- Does the market have a blind spot with rate expectations?

- Yields thunder lower – helping the equity rally; and

- Why I’m not interested in chasing equities at current valuations

Markets continue their ascent after a blistering November.

The Dow and S&P 500 each gained ~9% for the month – in what is typically a seasonally strong time of year.

From a year-to-date perspective, the Dow is up 8.5%, the S&P 500 is up ~19% and the Nasdaq up over 35%

The anomaly?

493 of the 500 stocks on the S&P 500 are barely positive for the year (i.e., the equal weighted index)

In other words, just 7 stocks have done the heavy lifting.

Hardly what you would consider a market with strong ‘breadth’.

Despite the gains in the so-called Magnificent 7 – the S&P 500 is yet to reclaim last year’s high.

So why are markets optimistic?

Four possible reasons (perhaps not limited to):

- No recession outcome in 2024

- Much lower bond yields

- Inflation trending back to the Fed’s 2.0% target; and

- Rate cuts as early as March next year.

How realistic are these assumptions? And what probabilities do you give each?

For me, the jury is still out on all four.

But for now I’m enjoying the ride… we will see how long it lasts.

Let’s explore…

The Complete Disconnect with the Fed

Earlier this morning the market heard from Fed Chair Jay Powell.

As usual, the market hung on every syllable.

Let’s start with what Powell said:

“It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease”

“While the lower inflation readings of the past few months are welcome, that progress must continue if we are to reach our 2 per cent objective”

Clearly the market paid little attention to the words it’s “premature to conclude with confidence” the Fed are sufficiently restrictive.

However, they did choose to hear the following (as it fits with their narrative):

Wage growth remains high but has been gradually moving toward levels that would be more consistent with 2 percent price inflation over time, and real wages are growing again as inflation declines.

The normalization of supply and demand conditions has played a critical role in the disinflation so far, as has the substantial tightening of monetary policy and overall financial conditions over the past two years.

The strong actions we have taken have moved our policy rate well into restrictive territory, meaning that tight monetary policy is putting downward pressure on economic activity and inflation.

Having come so far so quickly, the FOMC is moving forward carefully, as the risks of under- and over-tightening are becoming more balanced.

Market interpretation: the Fed is done.

For example, yields on the policy-sensitive 2-year treasury dropped 0.14% to a five-month low of 4.56%

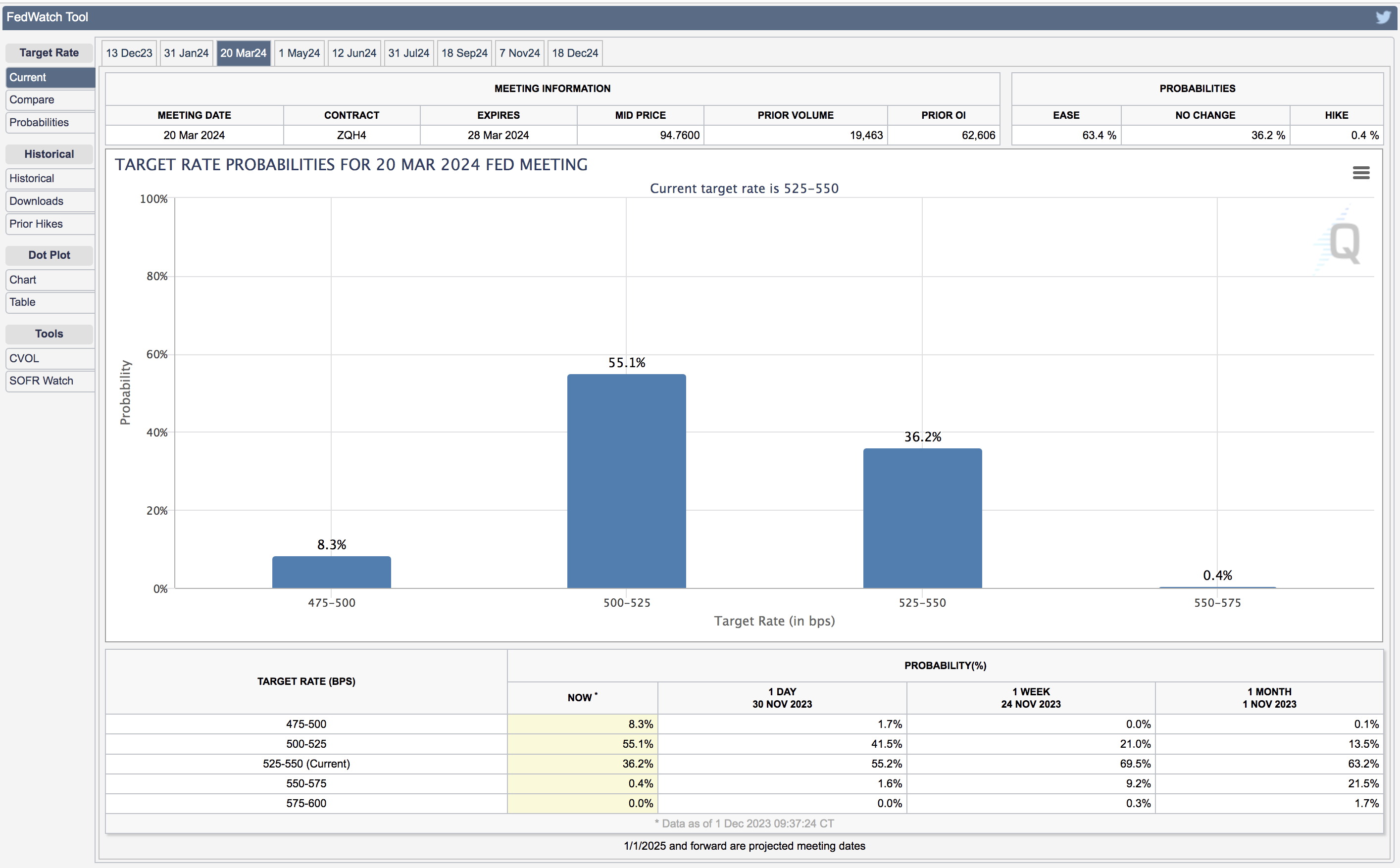

What’s more, federal funds future now see about a 55% chance of the Fed reducing rates as early as March 2024, up from about 21% a week ago.

The market clearly feels the Fed has hit its terminal rate this cycle.

With that assumption – sentiment is the Fed is more likely to move rates back to neutral, if not become accommodative (as the revised futures probabilities suggest)

But as I mentioned earlier – how reasonable is that assumption?

Potential Blind Spots

From mine, I saw little in Powell’s language which indicated an imminent move to cut rates (e.g., March)

For example he reminded us that the Fed is prepared to tighten further if needed.

But the market just took that as more “boilerplate” Fed language.

Bla bla bla.

For example, Powell said (more than once) that “3.0% or 2.5% is not 2.0%”

Inflation has declined to 3 percent over the 12 months ending in October, but after factoring out energy and food prices, which tend to be volatile, what we call “core” inflation is still 3.5 percent, well above our 2 percent objective.

Over the six months ending in October, core inflation ran at an annual rate of 2.5 percent, and while the lower inflation readings of the past few months are welcome, that progress must continue if we are to reach our 2 percent objective.

Therein lies the potential blind spot from market participants.

What if inflation remains sustained at 2.x%… will that induce a cut?

Markets think so…

I don’t.

What’s more, not only would we need to first get to 2.0% (something which is not yet certain) – Powell is also saying that would need to be sustained.

What does that mean? Two or three months at or below 2.0%?

In any case, the market is now pricing in a 55%+ chance of a rate cut as early as March – where the probabilities are now near 99% for June.

S&P 500: Optimism Reigns Supreme

Below we see the incredible velocity of the 5-week rally.

As I expressed last week – we’ve seen four similar episodes the past couple of years.

Dec 1 2023

What’s interesting here is the Index is now back at the same point it was the week of July 24 this year.

Put another way, the market was up ~20% in the first 7 months and has done nothing since.

It basically ’round tripped’.

As I was saying last week, what I’m watching is how it behaves in the zone of 4600 to 4650.

For example, we could be seeing a double-top.

If it fails and drifts back below 4500, it runs the risk of completing this technical pattern.

On the other hand, if it can break above the July high and sustain that level for several weeks, it will likely challenge the January 2022 high.

Personally, I am not wedded to either outcome.

For example, if the market continues to rally – I have decent long exposure to take advantage (adding to my portfolio’s 16%+ YTD gains)

That’s not a bad outcome.

However, if the Index fails, I look forward to potentially putting some of my ~35% cash to work at more attractive valuations (e.g. closer to 4,000).

In any case, I’m not tempted to chase expensive valuations where risks feels mis-priced.

Putting it All Together

Markets are correct to assume that inflation is trending in the right direction.

That’s good news.

They’re also correct to assume rates are restrictive – around 2.5% in real terms.

However, my argument is less about the direction of inflation – it’s velocity.

Put another way, what will we see with the last mile?

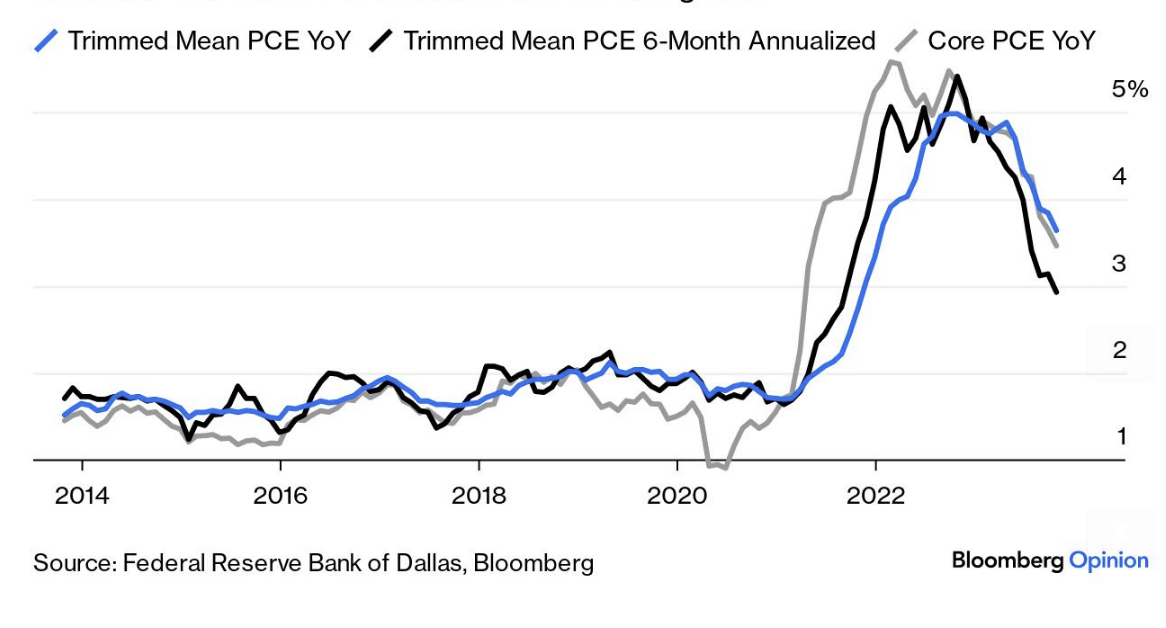

For example, this week we received the Fed’s favoured inflation measure: Personal Consumption Expenditure (PCE) data for October

Both core measure and the “trimmed mean” (where outliers are excluded and an average taken), showed continued steady declines.

Good news…

Over the last six months, the trimmed mean has been rising at an annualized rate of less than 3%.

But if I am to repeat the language of Powell… “2.x% is not 2.0%”

From Bloomy:

As I’ve stressed the past 12+ months – there is a lot of ground to cover to get to 2.0%

So what does that descent look like?

Will it be without an accident?

Markets seem to think so.

For now, I continue to remain invested but cautious.

Be wary of blind spots (as our friend Charlie would remind us)