- S&P 500 finishes higher by 24.2%

- Lessons I took away from 2023

- And thoughts on key investment themes for 2024

2023 has come to a close… and what a year it was.

For many, it will go down as one of the more challenging. For others, they will have banked some very attractive gains.

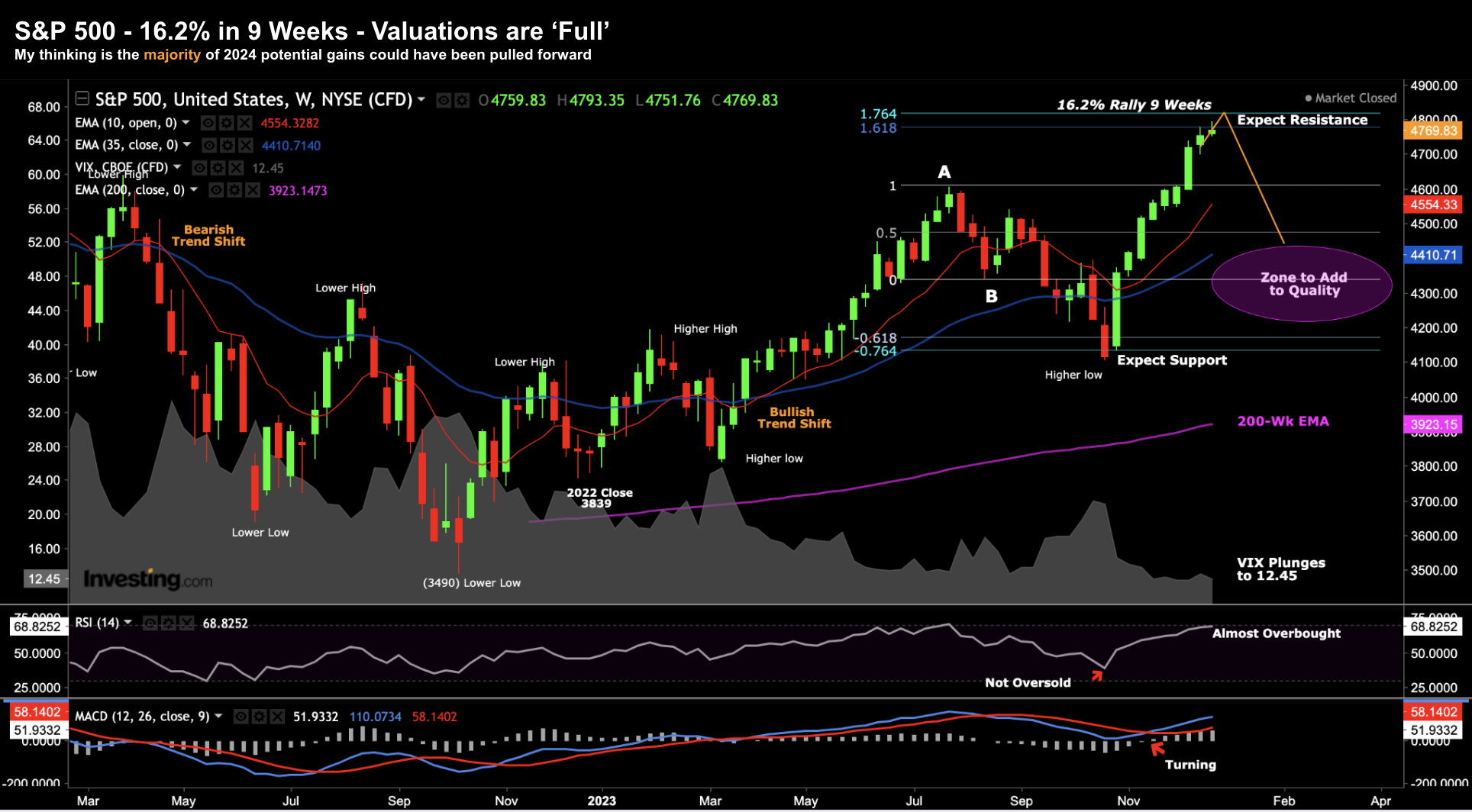

In short, the S&P 500 recovered from its worst year in over a decade – finishing the year 24.2% higher.

The past 9 weeks – the index added 16.2% of those gains.

Below is the weekly chart:

Dec 30 2023

But it was anything but a smooth ride…

By the end of July – the S&P 500 was 20% higher.

However, fast forward to the end of October, year to date gains were just 6.9% as concerns of over stickier inflation, rising interest rates and a regional banking crisis persisted.

Those concerns were swept aside over the past two months – with the so-called “magnificent seven” technology stocks leading the charge.

For those less familiar – the seven includes Apple, Amazon, Alphabet, Nvidia, Meta Platforms, Microsoft and Tesla.

For investors who didn’t have exposure to the above names – it would have been difficult to match (or exceed) the market’s return.

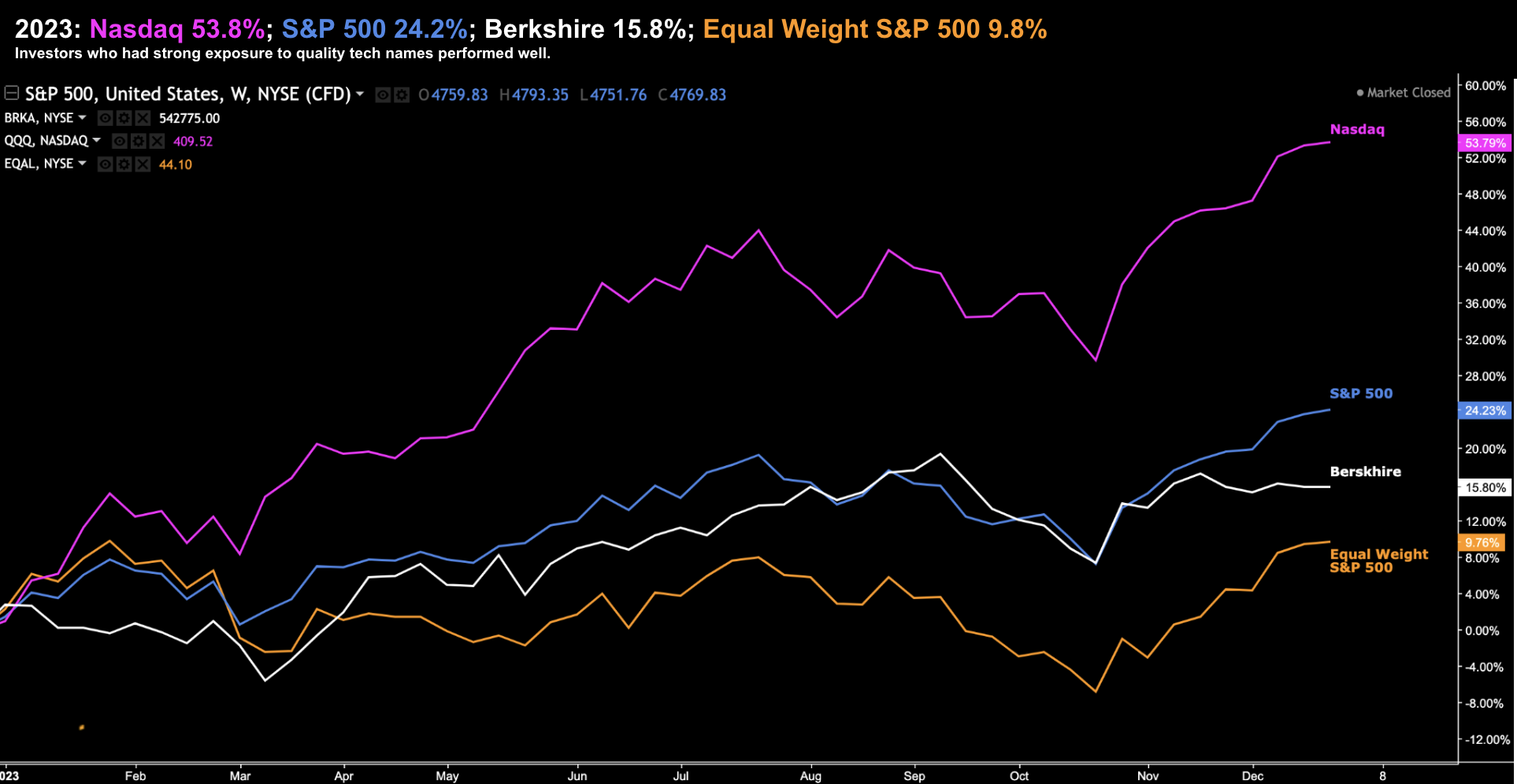

For example, if we consider the tech-heavy Nasdaq – it gained 53.8% this year.

That’s its best showing in more than 20 years.

By way of comparison – the Equal Weighted S&P 500 only returned 9.8% – with almost all of those gains coming in the final two months (on the promise of lower rates in 2024)

December 30 2023

Defensive sectors such as utilities, healthcare and consumer staples were the biggest laggards – pulling down the equal weighted sector.

This should not come as a surprise – as these stocks typically perform poorly when bond yields are high.

As an aside, Warren Buffett’s Berkshire Hathaway (BRK) had another impressive year – returning 15.8%.

It’s also noted that Buffett outperformed the S&P 500 by just over 20% in 2022.

My Performance – A ‘Solid’ Year

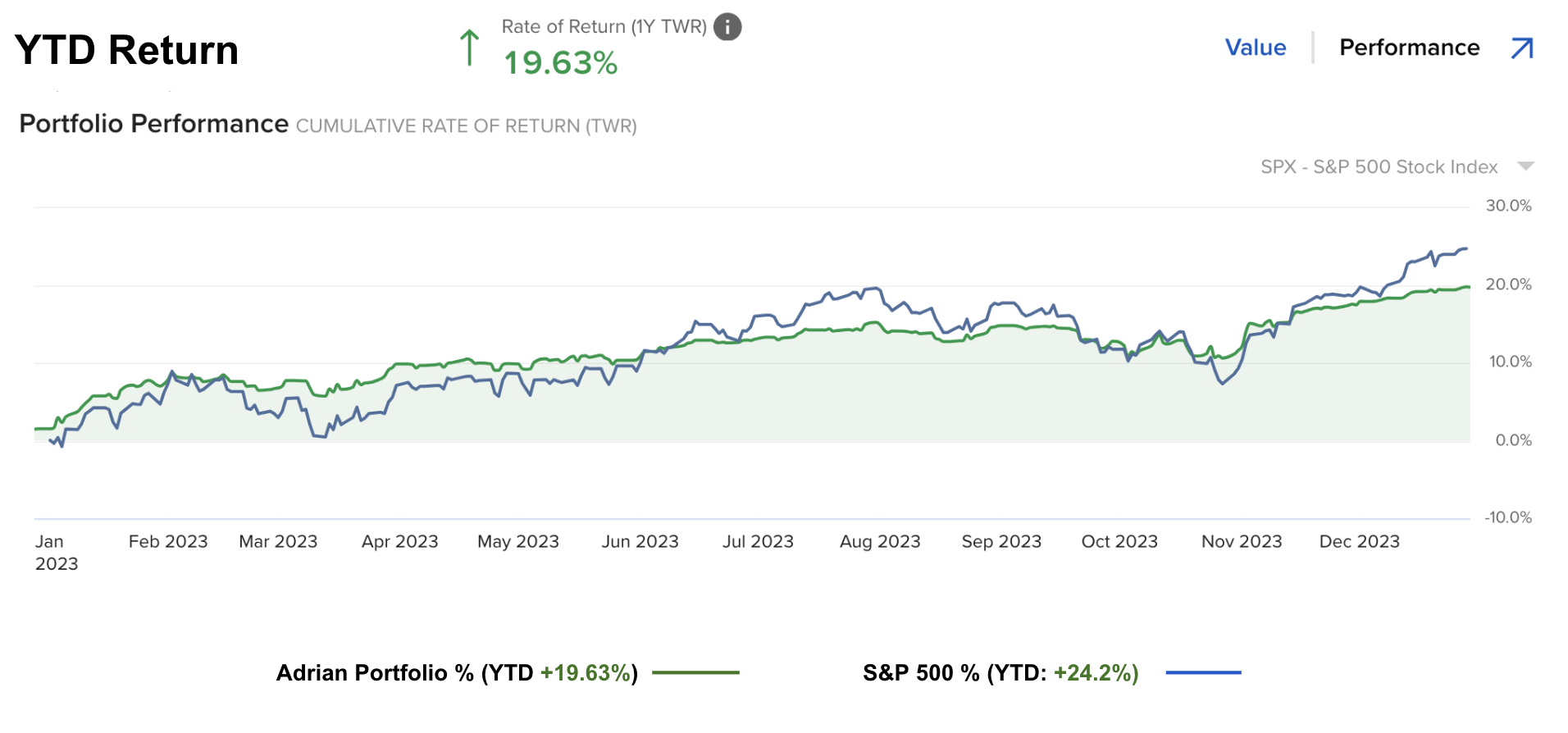

As for my own performance this year – I finished with a return of 19.63%

Dec 30 2023

I would call it a consistent year – managing to stay in the ‘green’ the entire year.

In addition – given the complexities we had to navigate – I will take the ~20% as a win.

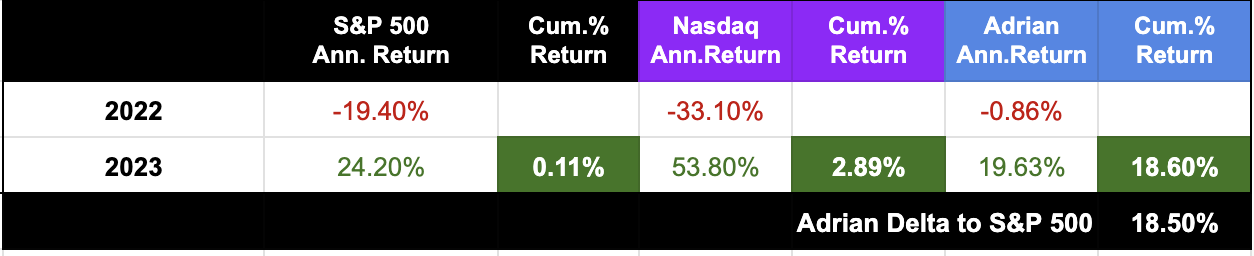

For example, if I consider the last two years performance, you can see how the S&P 500 and Nasdaq have barely managed to claw back into positive territory (0.11% and 2.89% respectively exc. dividends)

But despite the 19.63% gain – I made my share of mistakes (as I do every year).

However, making mistakes is where the ‘gold’ is.

For example, two obvious mistakes were:

- Reducing my ‘magnificent seven’ exposure to ~20% portfolio weight. Market weight is closer to 25%. In hindsight – I should have remained overweight tech – however I didn’t feel comfortable with the stretched valuations (e.g. forward PEs above 30 in some cases). In other words, the downside risk did not handily offset the potential upside reward

2. Similar to the above – I maintained a ~65% long exposure to equities all year. This is on the lower side for me. The power of hindsight tells this was too conservative. Similar to the above point – I felt there were considerable risks to the downside all year.

But given my returns of almost 20% and how much risk I took to deliver that return – I am happy with the result.

Put another way, I could have easily taken a lot more risk in tech names or increased my overall exposure – however that could have easily led to meaningful losses.

And that’s the game we are playing – one of carefully managing our risk.

For example, I never start the day asking how much could I make. That’s the wrong question. I always assess what I could potentially lose if my thesis is wrong (and it often is) and where my exposure is.

On the positive side, I also managed to get a couple of things right along the way:

1. When Meta traded as low as $120 per share (it fell below $90 at one point) – I added exposure to the name – with valuations around a forward PE of 12x. Meta should not trade that low. It’s a very high quality business with tremendous free cash flow and operating margins. I increased exposure – offloading the stock closer to $300.

2. Similarly with Tesla – at one point it traded below $120 – I added exposure. Since then I’ve reduced exposure around $280 per share (as I feel valuations are extremely full) – however I maintain a light position (less than 2% of my portfolio)

3. Perhaps my best trade was meaningfully increasing exposure to bonds when the 10-year yield was as high as 5.0%. I added to bond ETFs such as EDV, AGG and HYG – all of which appreciated handsomely as yields fell from their highs. Please refer to this post (which I issued at the time)

At some point (when the supply / demand equation shifts) – these assets will catch a strong bid. But we are not there yet…

That’s when investors will decide the value (in bonds) is just too compelling.

For example, we’re starting to see a sentiment shift in 2-year bonds – as these yields stabilize (i.e., there are buyers at 5.0%+).

And should economic growth slow next year (my expectation) – it follows that yields will fall. Put another way, buying will start to extend along the curve.

If correct, the price of bond ETFs like TLT, EDV, AGG etc will rise.

To give you an idea of the potential capital appreciation in bonds: If 10-year yields fall ~0.5% (back to 4.50%) – the respective bond price would gain ~13%

At the time of writing (Dec 30) – the US 10-year is trading around 3.9%. This saw the ETF EDV appreciate by around 30% over those 3 months.

And whilst it’s fortunate some trades go our way – the year was challenging.

We were navigating unprecedented waters in terms of inflation risks; 550 basis points of rate rises; the sharp ascent in bond yields; a simmering regional bank crisis; Russia’s terrible invasion of Ukraine and more recently the horrific events in Gaza.

In short, there was a lot that could have easily gone wrong. And there was no shortage of permabears calling for an imminent market crash.

But there was no crash.

Tip: be very wary of permabears – they’re dangerous. Sure – they make for a good headline (that’s what the media wants) – but most of the time they lose investors money. Stocks will always rise far more than they fall over the long term.

Looking Ahead to 2024

With ~20% gains locked away for 2023 – how do I feel about 2024?

In three words: cautious… but invested.

I expressed the same sentiment in early November – and it hasn’t changed a great deal.

If anything – with the 16.2% rally over the past 8-9 weeks – my forecast for a solid pullback in the first half has increased (e.g. from 60% probability to 75%)

Not only do things look close to overbought from a technical perspective (e.g., the weekly RSI) – fundamentally valuations are not attractive.

As I wrote two weeks ago – there are echoes of late 2021 / early 2022.

From mine, this is the primary risk heading into the new year.

The market knows the Fed will commence its easing cycle at some point in 2024 (perhaps most likely towards June) – and is already pricing in more than four cuts by year’s end.

What’s more, it’s pricing in earnings growth in excess of 12%.

For me, that’s aggressive.

Sure, the market however is right that inflation is likely to keep trending lower. And whilst the fight isn’t quite won – there’s a very high probability it will get back to the Fed’s objective of 2.0% in ~2 years (i.e., greater than 90%)

In addition, with inflation trending lower and economic growth slowing, there’s also a high probability we have seen peak bond yields this cycle (e.g. 5.0% on the 10-year).

That said, with the 12-month bills trading around 4.76%, this does not make stocks look attractive.

For example, with the market trading at 4769 and earnings expected to be $235 per share (assuming 12% YoY growth) – that is a forward PE of ~20.

Inverting 20x – we get a forward earnings yield of 5.0%

That’s a lot to pay given I can secure a risk-free 12-month note for 4.76%

But here’s the thing:

I also believe that 12% YoY growth in earnings will not be easy. And it will be made especially difficult if we:

- A 10-year move back above 4.0% (which I expect we will see); and

- A general slow-down in the economy (if not a recession)

To meet these numbers, companies will have to cut the size of their labor force; scale down operations and focus on margins due to slower consumer spend.

And that’s the other major consideration for next year…. how strong is the US consumer?

For example, will they accelerate their spending next year? And if they do – what will they use?

More credit?

From mine, it’s a lower probability outcome (e.g., 25 to 30%) – as consumers feel the pinch of higher rates and lower net savings to draw down.

What’s more, they are close to tapping out their credit cards today (with credit card levels hitting record highs and delinquinces sharply rising).

Below is zone where I would be increasing exposure to quality stocks (or the Index itself) next year:

Dec 30 2023

- Earnings expand ~7% next year to $225;

- S&P 500 trades around 4300;

- A forward PE multiple of 19.1x

As a result, 4300 is considered the higher range of what I consider reasonable ‘value’.

However, at 4100 with earnings at $225, we’re buying the Index closer to 18.2x forward – inline with the 10-year average (but well above the 100-year average of 15.5x)

For example, my core positions in stocks such as Apple, Google, Microsoft and Amazon did well for me this year – which was fortunate.

That’s luck. It wasn’t skill.

But I don’t expect these names to lead next year – not at the current valuations. If anything – I expect them to pull my performance down – however will maintain some exposure (continuing to take a long-term view)

Putting it All Together

2023 was one of the more difficult I’ve had to navigate.

I hope my blog was able to shed a small amount of light on how I made decisions – carefully weighing the risk vs reward.

Put another way, I like to think like the fox (and not the hedgehog).

The media on the other hand enjoys hedgehogs (e.g. ‘stocks will rally 20%‘ or ‘markets will plunge 30%’)

For example, whilst I was fortunate to get away with a ~20% return this year – it could have easily been a “10-15% loss” given my high exposure to tech.

To that end, there is a high element of luck with asset speculation. Anyone who thinks its entirely skill is misguided.

For example, good decisions combined with solid process will occasionally have bad outcomes.

That happens and we expect it.

And whilst I work hard to consistently apply the skills and processes I’ve learned – you still need some things to go your way. This year they did (for the most part).

As we look forward – below are my key themes for next year:

1. Rates have likely peaked this cycle. If that’s true – we will need to look at further portfolio diversification and the balance between growth and more defensive names. This is why I was saying earlier that I don’t think tech will lead next year;

2. If economic growth slows – we should look to high quality and low volatility names (e.g. Coke, Johnson & Johnson etc) – which carry highly predictable earnings and offer strong free cash flows. Note – I recently added to my Coke (KO) holdings around $53); and finally

3. feel we’re in a late cycle environment with both economy growth and monetary policy. Late cycle is where employment is essentially full and unemployment starts to increase; inflation comes down (opposite slower consumer spend); and the Fed is close to easing. If my thesis is correct – it’s typically a poor time to meaningfully increase exposure to risk assets (as some investors have done in the past 8 weeks).

To that end, it’s pointless to offer a forecast of where I think the S&P 500 will finish 2024.

That’s what a “hedgehog” would do. It makes for a good headline but not much else.

Think more like a fox.

All I will be focused on (as I was this year) is buying quality at value prices which represent a good long-term risk/reward.

That’s how this game is played.

For example, if we see the S&P 500 pull back to 4100 in the first half – I will be sniffing around for quality assets in the sectors I think will outperform.

Now heres the thing:

Those first half investments may lose value (or do nothing) in the second half of the year.

That won’t bother me.

If they’re still strong businesses and nothing material has changed with their earnings story – I will likely increase my position. I want to find high quality assets at a good price.

That’s why I don’t care where the S&P 500 finishes next year. It could be “3800 or 5000” – it makes little difference.

What we want to always do is buy quality at a good price. Put another way, it’s not just what we buy, it’s equally how much we pay.

You could easily lose a lot of money buying “Apple at $200” at 30x forward.

With that, I hope everyone is enjoying a terrific holiday and had a very profitable and prosperous 2023. And if it wasn’t profitable – I’m sure you took away some valuable lessons.

Those with a growth mindset (vs one which is fixed) never stop learning (and look forward to the opportunity to learn).

I will be back tomorrow with one last post for 2023 – a list of books that I’ve read recently which has been helpful with my own decision making process.