- Nike: Just Do It? Or Just Not?

- Lessons from Homer’s ‘The Odyssey’

- Not all analysts rush to raise their year end targets.

Is the market overconfident?

Does it only see upside? What weight does it assign to the risks?

And are the ‘sirens’ of perpetually higher prices too hard to ignore?

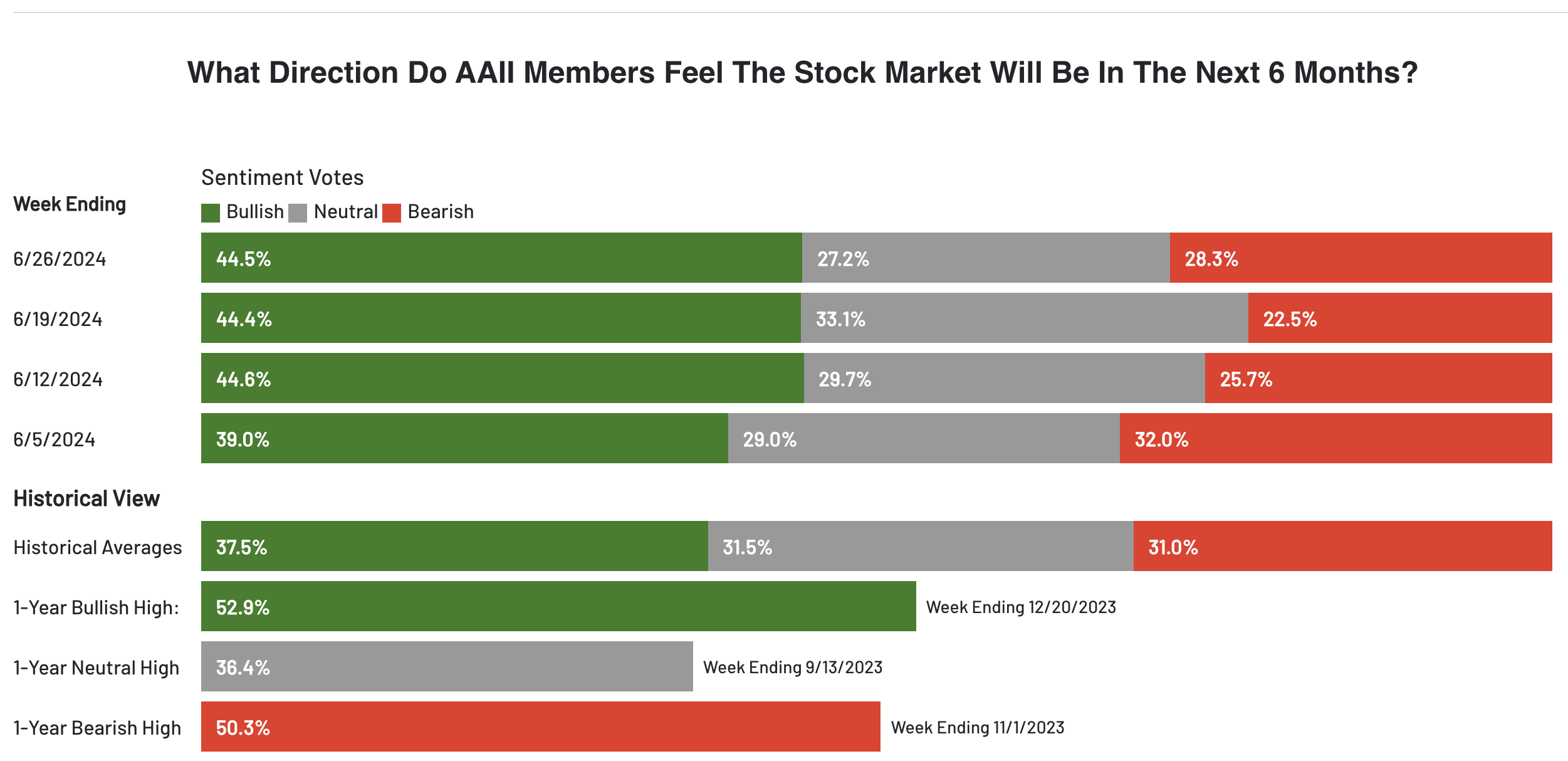

One popular measure of confidence is the weekly AAII Investor Sentiment Survey.

As at June 26th – 44.5% of all investors lean bullish – up from 39.0% June 5th.

That said, investor bullish sentiment is well off the one-year high of 52.9% from December 2023.

Investors have curbed some of their overwhelmingly bullish enthusiasm (a good thing).

A healthy market is when opinions vary.

Put another way, you don’t want everyone leaning to one side of the boat.

When this happens, typically the boat overturns.

Heeding Homer

In the epic poem by Homer – “The Odyssey” – we’re told of adventures of Odysseus, king of Ithaca, as he strives to return home after the Trojan War.

His journey spans ten arduous years, filled with trials and tribulations, including encounters with mythical creatures like the Cyclops, the enchantress Circe, and the Sirens.

Despite being detained by the nymph Calypso and facing the wrath of Poseidon, Odysseus’s cunning and resilience help him overcome these obstacles.

Meanwhile, in Ithaca, his wife Penelope and son Telemachus fend off suitors vying for Penelope’s hand, believing Odysseus to be dead.

The epic concludes with Odysseus’s triumphant return, the defeat of the suitors, and the restoration of his household.

The lesson with Homer’s poem is how Odysseus navigated the treacherous journey.

For example, as he made his way back to Ithaca – his ship had to pass the Sirens.

The Sirens were well known to sailors – where they try to charm seamen with a beautiful song.

And anyone who hears their song was said to throw themselves into the sea where they drown.

Knowing this and not risking the lives of his men – Odysseus instructed his men to tie him to the ship’s mast and to stuff their own ears with wax.

And should he plead to be free when hearing the Siren – ensure he is kept bound.

As they approached the Sirens’ island, the sea was calm, and over the waters came the notes of music so ravishing and attractive that Ulysses struggled to get loose.

He begged his men to release him – pleading with them.

But they obeyed their previous orders (aware Odysseus would to his) and ensured he remained tied.

They maintained their course and successfully navigated beyond the danger.

When it was safe – Ulysses gave his companions the signal to unseal their ears – and they relieved him from his bonds.

Why is this relevant?

When the market is going from high-to-high – and you fear you are missing out on returns – higher asset prices can echo the sounds of the Siren.

You are lured to pay any price… it’s calling you.

And if you don’t – you will miss out.

But at what risk?

The game can be like navigating the seas… a journey.

Therefore, it should not be viewed as a mistake to potentially sacrifice some of the shorter-term gains in return for insurance (as I explained here).

Hearing the Sirens

Speaking of hearing the call of the Sirens – I could not help but notice most (not all) analysts were scrambling to revise their year end S&P 500 targets.

For example, Goldman Sachs and Citigroup both aim for an S&P 500 level of 5,600 by year-end. Deutsche and Oppenheimer are not far behind at 5500

The music is calling.

From my lens (and I could be wrong) – an S&P 500 in excess of 5200 requires three things:

- Unemployment remains well below 4.50%

- The Fed’s ability to engineer a ‘soft landing’; and

- Inflation cools (e.g. around 3.0% or below) without pushing the economy into recession.

Well that’s the bet they are making.

Below are some of the revised year-end forecasts for both the S&P 500 and the US 10-year yield.

| Company | S&P 500 EOY 2024 | 10-Year Yield EOY |

|---|---|---|

| Goldman Sachs | 5600 | 4.0% |

| UBS Global | 5200 | 4.0% |

| Wells Fargo | 5100 to 5300 | 4.25% to 4.75% |

| Barclays | 5200 | 4.25% |

| JP Morgan | 4200 | 3.75% |

| BoA | 5400 | 4.25% |

| Deutsche | 5500 | 4.60% |

| Citigroup | 5600 | 4.30% |

| HSBC | 5400 | 3.00% |

| Oppenheimer | 5500 | NA |

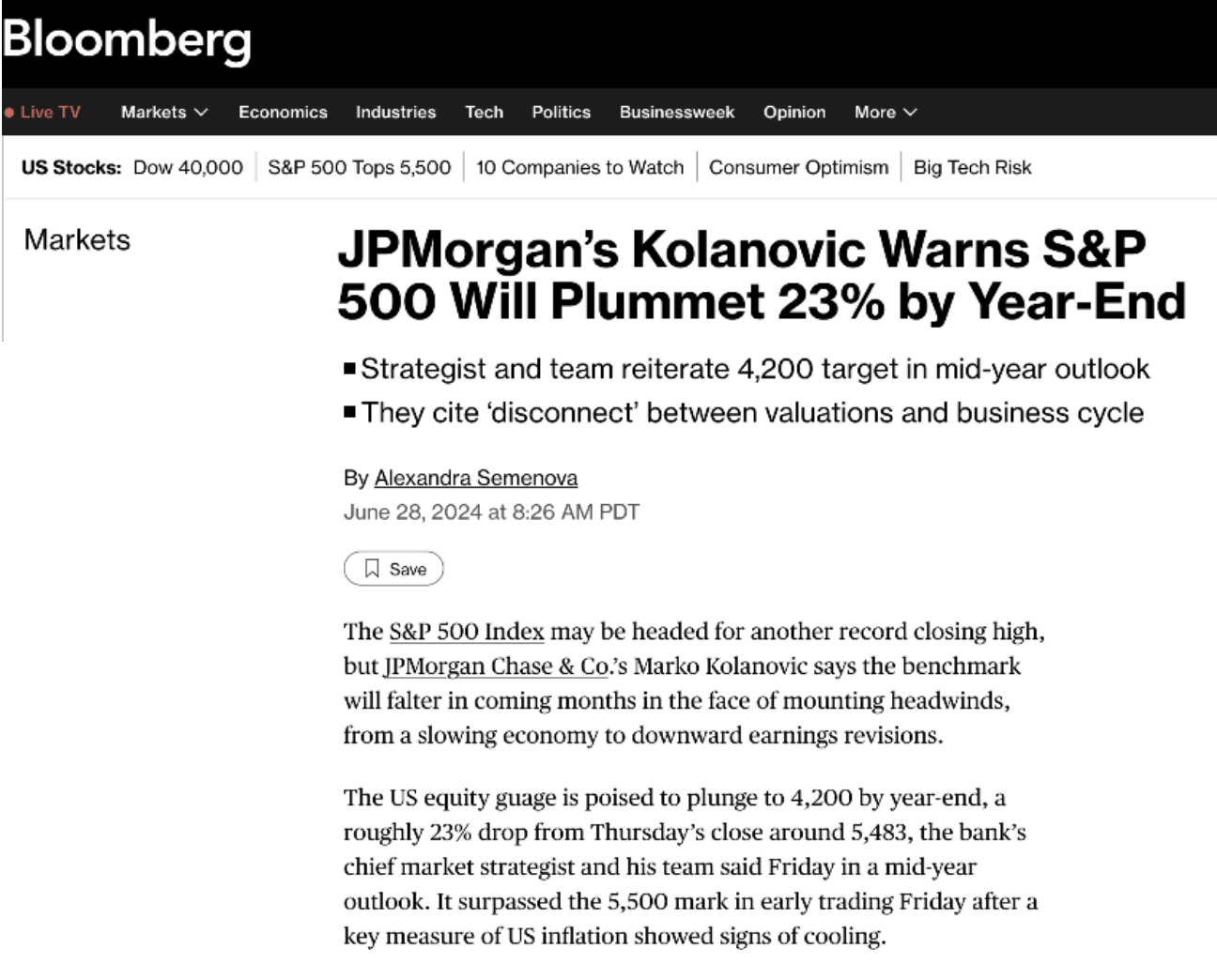

However, there’s one forecast who has essentially “bound themselves to Odysseus’ mast” – not willing to hear the Sirens.

According to Bloomberg – JPMorgan’s Marko Kolanovic – warns the S&P 500 could plummet to 4200 by year’s end.

His forecast stands out like a sore toe.

For what it’s worth, Kolanovic has been ranked the #1 ranked equity strategist on Wall Street for several years.

I personally don’t have a forecast where the market will end the year ( I don’t think it’s overly useful).

However, my only observation is the risk is more to the downside.

That’s not to say we may not finish higher – we could – however I think the gains are limited.

That said, there are opportunities within the market.

For example, whilst large cap tech are trading at or near record highs (which constitutes ~30% of the total market) – the balance of the Index continues to struggle.

I’ve highlighted this recently pointing out the bigger opportunity with exposure to the equal weighted Index (e.g., via the ETF RSP)

We saw such an example today…

Swooosh & Opportunity

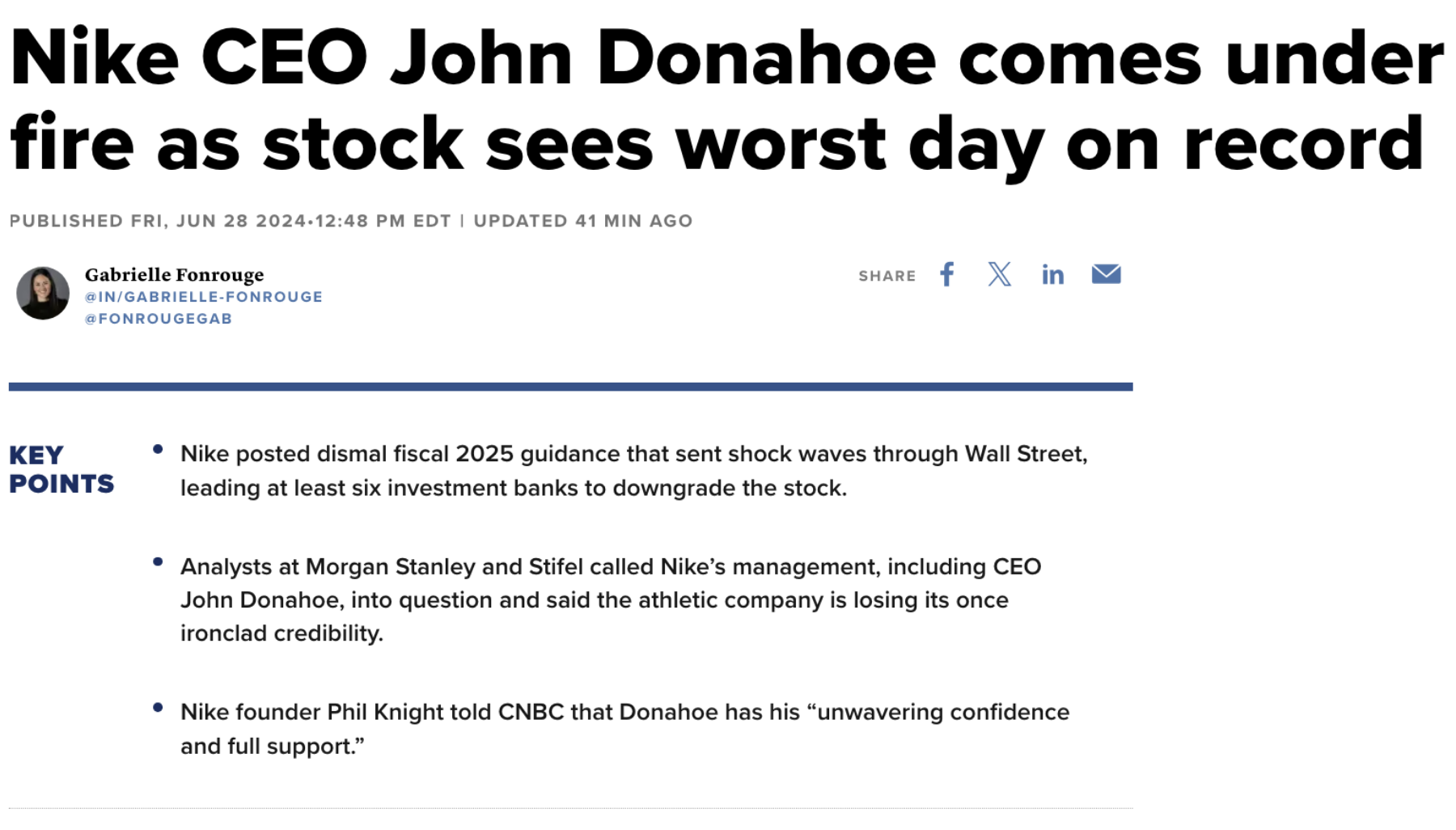

Friday marked the worst single day in Nike’s trading history (since its IPO in 1980).

The stock lost ~20% as their CEO warned of its weakest sales in 14 years and a challenging (increasingly competitive) environment.

It reminded me of what I heard from Lululemon a few weeks ago (just a different logo)

On Thursday, Nike warned that sales in its current quarter were expected to decline by a staggering 10% – far worse than the 3.2% drop LSEG had projected – after it posted its slowest annual sales gain in 14 years, excluding the Covid-19 pandemic.

The company also said it expects fiscal 2025 sales to be down mid-single digits when it previously expected them to grow.

The warning signs led shares to close 20% lower on Friday — making it the worst trading day in the company’s history since its IPO in Dec. 1980.

The plunge wiped about $28 billion off of Nike’s market cap, bringing it to just under $114 billion from $142 billion a day earlier.

It could not have been a worse report for their long suffering shareholders – with the stock trading near 2018 levels (and close to pandemic lows)

At a closing price of $75.36 – its forward PE is now 20.2x (based on an expected full year EPS of $3.73)

Typically Nike trades at a market premium – closer to 25x.

Not now.

First the weekly chart and then the trade…

June 28 2024

From mine, the stock could find some buying support around $70.00.

This was both a previous level of support and resistance.

Beyond that, there appears to be stronger support around $50 (e.g., this was strong support through 2015 to 2018)

However, the stock remains in a bearish trend which suggests lower prices ahead.

For shorter-term traders (which is not me) – this is perhaps one to avoid.

But let’s look beyond the chart…

Fundamentally, Nike remains the clear leader in the ‘sportswear’ market.

However, there are a number of up-and-coming challengers.

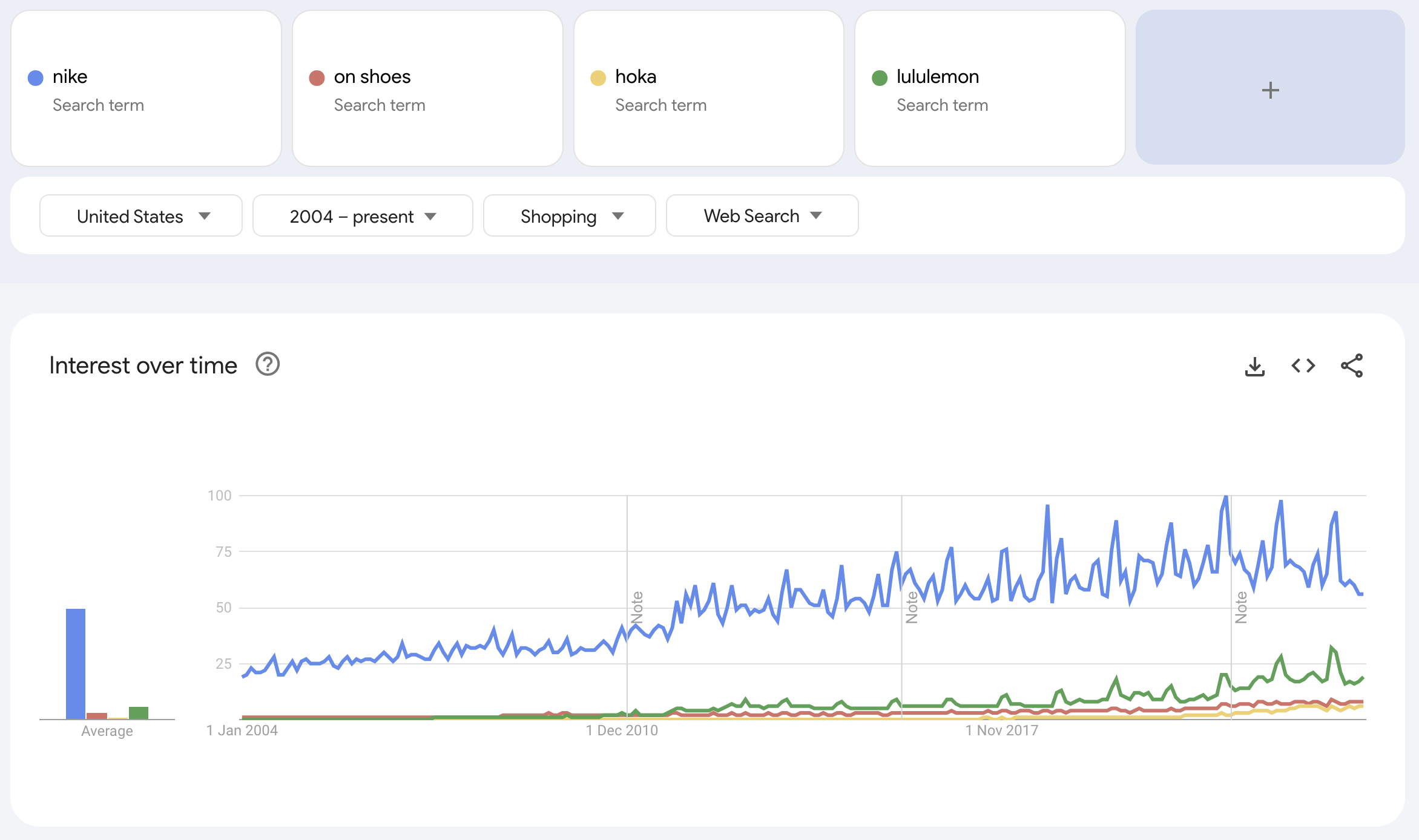

For example, take a look at Google Search Trends for the queries “Nike”, “ON Shoes”, “Hoka” and “Lululemon” from 2004:

Here we can see over the past 1-2 years – the uptick in these competitive brands.

That said, Nike still commands the lion’s share of the market.

According to Statista, it commands around 27% of the footwear market in the US – which comprises 68% of all its revenue.

Beyond footwear – it is said to own ~38% of total sportswear – where it spends over $4B a year on brand advertising.

Now coming back to Nike’s competitors – according to this article – brands such as HOKA (owned by Deckers) and ON – are now doing about $2B of revenue per year each.

“Nike remains the biggest player in the field by a large margin, but its size is also hampering its ability to push out great product and great storytelling to the market,” said Neil Saunders, managing director of data consultancy company GlobalData”

I agree… their size has arguably come at the expense of product innovation (what we see from these smaller – more nimble brands)

Nike is the titanic whereas other (emerging) brands act more like “speedboat”… with very little to lose.

In addition, some feel that Nike has also missed (or ignored?) the new running revolution.

I’m a big runner and I exclusively run in New Balance (specifically the 1540v3 – have done for many years given their strong structure and support – also recommended by podiatrists) – another brand enjoying a resurgence.

NOKA and ON have aggressively targeted running clubs which have worked to cultivate community and attract younger consumers (proving popular with GenZ)

Personally, I have not tried either brand but I am seeing them everywhere.

The global ON Running Club encourages runners to join local run groups, while HOKA’s global running club offers a more fashion-centric experience through its partnerships with other brands. Nike, meanwhile, has stepped away from the investment.

My expectation is we will see Nike focus its massive pool of resources to defend its share.

I also think we will see a Nike “marketing assault” during the Olympics – reinforcing to consumers they are the choice of world’s great athletes.

We will see…

To my trade…

Given my long-term investing preference – I entered a half-position in Nike today at the close.

I took a half-position as I fully expect the stock to trade lower. And if we see it closer to $60 – I will take a full position.

That implies I’m paying a forward PE of ~16x

From mine, that is roughly ‘3 or 4-turns’ lower PE multiple than what Nike warrants. I think it deserves a premium to the market given its position and brand value.

Buying the stock at this price suggests (to me) the potential upside reward meaningful outweighs the downside risks.

But I also expect this trade to take time.

It’s most unlikely to be a winner within 12 months. It’s also a leap of faith they have the muscle and focus to turn this around.

I have every expectation remaining in this trade for 3+ years (unless something materially changes in their story)

It will likely take Nike at least 12 months to re-energize its brand and product innovation.

However, I think they can reach younger consumers.

Given their access to resources, the power of their brand and market share – we could see this trade realize a CAGR in the realm of 15%+ over this timeframe (which would be ~5% greater than the long-running average of the S&P 500)

Putting it All Together

This game is not just what we buy – it’s equally how much we pay.

For example, investors who paid $180 for Nike ignored the fundamentals.

You might say they were lured by the Sirens.

Nike is not a 45x fwd PE multiple stock.

I would argue its fully priced at 30x.

But that’s what some investors paid.

However, given the power of their brand and market share, paying around 20x forward is a fair price for a strong company.

Paying 16x or less is a very good price with a good probability of reward.

As I have been saying recently, there are opportunities in this market but you need to be selective.

Stocks I’ve added to recently include Accenture, Adobe (both before earnings), Intel, McDonalds, Starbucks, CVS, Gilead, Bristol Myers and J&J.

From mine, these represent more attractive long-term risk-reward entry points. And whilst these trades may not work – that’s more than fine – I think the odds are more in my favour.

But this approach requires patience and the conviction to act when the opportunity presents.

Let’s check in with my Nike trade in 6-months and 12-months time.

Regards

Adrian Tout