- Does the market have it wrong (again)?

- ‘Priced to perfection’ at 19.5x fwd – assuming 12% YoY EPS

- Why I think earnings forecasts will come down

Over the past couple of months – I’ve been trying to reconcile the following:

- Can the market achieve 12% EPS growth; and in parallel

- See the Fed cut rates 5 or 6 times this year?

I ask this question as that’s what the market is pricing in.

It feels like a contradiction.

Can we achieve both?

For example, if the Fed is forced to cut rates aggressively – what does that tell us about the health of the economy?

I would assume it signals an economy in need of emergency assistance.

My (consistent) hypothesis has been rate cuts of this magnitude would likely be the function of either:

- A economic recession; and/or

- Some kind of major credit event

If that proved to be the case – how will that impact the market’s assumption for 12% YoY earnings growth?

Long-term readers will know my base case for 2024 is a recession.

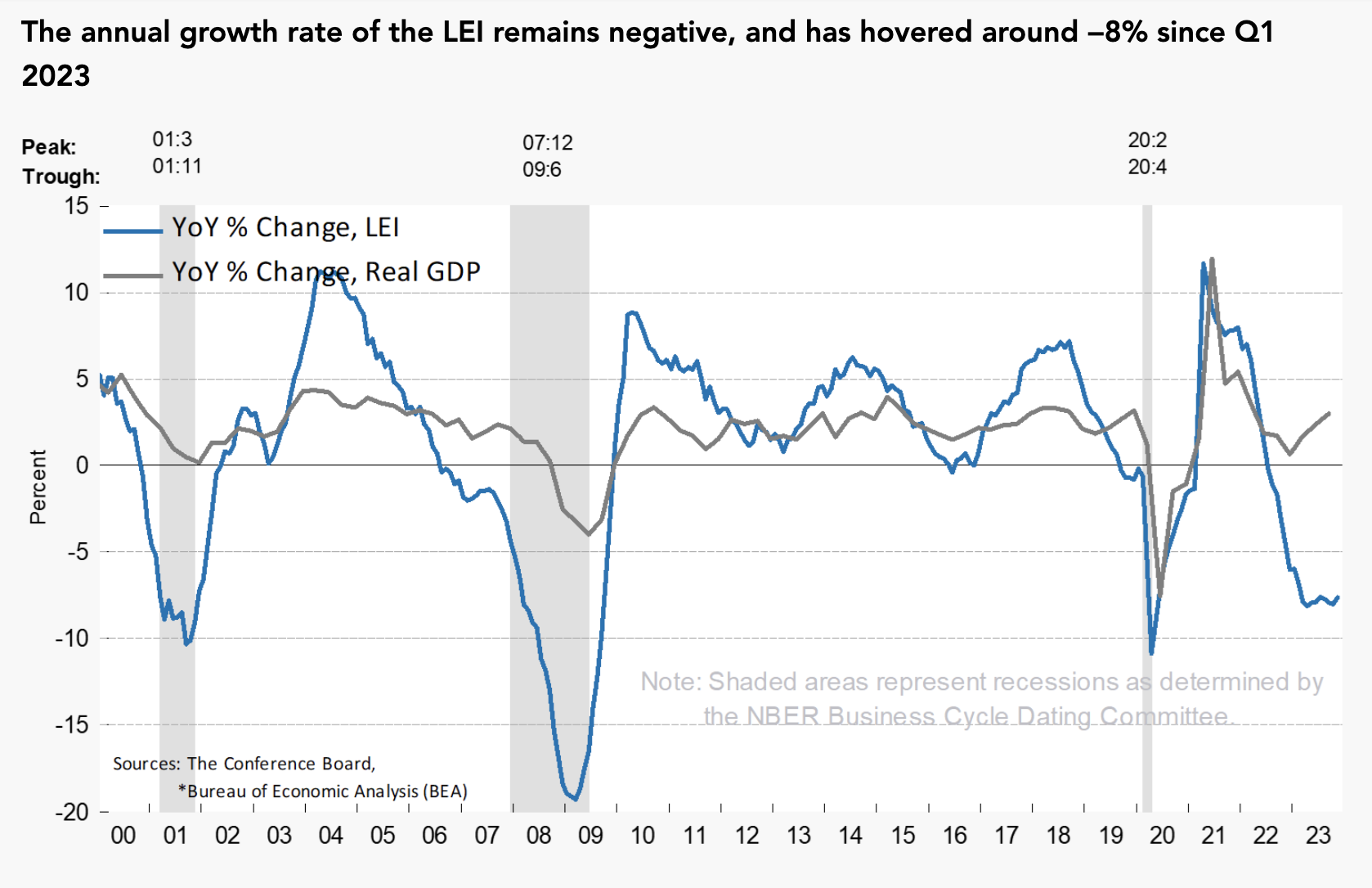

I’d be more than happy to have this bet wrong – however that’s where things currently stand given the leading economic indicators I choose to lean into (e.g. the Conference Board’s LEI and current “bear-steeping” of the yield curve).

Now if we are to experience a recession – yes – we could see as many as six rate cuts (and a likely suspension of the Fed’s quantitative tightening).

That would be consistent with how the Fed typically responds to economic downturns (assuming inflation is normalizing).

But then we should say goodbye to forecasts for 12% earnings growth.

For example, recessions always (without exception) result in an earning’s declines.

2023 is expected to realize earnings per share of $220 for the S&P 500.

If we saw a decline of say 5.0% – that would mean EPS closer to $210 per share (vs the $245 currently priced in)

Let’s look more closely at each of these two key market assumptions.

For me, I struggle to reconcile how each can co-exist (let alone their validity)

Assumption #1: 6 Rate Cuts in 2024

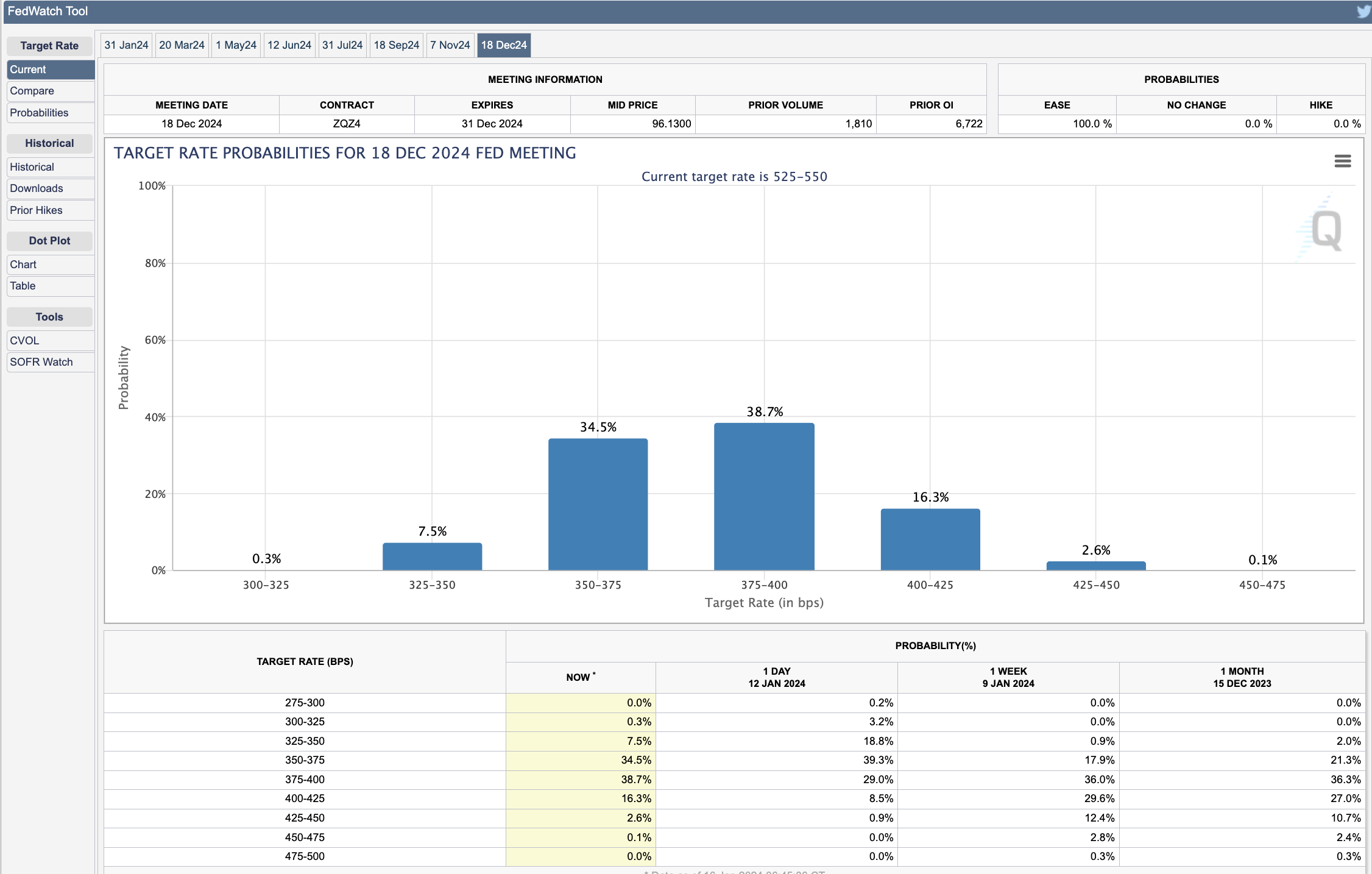

According to the CME’s FedWatch Tool – futures are pricing in at least six rate cuts for 2024.

In addition, fed fund futures see a ~60% chance for a seventh cut by December.

From mine, that’s aggressive (or optimistic).

For example, consider where things stand today with unemployment.

At a rate of just 3.7% – that’s essentially full employment.

Now, many readers will be quick to point out that inflation is falling – which means the Fed has some scope to reduce rates.

I agree with that.

Inflation is likely to continue to trend lower.

But that alone doesn’t justify 6 (possibly 7) rate cuts in the space of just 9 months.

Today, Fed President Chris Waller advocates moving carefully with respect to any cuts. From CNBC:

“As long as inflation doesn’t rebound and stay elevated, I believe the [Federal Open Market Committee] will be able to lower the target range for the federal funds rate this year,” Waller said in prepared remarks for an audience at the Brookings Institution.

“When the time is right to begin lowering rates, I believe it can and should be lowered methodically and carefully,” he added.

“In many previous cycles … the FOMC cut rates reactively and did so quickly and often by large amounts. This cycle, however, … I see no reason to move as quickly or cut as rapidly as in the past.”

That echoes my sentiment.

After Waller provided this statement – fed fund futures dialled back their expectations for 7 rate cuts – however maintains a 67% chance the FOMC will begin cutting in March.

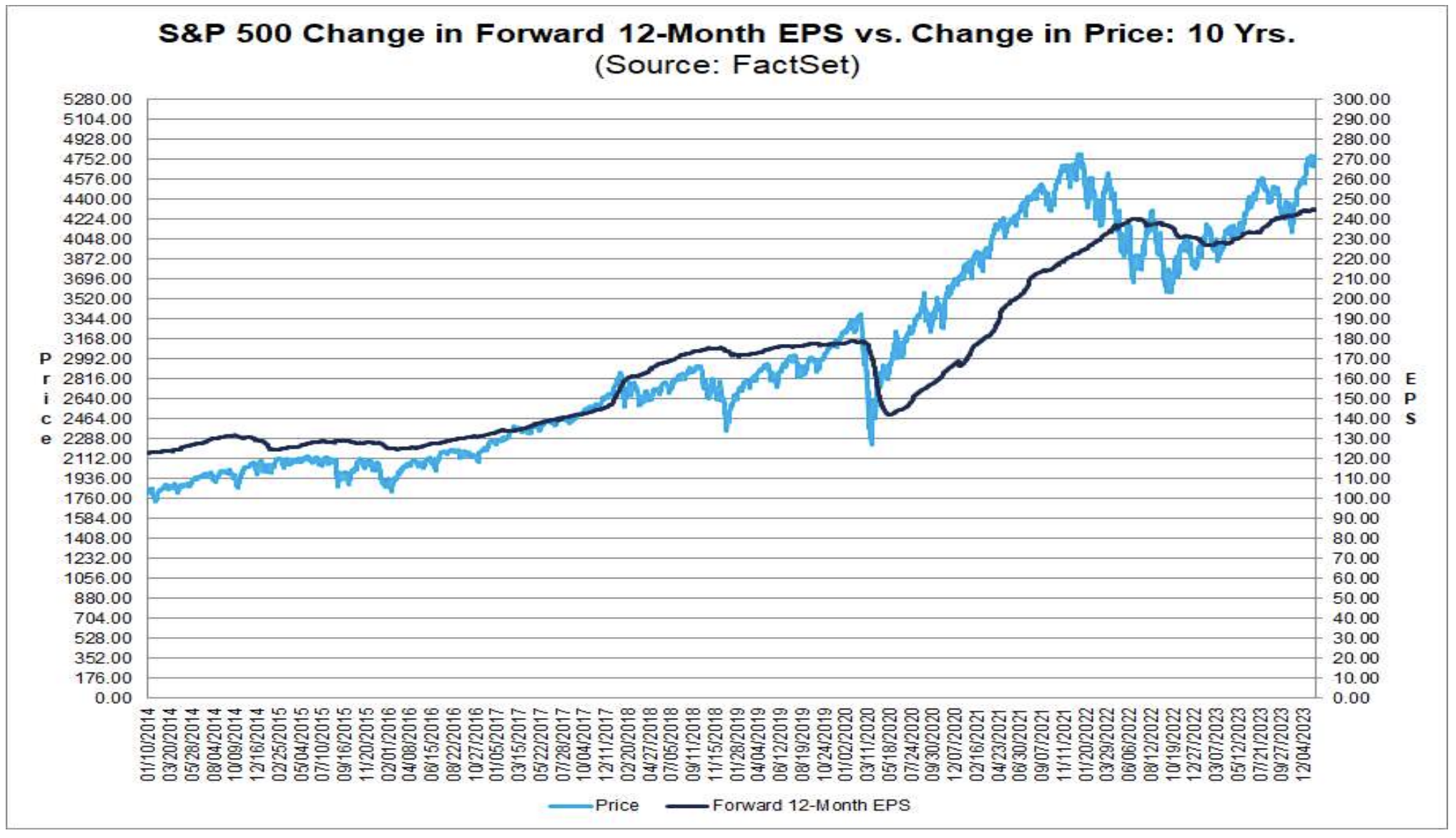

Assumption #2: 12% EPS Growth

Factset recently told us the market is prining in corporate earnings growth of ~12% in 2024 (or approx earnings of $245 per share)

At a price of around 4762 – that’s an implied forward PE of 19.5x

Beyond earnings – Factset also report that market analysts see revenue growth of 5.5%

As I write this – companies are in the midst of reporting earnings for the previous quarter – and what they see ahead.

So far, the S&P 500 is reporting a YoY earnings decline of -0.1% for the fourth quarter, which would mark the fourth decline in earnings in the past five quarters reported by the index.

However, based on the average improvement in the earnings growth rate during the earnings season, the index will likely report YoY growth of more than 4.0% for Q4

Again, this is expected to improve to 12% for the coming 12 months.

So what will drive this growth?

Answer: economic expansion (via a strong consumer) with strong cost discipline.

How much faith do we put into that assumption?

A Contradiction

This is the contradiction we find in the market.

On the one hand, the market expects the Fed to cut rates six (possibly seven) times whilst economic conditions remain (very) favourable.

It’s possible but I don’t think it’s probable.

Sure, we might see revenue growth should inflation persist longer.

But if that were the case – this would only see the Fed keep rates higher for longer.

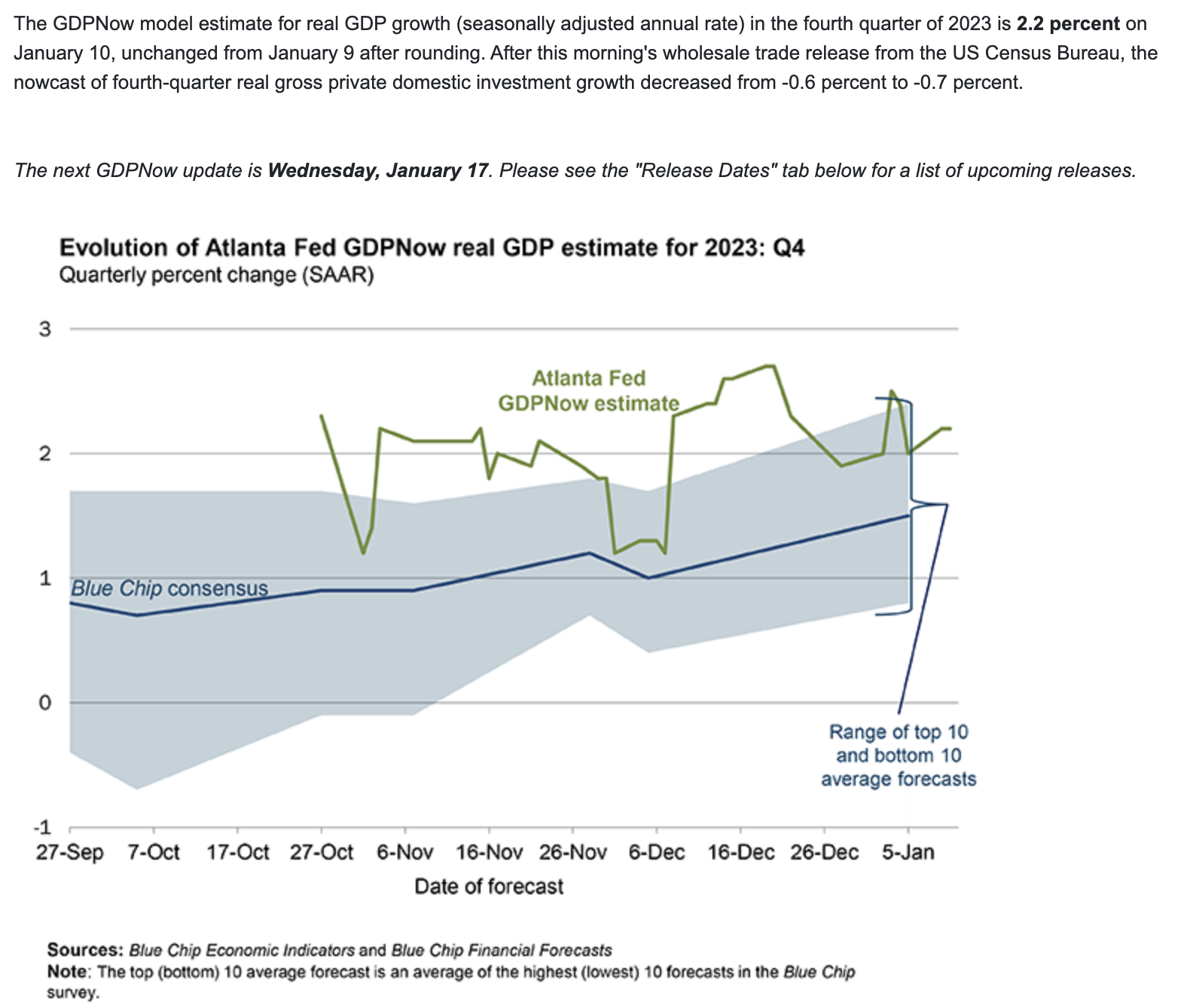

However, if we assume revenue growth matches GDP plus inflation (where inflation falls to near 2.5% to justify (some) rate cuts) – that implies GDP growth in the realm of 2.5%

Assuming that rate of nominal growth is not enough to justify six (or seven) rate cuts.

As an aside, below is the current forecast for Q4 2023

- Monitoring the quality of Q4 earnings

- Headwinds (or tailwinds) corporate America sees looking ahead; and

- What we find with employment and inflation trends

The Fed will next meet at the end of the month and provide us with their latest outlook.

Will Jay Powell echo the sentiment from Waller – pouring cold water on aggressive rate cuts? Or will the Chair simply add more fuel to the “dove’s fire” (as he did last month)?

Given December’s surprise pivot – I don’t pretend to guess.

Putting it All Together

The market decided to hit the pause button to start the third week of January… pushing the index back into negative territory for the year.

As I’ve expressed recently – I don’t think the long-term risk reward is favourable around 4800.

It feels like the market is making two (aggressive) assumptions in parallel.

That is, if it’s correct the Fed panics and cut rates six times – we will need to slash earnings estimates.

Alternatively, if the market can realize 12% EPS growth, it implies an extremely robust economy (one where consumers continue to accelerate their spending on 2023)

My best guess is earnings will be revised down after this reporting season.

If true, that implies the asking price of the S&P 500 (~4800) is perhaps 3 multiples too high.