- 3 timeless investment lessons from Buffett’s annual letter

- A tribute to Munger: ‘the architect of Berkshire Hathaway

- PCE inflation and Treasury Auctions to test rates this week

If we needed confirmation the market isn’t cheap – the Oracle of Omaha told us as much in his annual letter to shareholders.

Buffett’s letter is compulsory reading for anyone who is serious about investment.

It’s filled with timeliness insights from the mind of one of the world’s greatest investors (arguably the greatest).

For example, very few (if any?) have averaged a CAGR of 19.8% for 58 years (see page 17) vs the S&P 500 10.2%

An extra 9.6% per year may not sound like a lot… but when compounded over nearly six decades… it’s staggering:

- Berkshire Hathaway: 4,384,748%

- S&P 500: 31,223%

From mine, it’s not hard to outperform the market by a wide margin in the short-run (e.g., less than 5 years)

However, if you’re beating the market over 10 or 20 years – chances are luck is playing less of a role and you’re doing something consistently right (n.b., my 8-year CAGR is 14.5% vs the S&P 500 12.6%)

What follows are three key insights from Buffett that I took away. And as the Oracle often reminds us:

“Be fearful when others are greedy; and be greedy when others are fearful”

Insights from Buffett

As Buffett’s quote suggests – he dislikes overpaying.

However, Charlie Munger taught Buffett that it’s okay to buy ‘wonderful businesses’ at ‘fair prices’.

This was an critical lesson for Buffett early on in his career (1965 – he was 35).

For example, when he acquired Berkshire Hathaway – it was a struggling textiles business at a wonderful price.

From Buffett’s perspective, it fit the model of what Benjamin Graham (considered the ‘father of value investing’ and Buffett’s early mentor) always advocated.

However, Munger challenged Graham’s investment philosophy… arguing the model won’t scale.

Charlie was right…

Nevertheless, Charlie, in 1965, promptly advised me: “Warren, forget about ever buying another company like Berkshire. But now that you control Berkshire, add to it wonderful businesses purchased at fair prices and give up buying fair businesses at wonderful prices.

In other words, abandon everything you learned from your hero, Ben Graham. It works but only when practiced at small scale.”

With much back-sliding I subsequently followed his instructions. Many years later, Charlie became my partner in running Berkshire and, repeatedly, jerked me back to sanity when my old habits surfaced.

Until his death, he continued in this role and together we, along with those who early on invested with us, ended up far better off than Charlie and I had ever dreamed possible.

In reality, Charlie was the “architect” of the present Berkshire, and I acted as the “general contractor” to carry out the day-by-day construction of his vision.

Now contrast the acquisition of Berkshire Hathaway with say that of “Apple” (and you could equally apply to American Express, Coke, Bank of America and many others).

With Apple, in 2016, Buffett bought a “wonderful business at a fair price” (at ~9x forward earnings vs closer to 30x forward today).

To better gauge what is a ‘fair price’ – Buffett is well known for analyzing metrics like (not limited to):

- Price to earnings (PE)

- Price to book (PB) and perhaps most important

- Price to cash-flow (PCF)

With the S&P 500 trading over 21x forward earnings (assuming earnings of $235 this year which assumes 11-12% YoY growth) – his caution serves as a warning.

From mine, Buffett has mastered a patient approach of only buying when probabilities favour him (i.e., the price is at fair value)

In his language, he will only swing at a pitch which falls within his ‘hitting zone’.

Everything else can go through to the catcher.

And as we know – Mr. Market is not a very good pitcher – who tends to throw a lot of balls “very wide of the plate”.

But it won’t stop your ‘average’ investor swinging at rubbish!

I was not surprised to learn Buffett is more than willing to continue to build is cash war chest (with over $160B at his disposal or ~20% of total market cap)

With that, let’s follow with some lessons.

#1. Investing

“I can’t remember a period since March 11, 1942 – the date of my first stock purchase – that I have not had a majority of my net worth in equities, U.S.-based equities.

And so far, so good. The Dow Jones Industrial Average fell below 100 on that fateful day in 1942 when I ‘pulled the trigger.’

I was down about $5 by the time school was out. Soon, things turned around and now that index hovers around 38,000. America has been a terrific country for investors. All they have needed to do is sit quietly, listening to no one.”

I can think of more than a few times in my very short 27-year investment career where I would have been better served just to “sit quietly”.

But I’m slowly improving…

#2. Picking Winners

“Our goal at Berkshire is simple: We want to own either all or a portion of businesses that enjoy good economics that are fundamental and enduring.

Within capitalism, some businesses will flourish for a very long time while others will prove to be sinkholes.

It’s harder than you would think to predict which will be the winners and losers.

And those who tell you they know the answer are usually either self-delusional or snake-oil salesmen.”

There is a lot to be gained in knowing what you don’t know.

Put it this way, you are better off trying to be a “learn-it-all” rather than a “know-it-all”

Sadly, I tend to come across many of the latter – and far less of the former.

A moment on “know-it-alls” (as they are dangerous)

How often do you read or hear opinions from people who don’t know about a particular subject (e.g. they may have “surface leve”l knowledge) – but pretend they know?

It’s widespread.

For example, when war broke out between Russia and Ukraine, all of a sudden everyone was an military expert.

Or when we saw the horrific attacks in Gaza – everyone becomes an expert on the history between Israel and Palestine.

The pandemic wasn’t different. The internet was flooded with experts on viruses – how they spread – what “R” factors meant – and expert advice on shutdowns and immunization.

It’s incredible how many “experts” there are!

With respect to the game of asset speculation – there is no shortage of know-it-alls who are more than willing to tell you (or worse “sell you”) what will turn out to be winners or losers.

Nothing more than snake oil salesmen.

Just like we can’t pretend to know where the “S&P 500 is going next year”… what “interest rates will be in 12 or 24 months”… what “inflation will be”… or what company will be the next “Nvidia”

If you’re taking advice from someone who pretends to know these answers – stay well clear.

But what we can do is invest in high quality companies at fair prices.

And if those investments don’t work out – that’s more than okay.

But if you stick to your process – and on the basis these businesses generate strong cash flow and consistent profit margins – and assuming you paid a fair price – probabilities suggest your decision will most likely be rewarded.

To be clear, it may not but you have put the odds in your favour.

The lesson I’ve given people I’ve mentored (investing or otherwise) is process counts for more than results.

I’m far less interested in hearing the result (e.g., people might tell me they made “40% last year”) – that’s arbitrary – but I want to know the process you went through.

That will tell me whether it’s repeatable over the long run (or whether good luck was probably involved).

Over time sound, repeatable and robust process will likely counter forces we cannot control.

Buffett is an investor with a regimented process.

3. On Fear

March 18 2022 – I penned a missive titled “Why It Makes Sense to Buy Peak Fear”

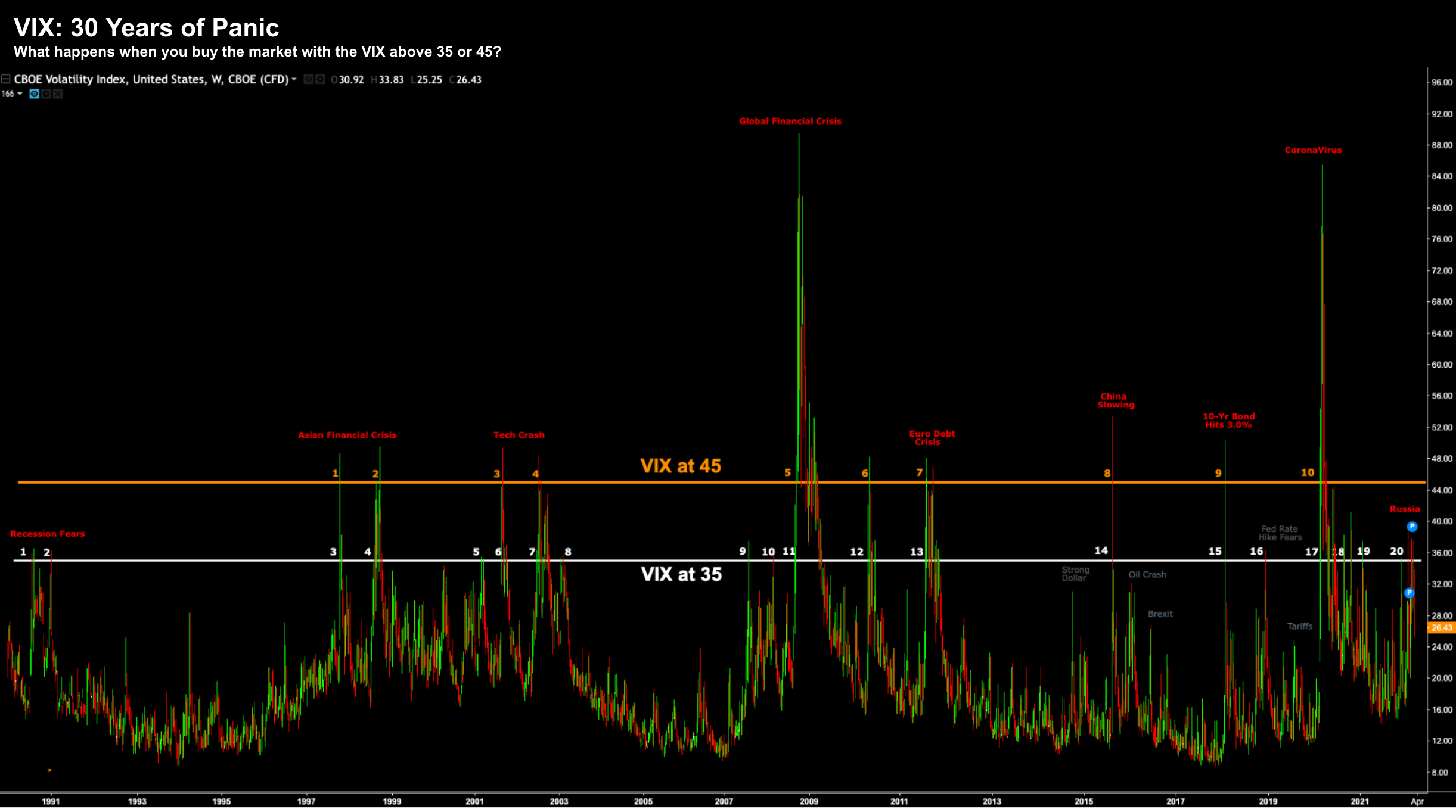

In short, I looked at subsequent multi-year returns when the VIX spiked above 35 and 45 (i.e., a sign the market was panicked). I put together a chart “VIX: 30 Years of Panic”

March 18 2022

- Recession of 1990/91

- Asian Financial Crisis of 1997

- Tech Crash of 2000/01

- Global Financial Crash of 2008/09

- European Debt Crisis of 2011

- Fears of China Slowing in 2015

- US 10-Year Bond Yields exceeding 3.0% in 2018

- Global Pandemic of 2020; and more recently

- Russia’s invasion of the Ukraine and Oil Shock

In every case – no exceptions – it paid to buy the market during these panics. Here’s Buffett:

“Markets can – and will – unpredictably seize up or even vanish as they did for four months in 1914 and for a few days in 2001.

If you believe that American investors are now more stable than in the past, think back to September 2008.

Speed of communication and the wonders of technology facilitate instant worldwide paralysis, and we have come a long way since smoke signals.

Such instant panics won’t happen often – but they will happen.

“Berkshire’s ability to immediately respond to market seizures with both huge sums and certainty of performance may offer us an occasional large-scale opportunity.

Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than when I was in school.

For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants.”

Buffet is right – another panic will come – we just don’t know when.

I also smiled when I read “… today’s active participants are neither more emotionally stable nor better taught than when I was in school”.

Amen.

I would say the human emotions of fear and greed are very much alive and well. Technology has only amplified things (especially speed).

Unfortunately technology has done little to change human emotions.

People are still as greedy as they were when Buffett was a boy… and perhaps just as irrational.

But for those who have the presence to “buy when others are fearful” – or immediately respond to market seizures – that’s the time to put cash to work.

The proof is in the numbers.

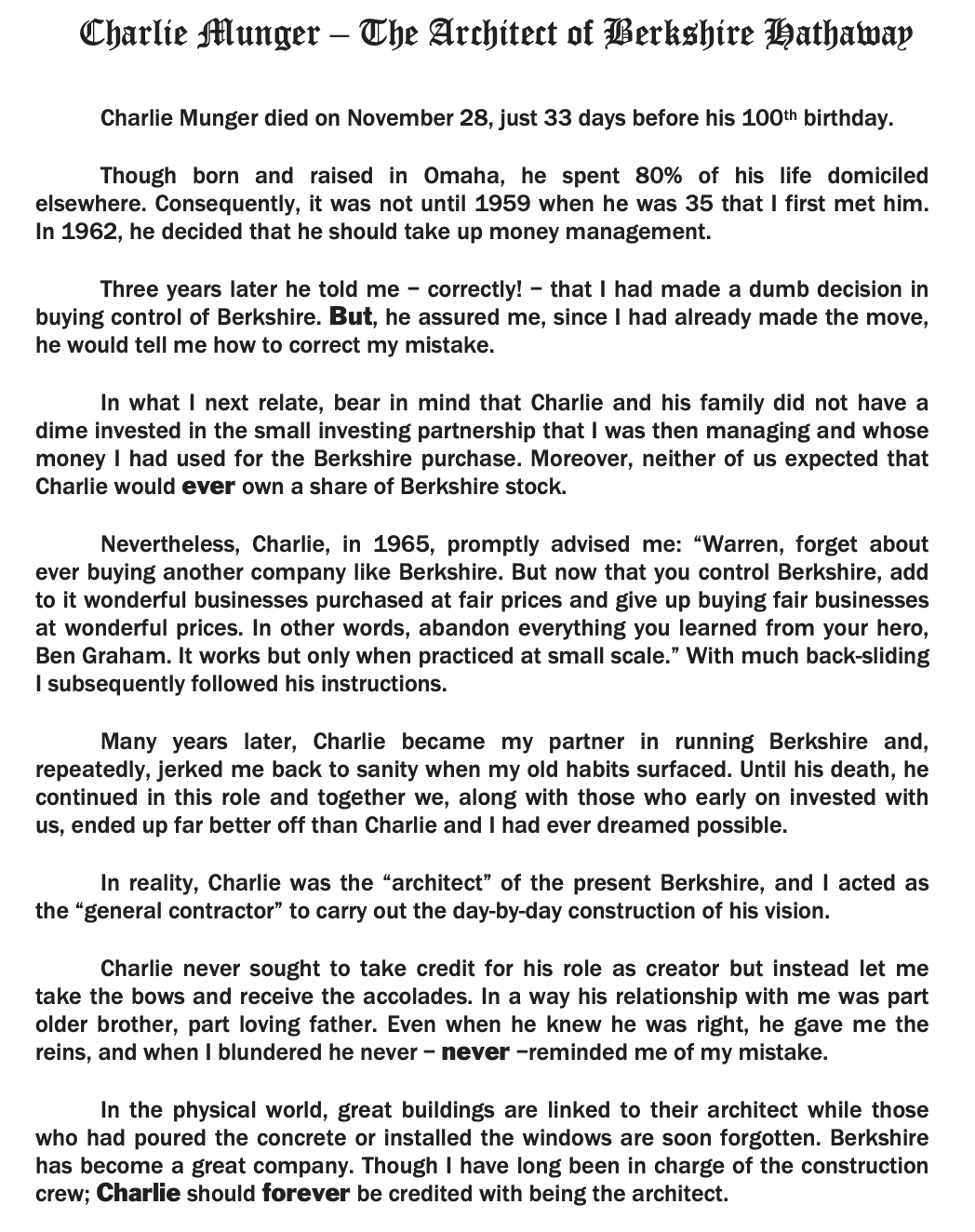

On Charlie Munger…

I loved the paragraph where Buffett said he was willing for me to “… take the bows and receive the accolades”

It’s hard to tell who is more humble (and/or wise).

Putting it All Together

Buffett’s annual letters deserve a place in your library.

You can re-read them and learn something new.

These lessons don’t date.

All things Buffett aside – this week is full of economic data.

Investors are looking ahead to durable goods, consumer confidence, PCE Inflation and ISM-Manufacturing in the coming days.

Of note will be PCE inflation – the Fed’s preferred measure. Given the hotter-than-expected PPI and CPI numbers last week – investors are braced for an uptick.

Pending the result – this could see the long-end of the curve (e.g., 10-year) continue to push higher.

That said, I will be adding to my bond portfolio if we see the 10-year above 4.50%

In addition, there is a wave of new US Treasury debt.

Treasury will be auctioning ~$229 billion in short-term bills and $169 billion in longer-term notes today and tomorrow.

Failure to see strong demand could also help underpin higher rates.