Words: 1191 Time: 5 Minutes

- Millennials the biggest spenders – prioritizing non-essential items and experiences

- Disparity widens b/w affluent shoppers and middle-to-low households

- S&P 500 trades at 22x forward earnings – worth the risk?

Never underestimate the U.S. consumers want to spend.

Well some of them at least…

Last month’s retail figures exceeded expectations – up 1.7% YoY in nominal terms (i.e., not adjusted for inflation).

Here are the numbers:

- Retail sales were up 0.4% MoM and 1.7% YoY nominally – beating estimates for 0.3% MoM growth.

- Control group sales (exc food services, auto dealers, building materials stores, and gas stations) were up 0.7% MoM,

- Nominal sales grew at a 6.4% annualized rate in Q3

But here’s the important point – these are nominal sales and only one month of data. One month is not overly helpful – what we want to always analyze is the longer-term trend.

As regular readers know – I apply three important treatments to economic data like (not limited to) retail spend:

- Adjust for inflation (using CPI);

- Look at the quarterly figures to remove monthly ‘noise’; and

- Gauge the trend with quarterly YoY percentage change

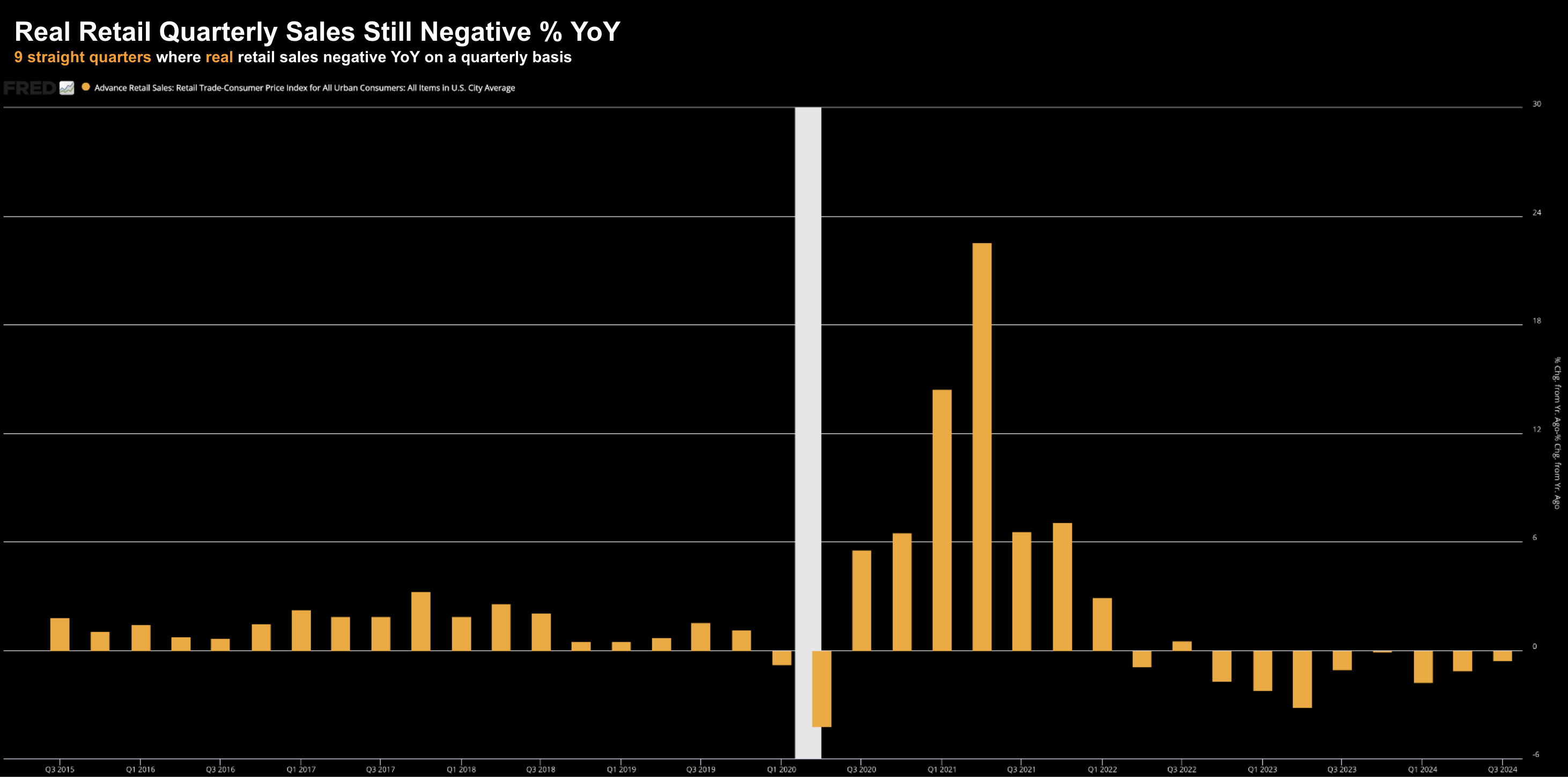

Below is what we find with real retail sales on a quarterly YoY percentage change basis:

October 18 2024

This paints a very different picture (which is rarely reported).

Everything measured should be in real terms.

This also helps explain why many leading brands (and retailers) are trading at or near multi-year lows (e.g. Dollar General, Nike, Ulta and many more)

However, those who are doing well (e.g., Walmart and Costco) have been able to:

- Secure the spend of lower income cohorts (as they offer deep value); and

- Attract new customers from higher income cohorts.

Not All Income Cohorts are Spending

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Based on this data – the consumer is hanging in there.

It would be a stretch to class retail spending as “strong’ (as some do) – however they are not falling off a cliff.

For example, Bank of America’s Brian Moynihan said they see “good spending behavior by consumers”

Good – not great.

Moynihan’s sentiment was echoed by JP Morgan and Wells Fargo

However, American Express today announced a surprising slowdown.

For example, in the third quarter, total Card Member spending increased 6 percent vs 9 percent expected.

AmEx customers are very much in the upper income cohort.

Now according to the Fed:

- Adjusted for inflation, avg. spending by high-income households was 16.7% higher in August 2024 relative to 6 years ago

- This compares with a 13.3% increase for middle-income households and 7.9% growth among low-income households over 6 years

And I think there are a few explanations as to why…

- Higher income cohorts have more exposure to risk assets (e.g., houses and stocks which benefit from inflation); and

- Any additional money benefited from higher interest rate income (e.g., in money market accounts at near 5%)

Both of these go towards enabling further spending…

However, if we compare that to lower income cohorts, they don’t get either of these benefits.

By proxy, take a quick look at the performance of Dollar General and Dollar Tree – large retailers who target lower-income cohorts.

Those stocks are trading at decade lows.

October 18 2024

Primerica reported that over half (55%) of middle-income households currently rate their personal financial situations negatively.

For the first time in a year, a majority of middle-income households are feeling negative about their personal finances,” said Glenn Williams, CEO of Primerica.

“In fact, this latest report represents the highest negative rating we’ve seen since we began fielding the survey exactly four years ago.”

Middle-income households’ view of the economy has deteriorated, too, over the past three months.

A significant majority, 73%, said they have a negative view of the nation’s economic health, up one point from the prior reading

For me, this is entirely the result of inflation.

Inflation benefits those with exposure to risk assets; and disproportionately disadvantages those who do not.

It’s why it’s called a “poor man’s tax”; and why more than half (when combing middle and lower income cohorts) the country feels worse off than they did before inflation took off in 2021/22.

As an aside, we’ll see if ‘kitchen table’ issues weigh on voters with the election in ~3 weeks.

S&P 500 Continues to Surge

Make that six straight weeks of gains for the S&P 500 – posting a new record high.

So what’s energizing the animal spirits? I can think of a few reasons:

- The Fed embarking on a new easing cycle;

- Consumers continuing to spend (wealthy consumers at least);

- Employment landscape appears strong – with wages rising;

- Inflation mostly under-control (excluding services and supercore)

- Earnings beating expectations (so far); and

- Oil prices falling (which will help consumers and inflation concerns)

Two things come to mind:

- Everyone appears to be leaning to the same side of the boat (highly complacent); and

- The market trades at a multiple of 22x forward earnings

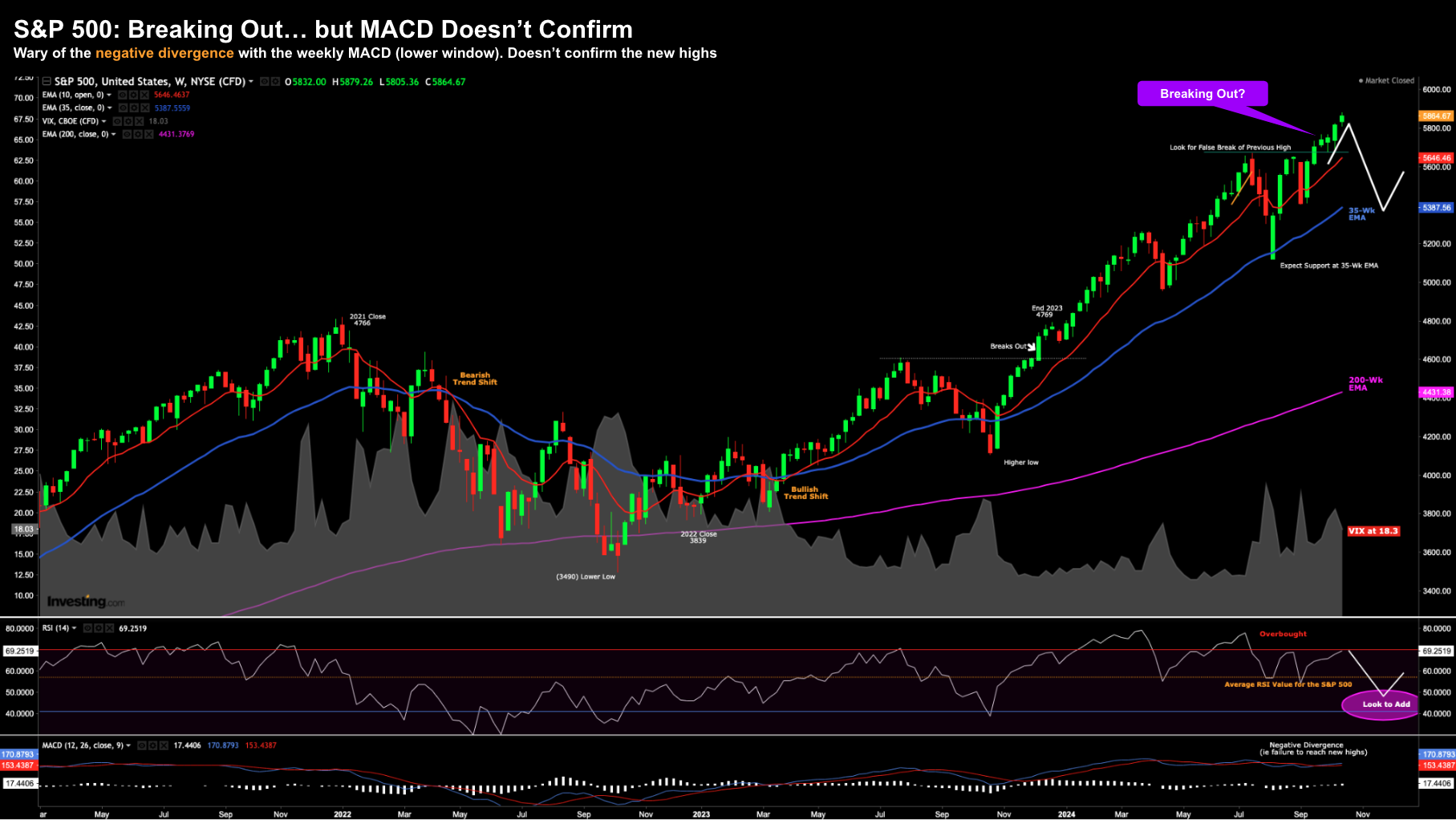

Let’s start with a technical review using the weekly timeframe:

October 18 2024

- If we maintain a level above the previous high (which remains intact); and

- Confirmation from the weekly-MACD (lower window)

My concern is the latter and the loss of momentum.

For example, observe how the weekly-MACD is not making new highs – where it has flatlined the past few weeks.

This is what we refer to as negative divergence.

We saw a very similar set up coming into 2022. We had a flatlining MACD however the price action was surging higher.

Apart from the technicals (always secondary) – my bigger concern are the fundamentals (and valuations)

Investors are paying 22x forward earnings at this juncture at 5864 (i.e., where the “E” is expected to be around $270 per share).

How I interpret this is we’re unlikely to get many more ‘turns’ in multiple expansion (at most 1 or 2).

For example, a forward multiple of 23x or 24x is exceptionally lofty.

Therefore, the way the market goes forward is with strong earnings growth (i.e., as it grows into the multiple)

Consider Apple:

Apple has a market cap of over $3 Trillion and consistutes a large weight in the S&P 500.

At $235 per share – it’s trading at a staggering 32x forward earnings (assuming $7.50 per share or 12% EPS growth) – where revenue is growing single digit.

Don’t get me wrong…

Apple is a great business – second to none. You want to own this stock (and I do)

However, it’s questionable whether it’s worth 32x forward earnings (and maybe why Buffett perhaps was happy selling half his stake)

Yes, it deserves a premium to a market multiple. For example, 25x is reasonable for Apple’s quality. And anything below 18x is a terrific deal.

However, that puts the stock at ~$190 (where $190 / $7.50 = ~25x)

Below are Apple’s earnings estimates for 2025 – with the average at $7.48 per share

We get into the thick of earnings next week…

And whilst I expect most companies to clear expectations for Q3 – what’s more important is they guide strong.

That’s what the 22x forward represents… what’s ahead.

From mine, there’s more risk than what’s being priced in.

What Matters for Investors

What Matters for Investors

The market is not cheap by any measure.

And whilst the economic landscape remains sound – you need to ask yourself it warrants paying 22x forward earnings?

For me the answer is no.

I remain ~65% long and will put capital to work on any meaningful pullback.

It’s not only what you buy – it’s how much you pay.

For example, in the near-term (next 12-24 months) – you could still lose money buying a stock like Nvidia or Apple at this juncture.

I still think there are tail risks which are not being adequately priced.

For example, you only need to look at gold.

Why is gold trading at record highs and up 32% for the year (outperforming the S&P 500)?

I don’t think it’s inflation… that appears to be getting back to below 3.0% (excluding services and supercore)

From mine, it’s pricing in the potential for significant market risk.

That risk could be fiscal (reckless spending and borrowing); or it might be geopolitical (gold isn’t fussy) – however one must ask why it’s surging.