- Bond markets are dictating terms to the Fed

- Did the Wall Street Journal just ‘leak’ a Fed 75 basis point hike?

- S&P 500 down 22%+ is great news for patient investors

Ugly? Brutal? Black Monday?

That’s how mainstream might describe today’s price action.

How about none of the above!

Yes – most major indices are down ~9% in just 3 days (or ~22% from the all-time January high)

Now pending your lens – this is either great or terrible news.

I’m in the former camp – and things are (finally) coming into focus.

It’s not a time to panic – it’s a time to get excited.

To that end, patient investors are about to be given a rare long-term opportunity.

Unfortunately those who overpaid for risk assets will feel a bit of pain for a few years (and may not have the ability to capitalize on lower prices).

But these “discount windows” (as I call them) do not come around too often. However when they do – you also need the courage to act (assuming you have the capacity).

S&P 500 Breaks 3800

As part of this blog, I’ve been expected a strong move lower in equities to put more cash to work (where I currently sit on ~35% cash)

Today the S&P 500 broke through an important technical level.

For example, here I suggested the level of 3800 was likely to break soon. Today it did just that – trading as low as 3749

Below is the weekly chart (updated for today):

June 14 2022

Quick technical (and fundamental) update:

- 3588 to 3700 is a zone I expect to see interim support – where (a) 3588 is the previous high of Aug 2020; and (b) 3700 is 76.4% outside the retracement labelled A-B

- 3600 represents a forward PE of ~15.5x – assuming the “E” is $232 for the S&P 500

- At $232 per share would represent earnings growth of ~4% year on year

With respect to the fundamental metrics outlined above – here’s Factset from June 10th: .

- Earnings Growth: For Q2 2022, the estimated earnings growth rate for the S&P 500 is 4.0%. If 4.0% is the actual growth rate – it will mark the lowest earnings growth rate reported by the index since Q4 2020

- Earnings Guidance: For Q2 2022, 71 S&P 500 companies have issued negative EPS guidance and 31 S&P 500 companies have issued positive EPS guidance.

- Valuation: At 3900, the forward 12-month P/E ratio for the S&P 500 is 16.8. This P/E ratio is below the 5-year average 18.6x; and below the 10-year average 16.9x

Consistent with earlier missives – you can stay patient as the market wrestles with the uncertainty surrounding the Fed’s next move; and sharply higher bond yields (more on this below)

For example, we got the expected ~10% bounce to the 10-week EMA – where the S&P 500 was met with selling pressure at 4177.

This is how bear market functions; i.e., short sharp rallies which generally see resistance.

My expectation was to expect selling pressure in the realm of 4200 to 4300.

We are now trading the next (expected) “leg” down – sketched in with the dashed white line.

And whilst I think we go lower – buying in the zone of 3500 to 3800 represents good risk/reward if your horizon is at least 2 to 3 years.

That said, there is nothing to stop the market having a big liquidation event. In other words, don’t assume “3500” is the 2022 low… it could be at least 10% lower.

I don’t pretend to know where that level is… however if I zoom out I believe this will be an extremely rewarding long-term entry point.

Bond Market Unsettling Equities

It’s often said that “where bonds go – so go equities”.

And this is exactly what is taking shape.

Bond prices are thundering lower – which is sending yields higher (they trade inversely to each other)

For example, below is the US 10-Year Yield – which screamed to a new high of 3.36% – this highest level in 11 years.

Translation: for the first time in a decade this is now an alternative investment.

June 14 2022

This is the primary source of the volatility we are seeing in equities (especially tech stocks).

Very few (if any) expected these kinds of moves.

As a result, for equities to find their footing (at whatever level) – we will need to see the bond market calm down.

For example, it’s rare to see the 10-year yield accelerate to the upside at this velocity. And it’s the pace of the increase which is knocking equities off balance (not to mention the correlating move in the US dollar index)

However, we should also note that it’s the bond market leading the Fed (not the other way around).

Bonds have been telling the Fed for ‘months’ they have it wrong. Today’s strong move higher in yields just put an exclamation point on that.

The “good news” is I think we will see the US 10-year yield start to turn lower soon.

From a technical lens – bonds are extremely oversold (i.e. the yield is now too high) – which suggests we could see them catch a bid soon.

And if that’s the case, and bond yields fall, it’s likely equities will bounce.

Wall St Journal ‘Leaks’ Fed Move

With respect to the move in yields – perhaps driving this was the following headline from the Wall Street Journal today:

If you recall my previous missive – I lead with these three bullet points:

- CPI hits 41-Year High of 8.6% YoY for May

- Why the Fed Should Announce 75 bps next meeting; and

- Expect 3800 to break as support for the S&P 500

I made the case why the Fed should announce a 75 basis point hike this week – and not 50 bps as expected.

But if there is one thing we know about the Fed – they do not like to surprise markets.

For example, as part of their last meeting, they said that 75 basis points was not even a consideration (which I said was a mistake)

Now the Wall St. Journal article could be a deliberate Fed leak… as the market starts to price in the 75 bps hike.

And whilst I think the market will be fine with 75 basis points – what it wants to hear is how hawkish they are looking forward.

For example, is it now “75, 75 and then we will see“?

Who know – but 6 weeks is a long time between meetings in this climate.

Irrespective, expect a very hawkish Fed.

For example, if they fail to act on the 8.6% CPI read from last month, they are essentially saying they are not really acting on the data.

And from there – they risk losing even more credibility.

The Fed no longer has the option of tip-toeing with inflation. The gig is up.

What’s more, the market wants them to get on top of this.

No Soft Landing

If you have taken anything away from my blog this year… it’s this:

This plane is not landing softly for equities..

And if Fed Chair Jay Powell was to land the plane softly – then we should call him “Captain Sully” (see this missive from April)

There is no easy way out for the Fed (or the market)

And from that perspective, the risk to equities remains to the downside in the near-term.

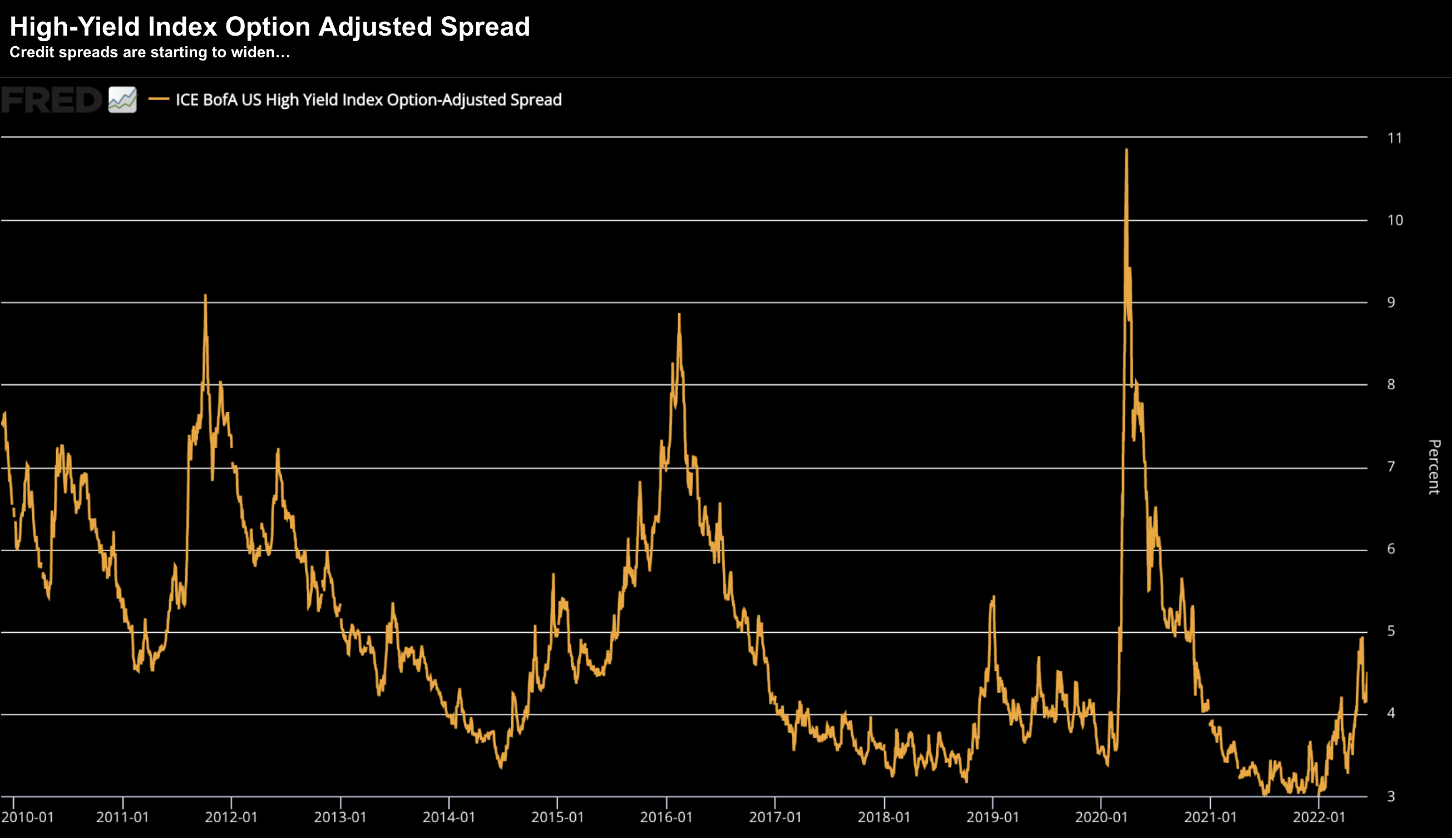

Again, look no further than rates and credit markets.

With respect to the latter – credit spreads are now as wide as they have been since May 2020.

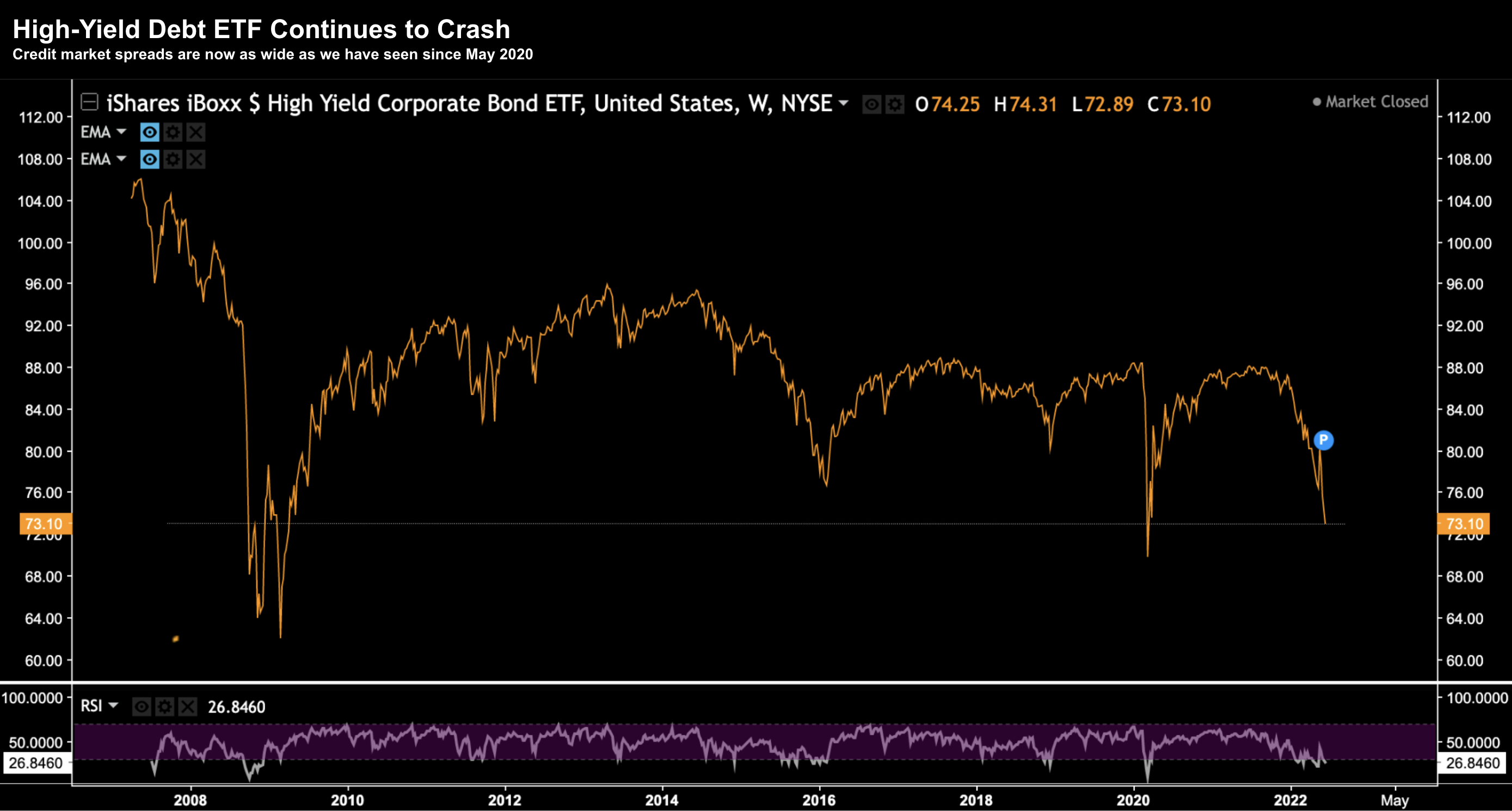

And related to the above – take a look at the monthly chart for the popular high-yield debt (using the ETF HYG)

June 14 2022

Nothing screams of “recession right ahead” than this chart…

As you can see, it’s not often we see panic selling in credit markets. But when we do – we should take note.

The thing is – on previous occasions – the Fed rushed in and bought all forms of debt (including corporate debt over the pandemic)

Not this time.

The Fed has exited the building (for now at least).

And in the absence of the Fed – what the market will need to see is for the HYG to start putting in a bottom (or credit spreads to narrow)

Therefore, the question you need to ask is how much of this is now reflected in the current equity risk premium (especially with 10-year bond yields above 3.3%)?

To that end – there is more to go.

For example, the S&P 500 trading around 3500 is well within sight (especially if the 10-year continues to trade north of 3%)

Putting it All Together…

Two other quick points before I wrap up…

The VIX hit a level of 35 today.

From mine, that’s good news.

Things are now looking more like the “flush” I wanted to see. However, I think there’s more…

Second, sharply lower stock prices is typically a self-fulfilling event. In other words, it will damage the so-called “wealth effect”.

And this is exactly what the Fed wants to do.

For example, if people feel wealthier (via higher stock and/or house prices) – they will feel better about spending / borrow more.

And that drives inflation.

But as stock prices plunge 20% (or more) – this can have the effect of damaging consumer’s behaviour.

For example, they tend to worry more… they borrow less… they spend less… which results in inventories moving higher etc.

And from there, the outlooks for overall growth and earnings all come down in unison.

Again, this is by design. It’s how the Fed will conquer unwanted inflation.

This pathway was never going to be smooth.

But that’s okay…

What it does is offer us a (rare) long-term opportunity to establish core positions in high quality assets (or the Index itself) at far more reasonable valuations.

Patience is generally rewarded when it comes to the game of speculation.

But you will also need the conviction to act (despite the strong bouts of volatility we will get the next 12+ months).

Equity gains are never in a straight line.