- Will the Fed target positive real rates to stamp out inflation?

- How high is the Fed willing to see unemployment go?

- Could 2023 be gold’s time to (finally) shine?

This time last year I offered this post “Thoughts on 22 with 5 Charts”

In short, these charts represented what I felt would heavily shape the investing landscape:

- WTI Crude Oil (and its impact on CPI)

- 10-Year Treasury Yields

- 2/10 Yield Curve

- Core PCE Inflation

- US Dollar Index

At the start of 2022, I felt that higher yields, a higher dollar, higher crude were all likely to pressure equities.

And whilst that was true… I didn’t see equities dropping near 20%

Forecasts will typically make you look foolish (and I am sure 2023 will be no exception).

Much has changed over the past 12 months…

What follows are 5 charts that have my (close) attention for the year ahead.

Let’s start with perhaps the most important… and it’s not inflation or yields.

That was last year…

For 2023, the narrative will be shaped by what we see with employment (and from their – economic growth).

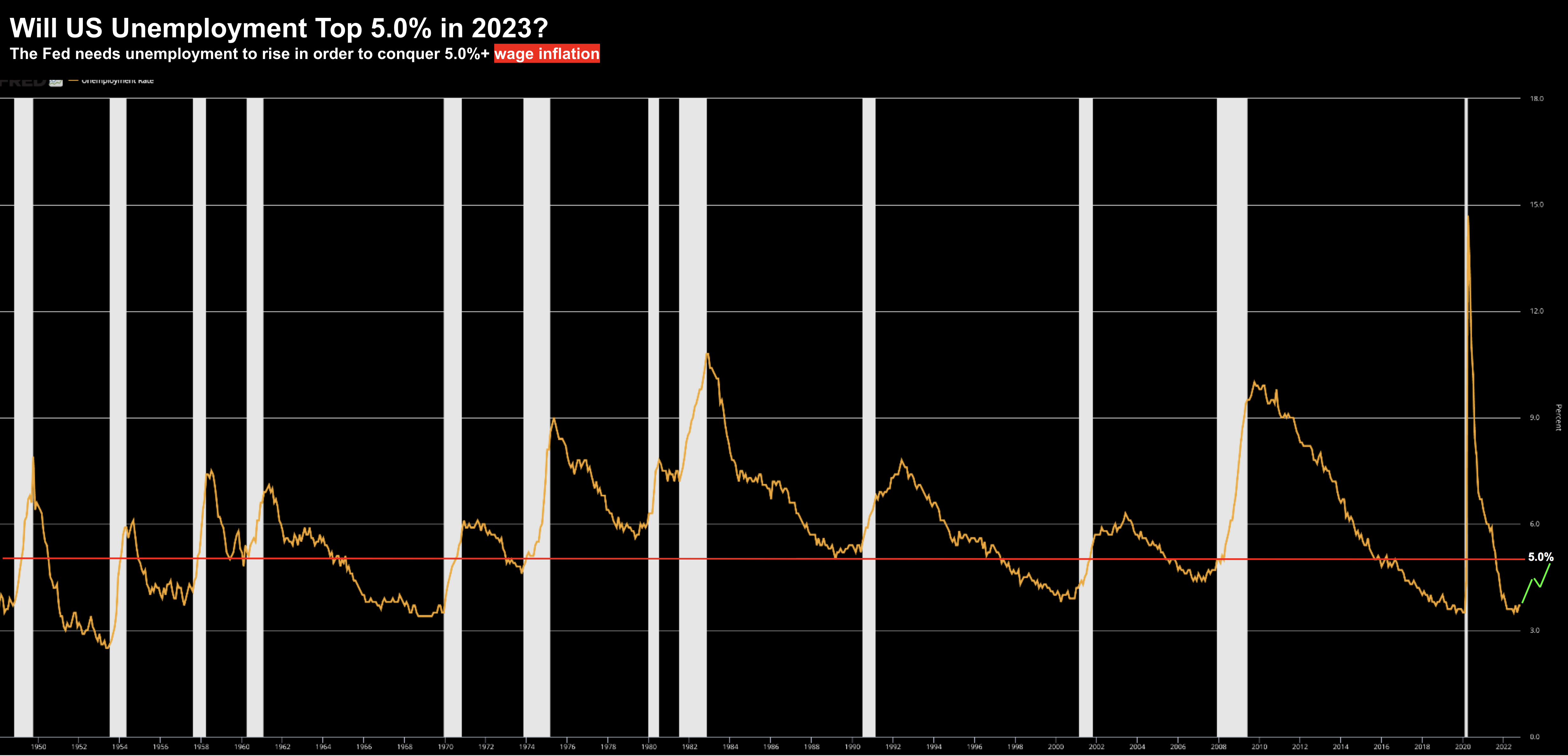

#1. Unemployment Rate

Perhaps more than any other macro economic indicator – this carries the most weight into 2023.

Why?

This will most likely dictate both the pace and duration of (restrictive) interest rates (i.e. anything above ~4.75%).

As we know, the Fed’s problem with inflation is services (and specifically wage growth)

It’s not goods inflation… that is dropping like a stone.

Now part of that problem is a very strong labor market… where unemployment today sits around 3.7% (with the economy still adding around 200K jobs per month)

What’s more, there are something like 10M open jobs in the market.

As the long-term chart shows – this is basically full employment.

Jan 3 2023

The market expects this chart to gradually tick higher… but how high?

For example, if it works its way to around 4.50% to 5.0% and doesn’t go further… that would be the best case outcome for the market.

That would most likely result in a very mild / light recession (and positive for equities – as earnings will contract less)

However, what if the Fed gets this wrong and unemployment climbs to a level of perhaps 8%+?

What’s more, how high will the Fed let it go?

And would 8%+ unemployment mean a harder landing?

Which overlaps with my second chart…. the Fed overshooting.

#2. Positive Real Short-Term Rates

Jay Powell has told us several times the Fed is committed to killing unwanted inflation.

And if that means there will be ‘pain’ (Powell’s choice of words) – so be it.

But what does ‘pain’ mean?

Lower stocks? Lower house prices? Recession? Bankruptcies?

All of the above perhaps.

My way of reading this (and I could be wrong) is the Fed will more likely overshoot on rates than the opposite.

For example, he has told us that the long-term cost of entrenched inflation is far greater than the (short-term) cost of recession.

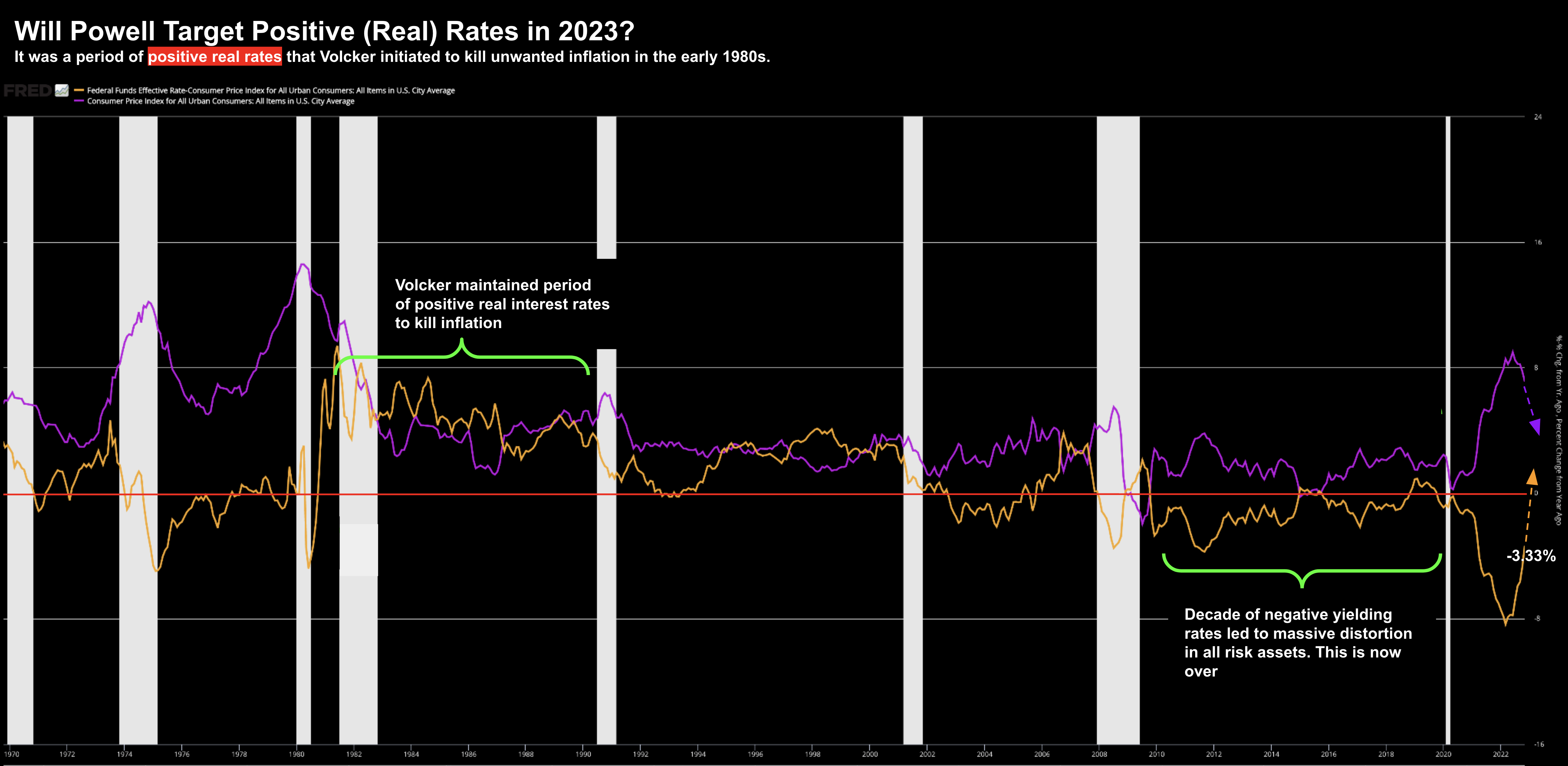

This leads to me to chart #2… Fed targeting positive short term real rates.

Jan 3 2023

- CPI Change YoY (currently ~7.1% and falling) in purple; and

- Real effective Fed funds rate (i.e. adjusted for inflation) in orange

Whilst both are important – what I’m more focused on here is the orange line… currently negative 3.33%

If we go back to the early 1980s (the last time inflation exceeded 8%) – Paul Volcker instituted a policy of positive short-term rates to kill inflation.

It worked.

However, if we look at what we have seen with real rates the past decade, they have remained below zero (red line).

And more recently, they were as low as negative 8%.

What’s important here is we monitor whether this works its way back above zero.

For that to happen it will be a combination of:

(a) the Fed raising short-term rates; and

(b) CPI falling.

For example, let’s say the Fed are able to raise rates to 5.0% and the inflation rate falls to 4.0% – real rates will be +1.0%

Only when real rates are positive will the demand for cash (and cash equivalents) be more attractive.

Put another way, negative rates are inflationary.

Coming back to my first point on employment – if the Fed is to raise the nominal rate to 5.0% (or above) – then expect unemployment to climb sharply.

As I wrote there (“Is the Market Fighting the Fed”) — I think the economy will start to “cry uncle” should the short-term nominal rate hit 5.0%

Question is – does the Fed need to go that far?

Many people are saying no.

But I don’t think we can make that call… not yet.

#3. Gold’s Time to Shine

My personal asset allocation thesis for 2023 is we’re going into a recession.

And if not late 2023… it’s likely to be 2024.

However, I’ve heard some people say (the bulls) we’ve already had the recession (e.g., stocks declining 20%) – but I am less convinced.

If we’re going to have a recession over the next 12-24 months – it would be the most-anticipated recession in US history.

For example:

- Forecasters surveyed by the Federal Reserve of Philadelphia put the probability at 40% – the highest reading since at least 1975

- Economists polled by Bloomberg see the chance of a 2023 slump at 65%

- Bloomberg Economics puts the risk of 100% with a start date of September; and

- Today former Fed Chair Alan Greenspan says recessions risks are now “most likely”

I’m not sure about a “100%” probability (that’s a bold call) – but it would be contrarian to say we’re not going to have a recession.

Over the past ~6 months – numerous leading economic indicators suggest it would be hard to avoid a contraction.

Here are some other notable forecasts:

- Barclays Capital sees 2023 as one of the worst years for the world in four decades

- Ned Davis Research puts the odds of a severe global downturn at 65%

- International Monetary Fund expects a third of the world, at least, to contract

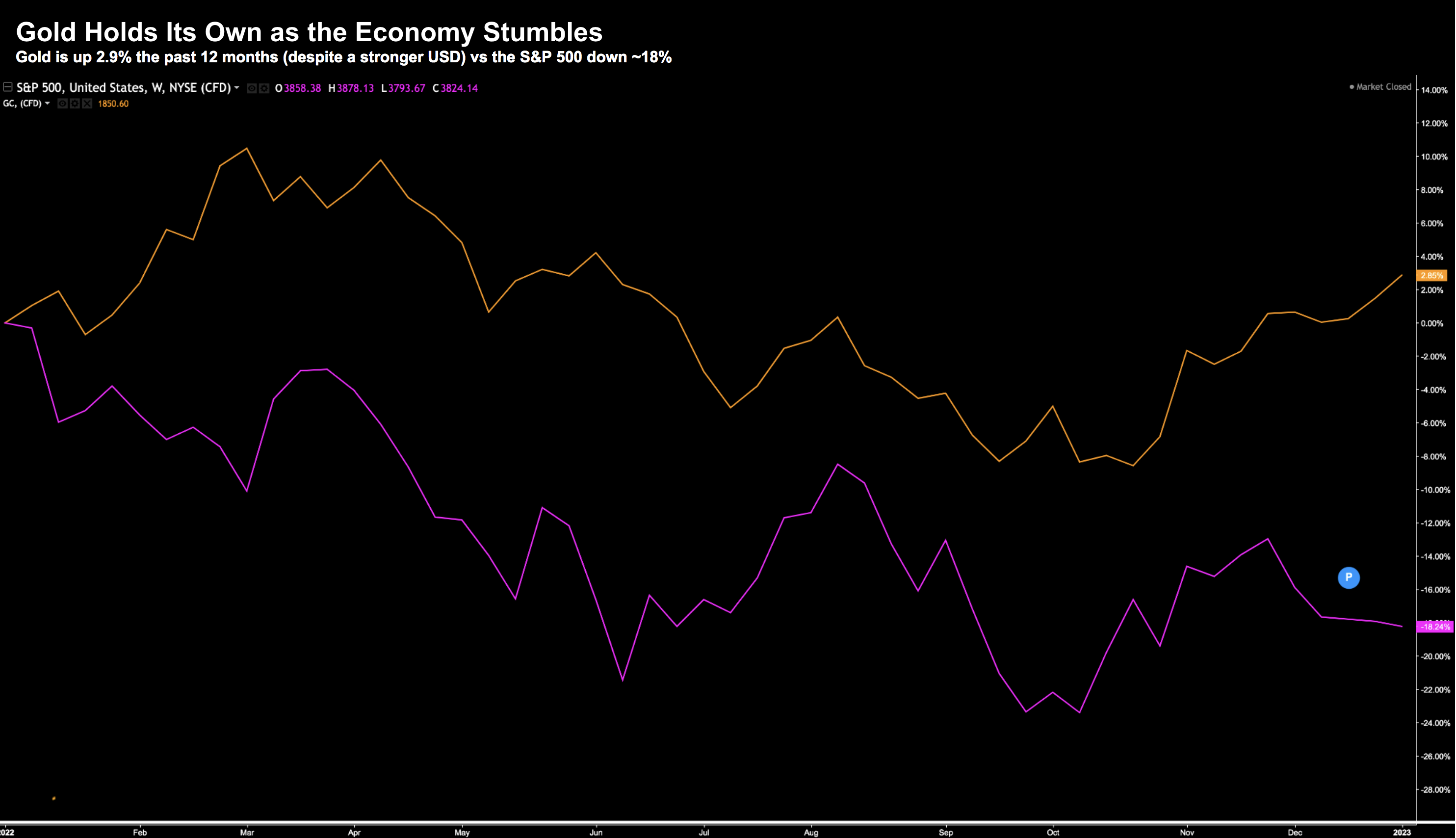

On the basis we do see a contraction, I believe gold has a higher probability to outperform.

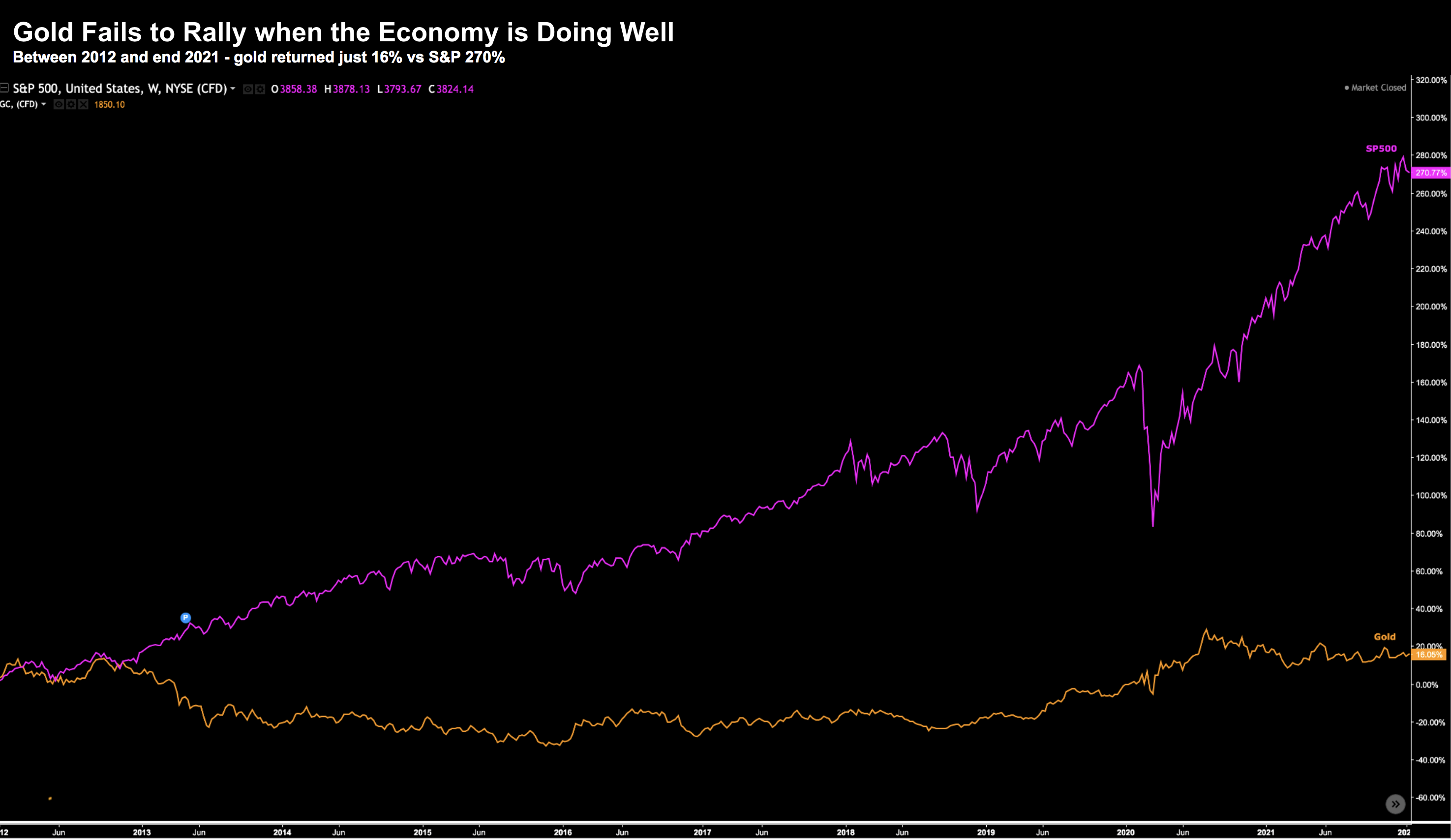

For example, if we invert our thinking (always a good thing to do with any assumption) – we know that when the economy is not contracting, gold fails to perform.

For example, look at the period between 2012 and the end of 2021.

Here the S&P 500 returned 270% (excluding dividends) vs Gold ~16%.

If you had overexposure to gold during the period (as the perma-bears recommended every year) – you did not do well.

S&P 500 (purple) vs Gold (orange) — 2012 to 2021

S&P 500 (purple) vs Gold (orange) — Jan 1 2022 to Jan 3 2023

Let’s look at some targets for the yellow metal using the weekly chart:

Jan 3 2023

Gold remains in a long-term (weekly) bullish trend.

Over the past two years it has twice tested the level of $2,078 and failed.

I think we test that level again before breaking through.

Fibonacci retracement levels offer a target of up to $2,300 (or ~24% upside).

If taking the trade, I would take half profits at $2,300 – raising my stop on the balance to $1,600 (the previous major low)

Note: as the economy starts to recover – look to exit all gold positions.

#4. Tech Lower First – Then to Rally on Fed Rate Cuts

Number four on my list is tech…

It’s been at least 20 years since tech has been this out of favour.

Then again, it’s also been ~20 years since we have seen rates materially rise!

Even Apple is being taken to the woodshed (which I forecast recently) – targeting a price of around $110.

Higher rates don’t bode well for long-duration assets.

Their promise of future cashflows are being discounted.

To that end (and further to recent missives on asset allocation) – tech will struggle under the weight of Fed rate hikes.

However, when (not if) the Fed eventually signals it’s considering the possibility of cuts, it will be time to increase your exposure.

And specifically, I am talking about the four highest quality stocks (i.e., Apple, Amazon, Google and Microsoft)

The problem of course is this could be 12+ months away… we don’t know.

This will depend on the macro factors I’ve discussed above (i.e., sticky wage inflation, unemployment levels, Core PCE inflation etc).

By way of proxy, below is the downside I expect in tech (using the ETF QQQ)

Jan 3 2023

Tech is on the verge of breaking support – led lower by likes of Apple, Tesla and perhaps Microsoft.

At the time or writing, the QQQs are trading at a (well-defined) support zone (~$260).

Should this break (and I think it does) – we could see targets of ~$220 to $230… aligning with the long-term support line.

And if we see prices in that realm – it’s possible some of the higher quality names are trading at forward PE’s well below 20x.

That doesn’t happen often.

Now that doesn’t mean we simply buy it there…

My preference would be to wait until we get a clear signal from the Fed their “rate pause period” is nearing its end – and they are considering cuts.

For now, we remain in a hiking phase through at least May… where the debate on future hikes gets more interesting (I talked about this here).

Could the Fed cut later in 2023?

Of course…

However it’s a function of the (employment) data.

I think it’s lower probability we see cuts this year (which is currently a contrarian view) – then again – I’m not attached to being right.

I have a thesis and I’m open to that being wrong.

What I will be looking to do is increase my exposure to tech (e.g. back to market weight) once we see rate cuts.

Until then… don’t expect tech to outperform.

#5. US Dollar to be a Tailwind

My final chart is the US dollar index…

This was on my list last year however for the opposite reasons.

For example, last year I was calling for US dollar strength on the back of Fed rate hikes (and interest rate differentials).

For the most part, that was the right call.

However, as we get further into 2023, I think we could see US dollar weakness as the Fed’s hiking cycle matures.

(Note: do not confuse that with the Fed maintaining a restrictive rate through 2023)

And if we do see weakness with the dollar index… whilst that will be inflationary… it’s also an earnings tailwind for large-cap tech (and not the strong headwind it’s been for the past 12 months)

Jan 3 2023

For what it’s worth, the dollar is likely to catch a bid in the current zone

Previous resistance will likely become new support.

However, with the weekly trend now turning bearish, probabilities favour lower prices.

And that makes sense given where we are in the rate hike cycle.

If the dollar index can break through the current zone of support… it would be a quick trip lower.

I don’t think the Fed will want that – as a lower dollar is inflationary.

However, it will be supportive of the economy and large-cap offshore earnings.

Putting it All Together

In closing, I think it’s likely to be another volatile year.

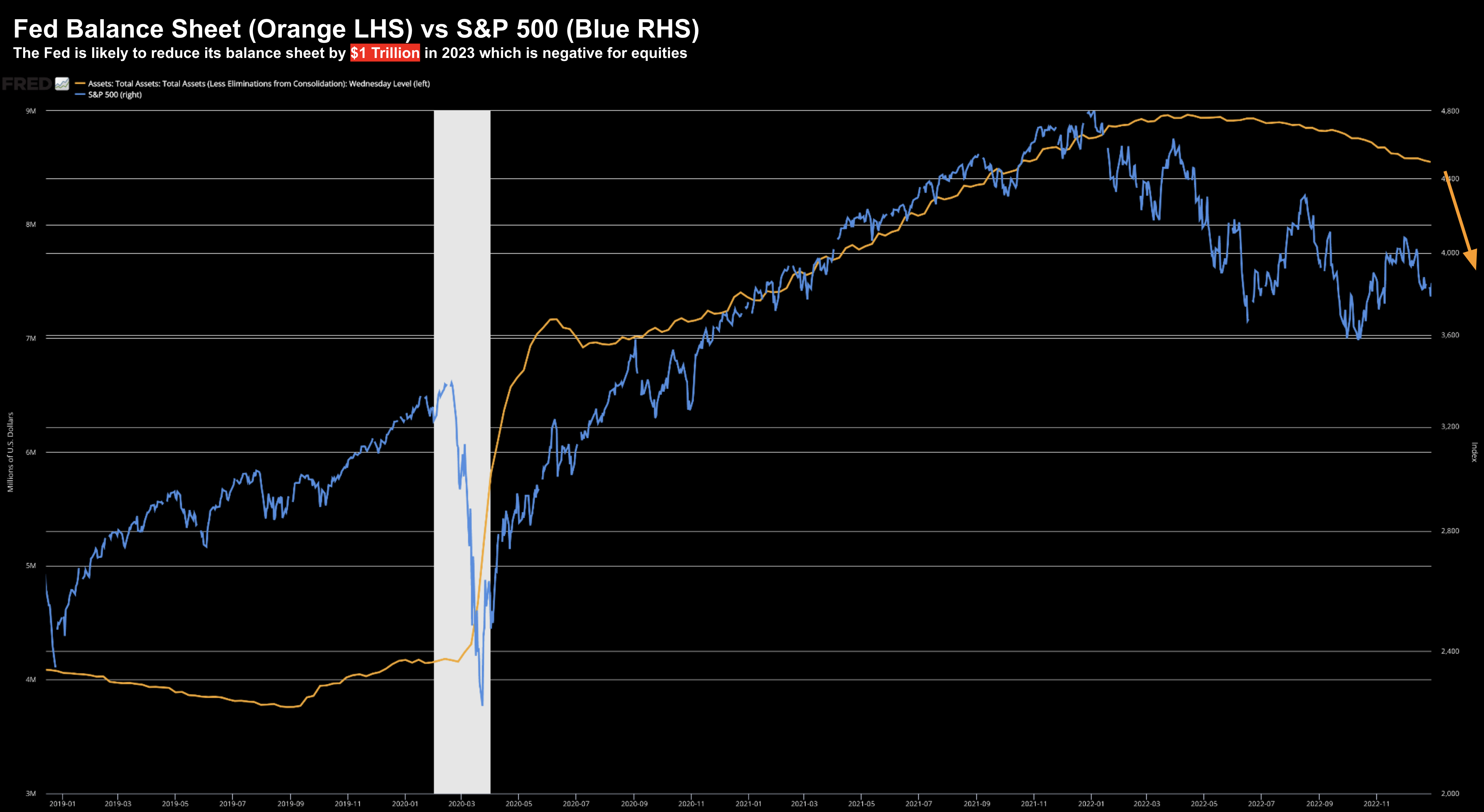

The only other chart I would include was part of my last post: the expected $1T reduction in the Fed’s balance sheet.

Are we underestimating the headwind this represents for equities?

And are there systemic (credit) risks?

I don’t know.

However, we should expect a lot less liquidity in the system.

Outside that, I also question whether the market has fully priced-in the downward earnings revisions to come? For example, I see earnings contracting this year (not expanding as the market believes)

What’s more, will equities be caught offside with how long the Fed keeps rates ‘restrictive’?

For example, some (many?) are of the view the Fed will be quick to pivot to rate cuts. I’ve read some analysts seeing cuts as early as August.

I am less convinced.

For example, what’s to say the Fed are not targeting positive real rates? And if so, does that mean we will see a nominal rate closer to 5.00% to 5.25%?

That’s not what markets have priced in.

However, that’s where I’m leaning at present (pending what we see with the data).

Markets will take their cues by what we see employment and wage inflation.

In closing, my thesis is the Fed is likely to overshoot to ensure inflation is not entrenched. Wage growth needs to come down from over 5% today to levels closer to 2%

That’s going to take time (and much higher levels of unemployment)

This means we still need to play strong defense.

The time to play offense will come when it’s apparent they have the option to cut.

And that’s not something we will see until mid-year (at the earliest).