Words: 1,882 Time: 8 Minutes

- Markets start pricing in Trump’s pro-growth agenda

- Global implications of Trump’s economic policies

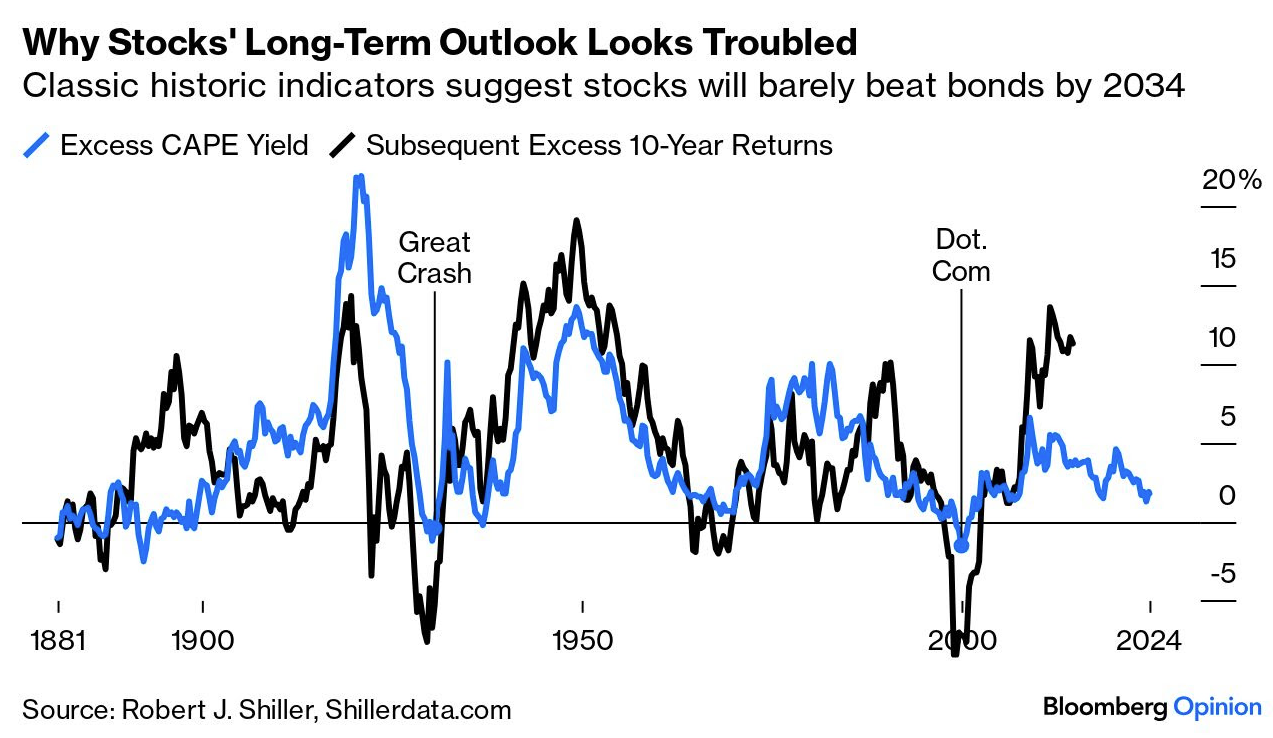

- Things now looking very expensive

For example, stocks were trading near their highs and bond yields were rising.

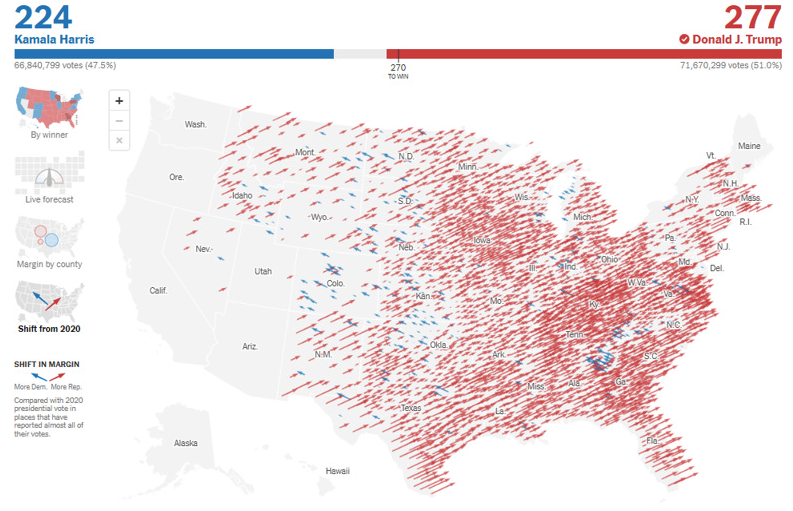

However, since Tuesday’s ‘red wave’ – we’ve seen further significant shifts in market sentiment.

Source: The New York Times: Shift to Trump from 2020

However, what markets had not priced in was the Republicans taking control of the House, Senate and White House (a ‘red sweep’)

At the time of writing (Nov 9th) – there are still 12 uncalled races for the House – with Republicans needing 6 of the 12 for control.

However, markets see this as a done deal.

The prospect of Trump having ‘full run of the tables’ saw the market post its best post-election performance since 1896 (The McKinley Rally).

Investors are betting that Trump 2.0 will favor the US economy, particularly with his proposed tax cuts (mostly for corporations) and deregulation.

This was his economic policy eight years ago… and it’s unlikely to change.

Let’s start with a look at the S&P 500 using the weekly timeframe – as it pushed above 6,000 for the first time.

S&P 500 Excited for Republican Sweep

The move in equities this week was quite something…

Just as stocks appeared they could roll over – they did the opposite.

However, I would express caution if turning too bullish…

November 8 2024

Three things I’m mindful of:

- 61.8% to 76.4% Fibonacci zone outside the August pullback (often an area of resistance);

- Weekly RSI and MACD indicators do not confirm the rally (showing negative divergence); and

- Price action very extended from the 35-week EMA

Each of these (technical) indicators gives me caution.

That said, I have not reduced my ~65% long equity exposure (which has remained consistent for most of this year)

I think investors should always have some long exposure (this week was a great example).

It’s very difficult to say how much further this rally could go… and I don’t pretend to guess. Forecasting market moves in the very near-term is a fool’s errand.

That said, there could be more juice in the rally before Trump is sworn in on January 20th.

For example, there is very little in the way of negative catalysts coming into year’s end. We have:

- The central bank who continues to ease policy (bullish);

- Inflation coming down slowly (bullish);

- Election uncertainty behind us (bullish);

- Q3 corporate earnings finished (neutral).

Therefore, it’s difficult to see what could push the S&P 500 meaningfully lower in the very short term (e.g. next few months).

🗒️ Some Sector Winners & Losers

Trump’s policy proposals are expected to stimulate economic growth through tax cuts and deregulation, which is likely to benefit specific industries.

And I think that will be the most important thing for investors; i.e., figuring out where to add exposure (and equally where not to).

Let’s start with bank stocks… maybe the biggest winners this week.

For Mike Mayo, the veteran analyst known for pointed opinions on the largest US banks, the election of Trump is nothing short of a sea change for the industry.

Banks were initially hit hard by the early stages of the bond yield crisis (which saw some banks collapse) – but have seen a resurgence due to expectations of favorable deregulation and a more robust economic environment.

By way of example, there was speculation this week the Trump administration may consider re-listing Fannie Mae and Freddie Mac.

Take a look at the surge we saw with ticker FMCC:

November 8 2024

Additionally, we saw small cap stocks jump on the prospect of far less bureaucracy.

Larger firms can manage the excessive government red-tape- however that’s not the case with smaller companies. They simply don’t have the resources.

The Russell 2000 is now pushing towards its all-time highs:

November 8 2024

What’s more, industries such as fossil fuels are poised to benefit from Trump’s energy policies.

On the other hand, clean energy sectors such as solar and wind may face challenges. Solar stocks were pummeled this week.

Crypto appears to be another big winner under Trump – with expectations he will be more favorable toward digital currencies.

Bitcoin (BTC) traded above ~$77K post the election – with some thinking it will hit $100K by the end of the year.

Below is a logarithmic chart for BTC (scaled by percent gains) – where $100K appears likely.

November 8 2024

Conversely, real estate—Trump’s own industry—faces headwinds should interest rates rise.

For example, if long-term bond yields go higher (which has been my expectation) – this will negatively affect property sales and construction activities.

Below is what we’ve seen with the US 10-year yield the past few weeks…

It surged since the Fed first cut rates by 50 bps… taking another leg higher on Trump’s win.

As regular readers know, I am calling for much higher long-term bond yields in the years ahead (stronly advising investors reduce their exposure to longer-term bonds)

November 8 2024

The question (which is very difficult to answer) is at what point will a far higher 10-year yield impact equities?

For example, the last time the 10-year pushed 5.0% (October 2023) – stocks shed ~10%.

My view (as I wrote recently) is we could see something similar…

With stocks trading at a forward PE of ~ 22x (i.e., earnings yield of 4.5%); and if we assume a 10-year yield at 5% – this implies negative equity risk premium.

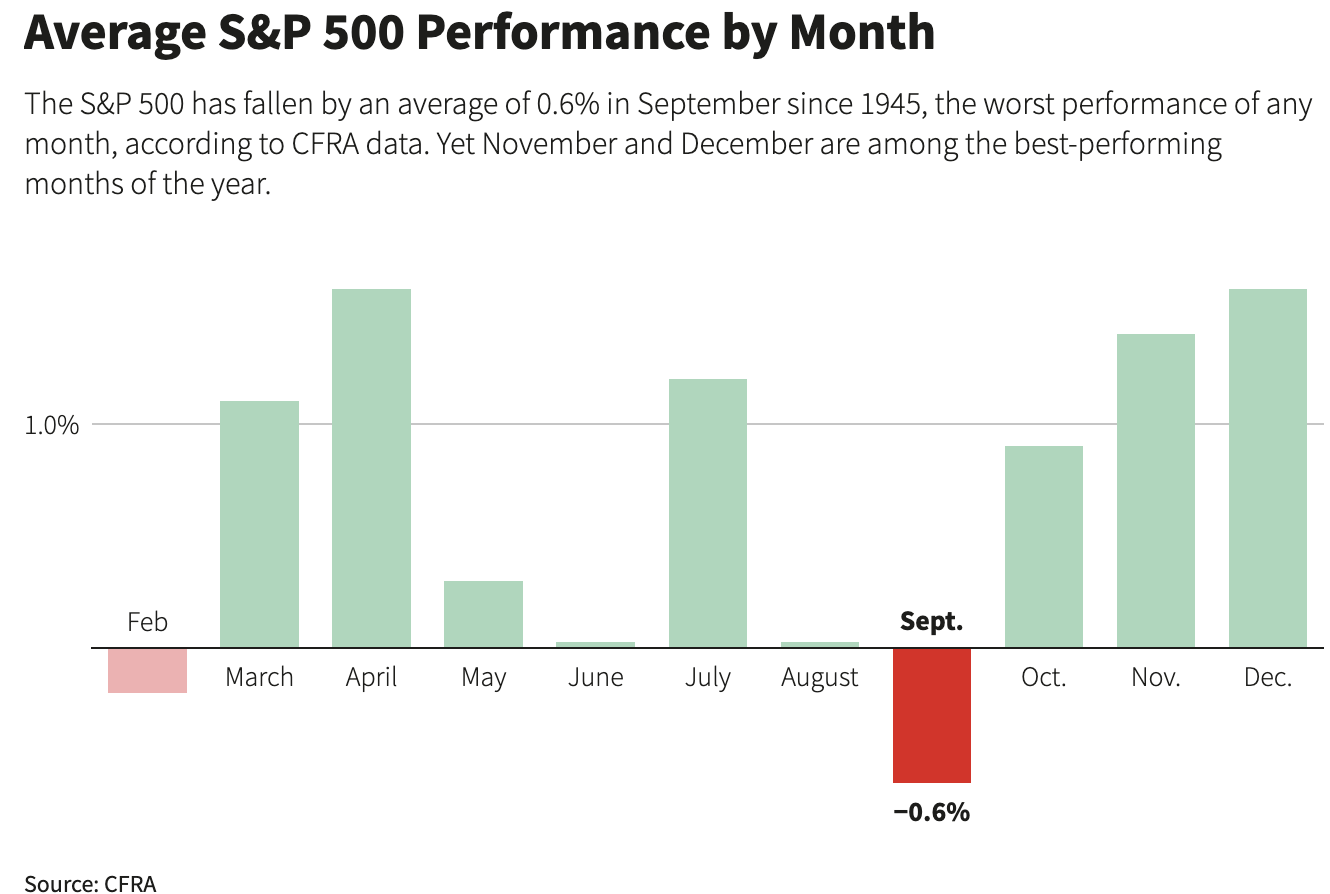

Re-sharing a Bloomberg chart from this post:

Repeating my language:

This chart subtracts the 10-year Treasury yield from the CAPE Yield (the inverse of the main metric).

The lower the excess yield you get from stocks, the less well they do subsequently relative to bonds.

For example, if we invert today’s forward PE ratio of 22x – we get 4.5% (i.e., equity earnings yield)

This is a mere 0.3% higher than the risk free 10-year yield of 4.2% (echoing the paltry Excess CAPE yield)

Based on Bloomberg’s chart – if buying stocks when the ‘Excess CAPE yield’ is near zero – it’s proven to be a poor return in the years to follow.

- ~1929 – led to ~20 years of below average return

- ~1972 – led to a decade of lost returns; and again

- ~2000 – led to ~9 years of sub-optimal returns

For clarity, this is not to say that equities could continue their current run over the next 12 months or so. They could.

What we are looking at here are the return in the years ahead (not the very short-term).

The question is whether this lies ahead if paying the current multiple for stocks (with basically zero equity risk premium)?

💲 Dollar Challenges & Trade Implications

One of the primary challenges facing the Trump administration is managing its economic relationship with the rest of the world, particularly in relation to the US dollar and trade policies.

For example, Trump favor’s a weaker US dollar.

He has long advocated for a weaker dollar to make American goods more competitive on the global stage.

However, with the 10-year yield increasing, it also makes the US dollar far more favorable.

A strong dollar, largely driven by US fiscal and monetary policies, complicates Trump’s goal of reviving industrialization and boosting exports.

This could be challenging for Trump to achieve.

For example, if the US economy is expected to grow (as Trump expects) – it will be considered more attractive for investors (vs other lower rate countries)

Trump’s trade policies, including the imposition of tariffs, may also intensify the pressure on global currency markets.

For example, whilst my best guess is he will use tariffs as a bargaining chip to get other nations to revalue their currencies, it is unclear whether this will result in the desired depreciation of the dollar.

It may not (should the US economy continue to strengthen).

That said, I also believe the possibility of a currency war or coordinated devaluation (such as the 1985 Plaza Accord), is viewed as unlikely, as other nations are also facing significant challenges related to their currencies.

Additionally, with the US government heavily reliant on foreign investment (which Trump will incentivize) – the political feasibility of such aggressive actions towards US trade partners remains in doubt.

Are market’s pricing this risk in?

I don’t think so.

Beyond currency, Trump’s trade agenda could have broader implications for the US-Mexico-Canada Agreement (USMCA)

This is likely to become a major focal point of his second term.

On this, I would expect Trump to push for policies that restrict near-shoring, where companies move production from China to Mexico, and this could create friction with trading partners.

Again, what risks have been priced in?

As the US begins to impose new tariffs, the USMCA renegotiation (scheduled for 2026) – could serve as the next major litmus test of Trump’s “America first” growth agenda.

☣️ Other Global Risks

It took less than 24-hours for markets to start pricing in a stronger US dollar, higher US yields and tighter monetary policy.

However, each of these things are now putting immediate pressure on foreign economies, foreign currencies and especially emerging markets.

Consider the Aussie dollar – it plunged on the news of Trump’s win – an economy very dependent on China.

Countries like Brazil and the UK – who are struggling with higher borrowing costs – could also see political instability and economic unrest as a result of Trump’s ‘America First’ policies.

In Brazil, for example, concerns about government borrowing have led to currency depreciation and rising interest rates, causing investor uncertainty.

The situation in Europe, particularly in Germany, is also concerning.

The collapse of the German coalition government, amidst rising global bond yields and fiscal tensions, highlights the broader challenges facing the eurozone.

Obviously a much stronger US dollar is exacerbating these challenges, as other countries must offer higher yields to attract capital.

However, offering higher yields will increase their borrowing costs (not a luxury they have)

For countries already facing fiscal difficulties (such as those mentioned) – a stronger US dollar could act as a destabilizing force, potentially triggering political backlash and financial instability.

In summary, such global developments underscore the interconnectedness of Trump’s domestic policies and the broader international economic system.

What we see with the US 10-year yield will be core to these risks.

I don’t think the world is ready for this to sustain a level above 5.0% – given the sheer magnitude of the debt.

The Trump administration’s decisions on trade, tariffs, and the dollar will have far-reaching implications, not just for the US, but for the global financial landscape.

💥 What Matters for Investors

The market has moved quickly to price in expectations around Trump’s policies.

However, I think it’s important that participants don’t confuse speed with the market being “efficient”.

Most of the time market’s over-react in either direction.

And I think this is likely one of those cases…

At this point it’s far too early to distinguish the “noise from the substance”.

For example, consider the various risks I flagged above. These are clear unknowns.

Trump’s economic policies, including tax cuts, deregulation, and trade protectionism, will bring both opportunities and challenges for different sectors.

There will be positives and negatives.

However, the strength of the US dollar, US 10-year bond yields, global trade dynamics, and potential political decisions (such as the fate of the USMCA) —will be critical factors influencing the economy and market’s trajectory.

My advice: don’t be too quick to increase your risk exposure… allow some time for the dust to settle.