- Stocks and bonds both face a technical litmus test

- At what point do lower bond yields become a “headwind”?

- Is the rally in stocks ‘conditioned’ or one based on strong logic?

Market consensus is for a soft-landing with at least three rate cuts next year.

The market does not expect a recession.

This may prove correct (I don’t pretend to know) – but there are some chinks in the armor.

Readers will know I don’t subscribe to a soft-landing.

Typically in the lead up to a recession – spectators will generally lean towards it being “soft”.

Few ever forecast ‘hard landings’.

For example, if you have unemployment below 4% and positive GDP growth – it’s hard to see anything else.

But very rarely do things land softly.

We’ve seen one over the past five decades.

That’s not a high ratio of success.

What’s more, soft landings are exceptionally rare after 550 basis points of rate hikes (not to mention over $1 Trillion in quantitative tightening – of which we have no parallel).

But let’s start with a technical review of what we see with the S&P 500 and the US 10-year yield.

Both face a litmus test – trading at key levels.

And I will follow that with some questions…

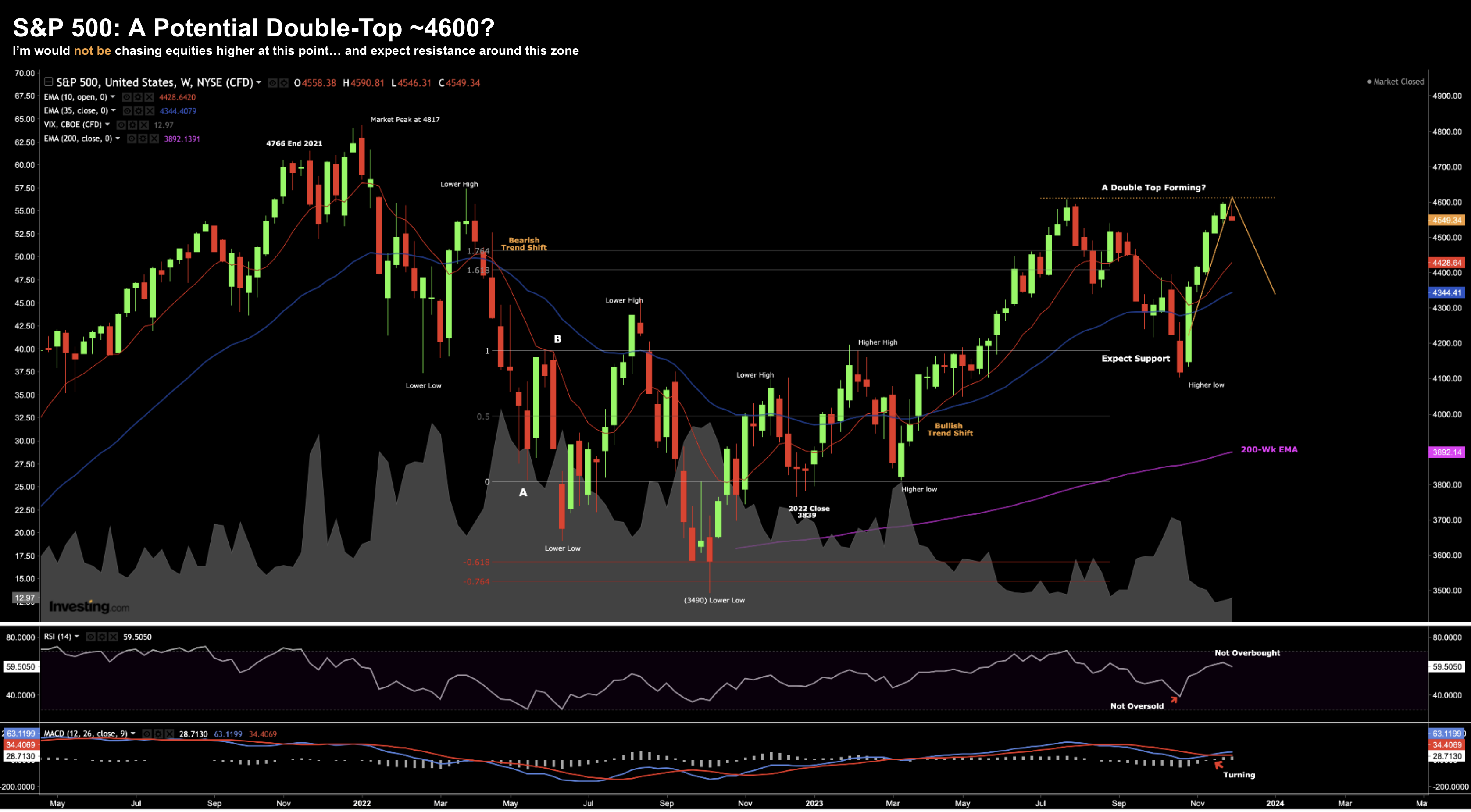

S&P 500: Potential Double-Top?

Dec 6 2023

Over the weekend I raised the possibility of a potential “double top”.

For those less familiar – this is where the market challenges the most recent high and fails.

The formation is like “twin peaks”… indicated by the (forecast) orange line.

My suspicion is that’s what we will see… where the market is rejected in this zone.

However, we could still see the market turn and rally from here.

Remember: November and December are typically seasonally strong periods of the year.

How if we were to see rejection from 4600 – it could see us trade closer to 4300 in the coming weeks (i.e., the 35-week EMA).

Typically this is where the market will find support whilst in a bullish trend.

If 4300 fails – I see strong support around the 4200 zone.

Yields Plunge…

If you increased your exposure to bonds in recent weeks – you’ve done exceptionally well.

For example, one ETF I added to – EDV – rallied from ~$62 to ~$78 – or close to 26%.

Whilst I felt yields were likely to ease (opposite expectations for slower growth etc) – what was unexpected was how quickly this occurred.

However, this kind of bond volatility is not a positive.

The rally in EDV (and similar ETFs like say TLT or AGG) is entirely due to what’s happening with bond yields.

Yields have tumbled from levels of ~5.02% to trade closer 4.12% at the time of writing in just 7 weeks.

That’s highly unusual…

Dec 6 2023

For example, is this the bond market pricing in such things as (not limited to):

- Much slower growth next year (but not a recession)?

- Inflation closer to the Fed’s target (and a disinflationary environment)? and

- Potentially at least two (maybe three) Fed rate cuts?

Maybe it’s a combination of the above – I don’t pretend to know.

But here’s something else:

At what level does a lower 10-year yield become a warning sign?

For example, when you consider this instrument is typically a proxy for growth, what does a 10-year yield falling below 4% represent?

I’ve previously said the 10-year could trade with a “3-handle” at some point around mid-next year (and why exposure to vehicle like EDV represents opportunity) — but I don’t think that’s necessarily ‘good’ for stocks.

From mine, that would be reflective of an investor who is skittish on risk assets.

Yes, money is cheaper.

But that counts for little if the consumer is tapped out, unable to get work and growth is recessionary.

Up until recently, stocks embraced lower yields.

However, they embraced them on the back of a potential soft-landing. This was the fuel behind the rally.

And yet, despite the sharp pullback in yields this week, stocks have stopped rallying.

The question to ask is why?

“System 1 vs System 2” Thinking

Equities have clearly relished the prospect of easier monetary conditions.

And why not – the US economy only seems to function on cheap and available credit.

But as I asked recently – is this a potential blind spot?

For example, what happens if the Fed does not cut rates in the first half of the year?

Or what if the 10-year rallies as the government continues to auction fresh long-term debt?

Investors will demand a premium.

This problem has not gone away – a torrent of fresh debt is coming down the pike – and markets will need to soak it up.

Will “4.1%” adequately compensate investors for duration risk?

The market assuming there will be rate cuts may not be entirely rational… but feels a lot more ‘Pavlov’s Dog’

In other words, it’s classical conditioning.

As an aside, recently I’ve been re-reading Daniel Kahneman’s brilliant book “Thinking Fast and Slow” (it’s a must read)

Kahneman explains how the brain implements a combination of “System 1 and System 2 thinking”

System 1 is a near-instantaneous process; it happens automatically, intuitively, and with little effort. For example, if I asked you to “tell me the alphabet” or “count to ten” or “brush your teeth” – this would all be System 1. Almost no thought is involved.

System 2 on the other hand is slower and requires more effort. It is conscious and logical. It requires us to consider all the circumstances and what could cause things we may not immediately see.

From mine, the market’s reaction the past few weeks has been more “System 1” vs “System 2”

For example, despite Fed Chair Powell reiterating they’re a long way from rate cuts (and their objective) – fed funds futures have now completely priced out the idea of any more rate hikes.

Consider the recent four-week pivot in fed funds futures:

- 32.5% for a 25 basis point hike by January has flipped to a 15.2% expectation for a cut

- Cuts were previously not fully priced in until July – the first is now expected by March (76% probability)

- Two additional cuts are now priced in for calendar year 2024.

Again, what is the rationale behind each of these assumptions?

From mine, this feels more knee-jerk than carefully considered.

Putting it All Together

Before I close, we received more news the economy is slowing.

The employment picture continues to weaken (not a surprise for regular readers).

Great news for the Fed – less so for the economy.

On Tuesday, we learned the number of unfilled jobs (JOLTS) dropped to 8.7 million, the lowest level since early 2021 and below all estimates. What’s more, the previous month was revised down.

Softening labor demand is also evident in weekly jobless claims figures.

The number of recurring applications for US unemployment benefits has jumped to the highest in about two years.

The figure has climbed since September, suggesting out-of-work Americans are finding it more difficult to secure new employment.

The one sector which is consistently adding jobs (between 50K to 60K per month)?

You guessed it – the government (i.e., jobs that increase the debt burden).

This Friday we will get another glimpse into how much labor is slowing.

Friday’s November payroll report is expected to show a 187,000 rise in non-farm payrolls, up from 150,000.

However, I think there is material underlying weakness in the labor market as I highlighted here.

My expectations are for unemployment to hit levels between 4.50% and 5.00% in 2024.

If true – that’s not representative of a so-called “soft landing”.

That’s recessionary.