- Recession risks should not be ruled out

- Bond markets continue to ask questions… why are 10-yr yields rising?

- Deficit spending at ~7% of GDP is unprecedented during economic expansions

My last post was titled “Time to Forget About Recession Risks”

After the Fed initiated its (inevitable) easing cycle with a jumbo 50 bps cut – the soft landing script kicked into full gear.

Markets roared higher on the news – as they price in strong economic growth in the months and years ahead.

And who knows – maybe that’s what we get?

But have you noticed what we’ve seen with bonds post the Fed – especially the long end?

Those yields have been rising – not falling.

The closely watched benchmark US 10-year yield for example is up 17 basis points (where one basis point equals 0.01%.)

That wasn’t Powell’s plan.

He expected market rates to fall – not rise.

Sept 26 2024

So why are interest rates rising despite the Fed trying to steer them lower?

Bond Market Skeptical

A few weeks ago, my recommendation was to take profits (or reduce exposure) if holding long-duration treasury bonds (e.g., the 10-year and beyond).

In other words, my expectation was bond yields would rise causing bond prices to fall.

I personally took half profits on my EDV position (which benefited from falling yields).

Now part of this rally in yields is the bond market simply getting “too far in front of its skis.”

In other words, bonds were pricing in far too many cuts.

They made a similar mistake in January

But that might only be part of yields pushing higher…

Another possibility is the Fed’s willingness to tolerate higher inflation as they pivot their focus to employment stability.

We will get a read on the Fed’s preferred measure – Core PCE – tomorrow.

And whilst the market expects a softer print – it’s something which bears watching over the coming months as the Fed continues to ease.

The third part of the equation (which has my full attention) is the ever-increasing onerous government debt and deficit burden.

Both sides of the aisle will continue to borrow and spend… a trend which is not sustainable.

But what party is going to address the issue?

If you do that – you will not be elected.

Reduce any form of government benefit and that’s the end of your political campaign.

However, fiscal recklessness is likely to raise borrowing costs – irrespective of any actions the Fed take.

Powell has warned Congress of this issue several times…. however his warnings remain ignored.

A “Bear Steepener“

But here’s where recession risks get interesting…

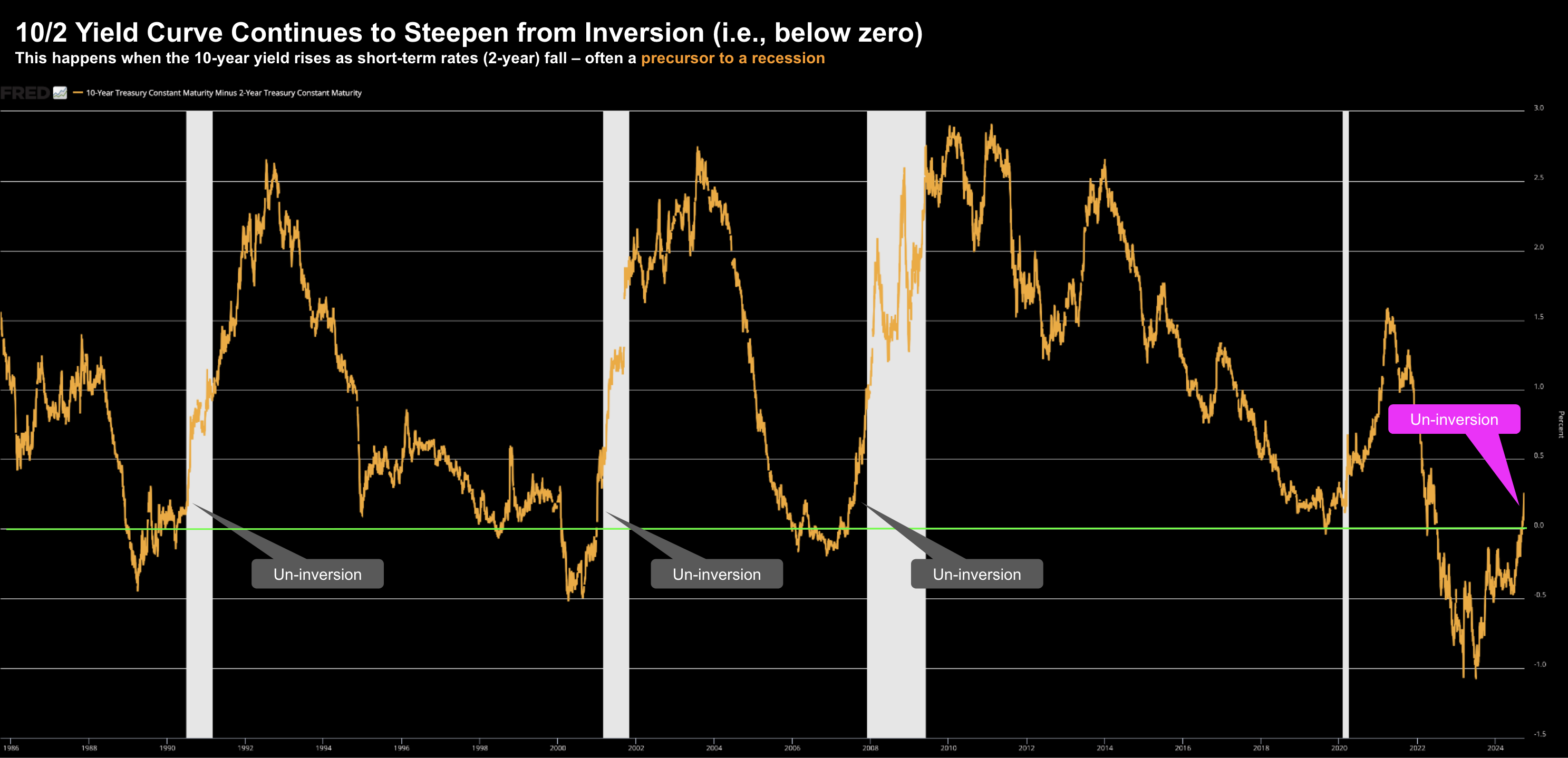

For example, one of the reasons I think it’s foolish to rule out that risk next year is the un-inversion (and re-steepening) of the 10/2 yield curve.

Sept 26 2024

Take a look at what we saw following the previous three “un-inversions” and re-steepening of the 10-2 yield curve.

Not long after – there was a recession.

The difference between the 10- and 2-year yields has widened significantly – approx 12 basis points – since the Fed meeting.

This is what markets call a “bear steepener”…. and I don’t think it’s getting enough attention.

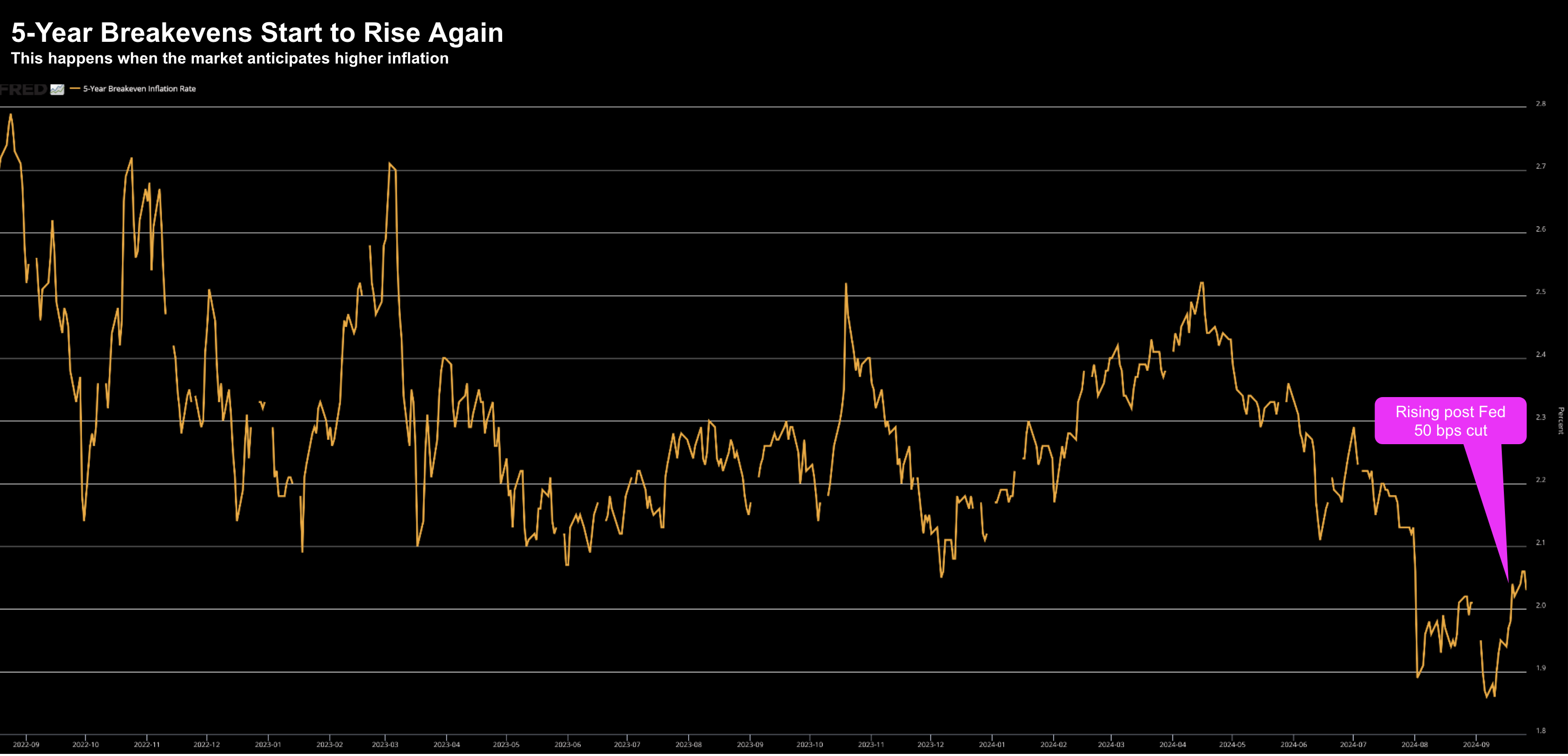

Now generally this is the bond market anticipating higher inflation ahead.

And we see that showing up in the “breakeven” inflation rate; i.e., the difference between standard Treasury and Treasury Inflation Protected Securities (TIPS) yields.

The 5-year breakeven rate, for instance, has risen 8 basis points since the Fed meeting and is up 20 basis points since Sept 11th

Sept 26 2024

From mine, this rise in yields is an early indication that (bond) markets expect inflation could creep higher – as the Fed ‘trade’ that risk against achieving supporting (full) employment.

In other words, ‘balancing the risks’.

Putting it All Together

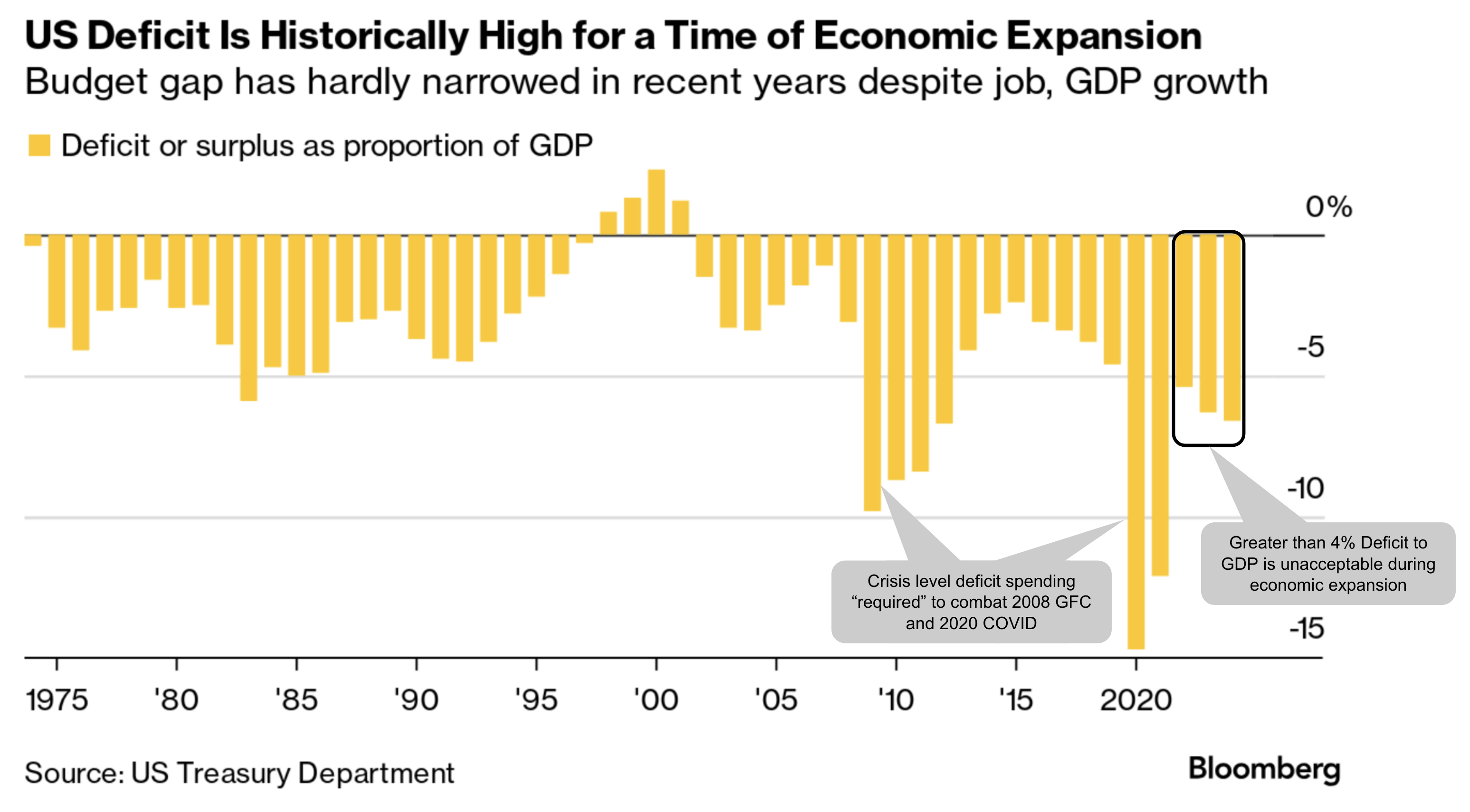

From mine, the bigger concern is government deficits and debts.

I don’t think inflation is a large risk (but deserves watching) however the mounting debt situation is clear and present.

For example, higher borrowing costs have pushed financing costs for the budget deficit this year over $1 trillion for the first time.

Interest costs alone exceeded the expense for defense (where the rate paid is measured against the 10-year – not the Fed funds rate)

It’s true that lower rates will help lower that burden – 10-year and 30-year (long end) treasury buyers will be wary of a deteriorating fiscal situation.

For example, the current government running a deficit of ~7% of GDP during an economic expansion is unprecedented.

The thing is – that level of deficit spending is reserved for economic emergencies (e.g., recessions, wars, COVID etc)

I shared this graphic a few months ago – highlighting the level of spending post COVID.

My advice:

Lighten your exposure to the long-end of the curve.

These yields could easily trade well above 5% or 6% over the next 3 or 4 years – which would wreak havoc.

As one reader emailed me “the world is not ready for a 10-year at 6.0%”

They are not.

Keep an eye on the “bear re-steepening”… it deserves your attention. This is a risk to equities.

And should this continue (e.g., 10-year yields rise as the 2-year falls) – then recession risks increase.

That is not something equities are currently pricing in – as they achieve all-time highs – trading near 21x forward earnings.