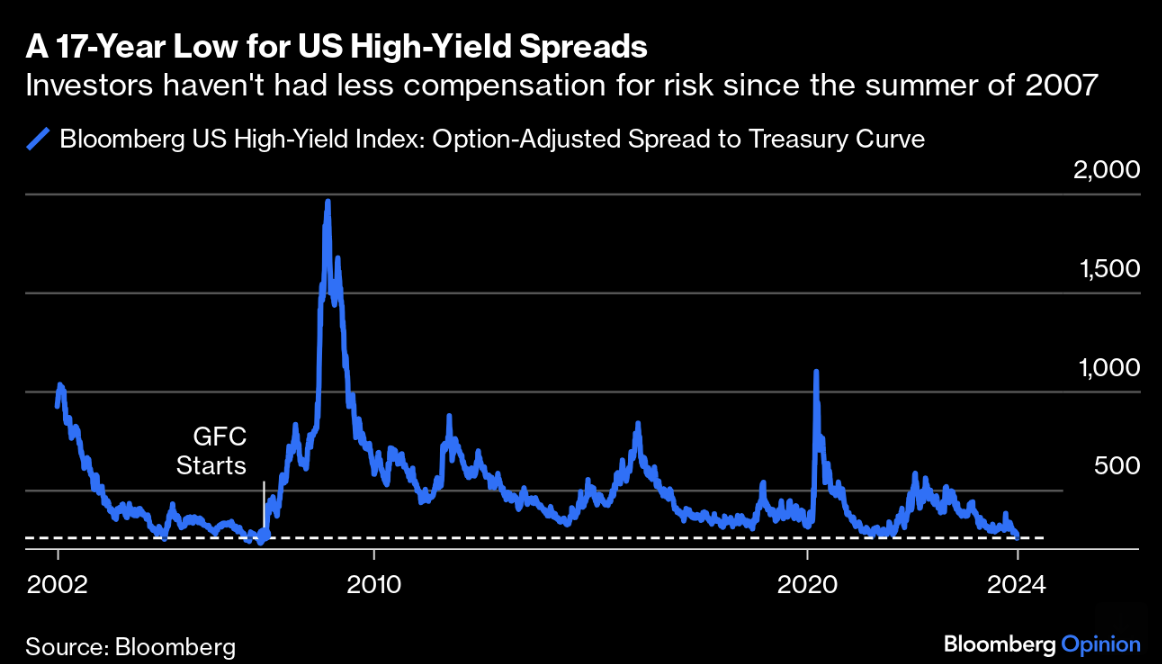

In the same article, Bloomberg Opinion cite the spread of high-yield bonds’ yields over (safer) Treasuries — a crucial measure of the compensation you receive for lending to companies with weak credit.

They state this has now fallen to 17-year low in recent days, according to Bloomberg indices.

November 12 2024

The last time the spread was this narrow was 2007.

On that occasion, spreads rose quickly as the structured credit market based on subprime mortgages began the collapse that ended with the Global Financial Crisis.

Again, it’s important to stress this does not imply some collapse is around the corner. Not at all…

All that is shows is the very high levels of risk investors are now willing to take (whether it’s in equities and/or credit)

Inflation Risks Ahead?

Inflation Risks Ahead?

The final chart to share is what we see with the ‘smart money‘… US 10-year yields.

From mine, the (strong) reaction in these yields is the most important development post the election.

In short, it could suggest the market is pricing in the possibility for higher inflation

November 12 2024

If true, this presents a challenge not only for stock valuations – but also Trump’s policies.

For example, if we’re to experience rising inflation, it could make it more difficult for the Fed to lower interest rates (which is what is being priced in)

My view (as it has been for the past 6+ months) is the market is pricing in too many cuts next year.

Based on what we see today with consumer spending, GDP, employment and PCE inflation – it’s hard to understand how the Fed can be overly aggressive.

In summary, should core inflation remain above the Fed’s 2.0% target (it currently sits ~3.3%) – then it gives the Fed less flexibility.

How will that play into growth projections?

What Matters for Investors

What Matters for Investors

The post-election rally could continue for at least a few months yet.

Momentum is a powerful thing… and will typically go further than you think. Trade against it with caution.

Those with a very high risk tollerance will likely try their hand and squeezing out more gains.

However, it’s not an infallible predictor of future economic success. For example, if we consider:

- The excessive valuations of U.S. stocks (22x forward earning)

- Spreads in the high yield debt market (e.g., hitting 17-year lows); and

- Growing concerns about inflation (evidenced by the rising 10-year yield)…

These indicators suggest (to me) there are risks which should not be ignored.

Note: There’s good reason Warren Buffett’s cash hoard sits at record levels ($325B). What’s more, he has also stopped buying back his own stock.