- US 10-Year to push higher

- Year-end rate expectations up 100 bps in just 4 weeks

- Fed President Waller warns of higher than expected rates

Markets are fixated on one chart:

The US 10-Year Treasury yield.

And for good reason – it’s the center of the financial universe.

Every financial asset is effectively ‘tied’ to it.

The big news is this US treasury is trading back above 4.0% – it’s highest level since last November.

It’s not surprising to learn that US mortgage demand just hit a new 28-year low.

Econ 101: make sometime more expensive – expect less of it.

Higher bond yields matter.

2 weeks ago – I talked about the longer-term opportunity about to be gifted to patient investors on a higher 10-year yield

So far – this looks like playing out – but a little more time is needed.

Let’s set the scene with the weekly chart…

US 10-Year Yield Spikes

Over the past 5 weeks, 10-year yields have moved from 3.33% to 4.05%

That’s a move of some 22%

March 2 2023

Technically this chart looks like it has room to the upside.

However, I think it finds resistance around 4.40%.

As an aside, look how the 35-week EMA (blue line) acted as a general zone of support since the trend turned bullish late 2021 (highlighted by the blue arrows)

Similarly, it acted as resistance on the way down (with the trend bearish)

This is why I choose these two weekly moving averages.

Now fundamentally, I’ve been writing how the bond market has (finally) connected the dots that rates are likely to stay higher for longer.

Just took them a while.

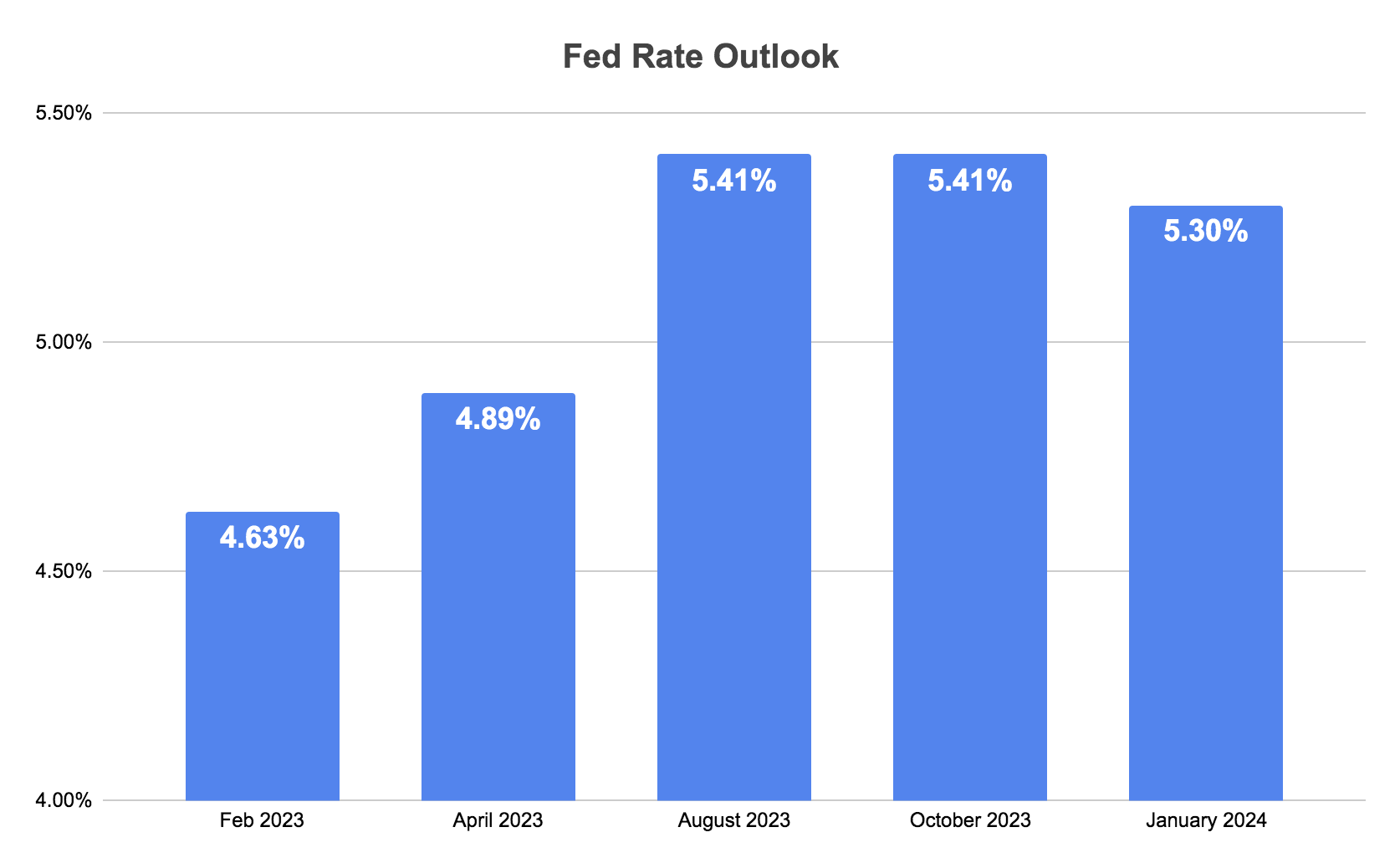

For example, year end rate expectations have now risen 100 basis points in just 4 weeks.

That’s unheard of.

We’ve never seen anything like this in the last 40 years.

Then again, we have also never injected an additional $4 Trillion into the economy in 2 years… while anchoring rates at zero either!

Unintended consequences you might say.

Moving on…

Why this Matters…

Whether you are financing a new home loan, a car, paying off your student loan or credit card… this matters.

What’s more, these yields enjoy a strong inverse correlation with the S&P 500 (white)

March 2 2023

In short, higher yields are painful for stocks.

It’s no secret – the cost of funding is higher.

And any company needing to secure additional funding (or refinance maturing debt) is going to pay a high price.

That hurts the bottom line.

Now if we see the 10-year back to 4.4% – it would not be unreasonable to see the S&P 500 at levels ~3600.

And this is my expectation…

That said, if the 10-Year reverses on a more dovish Fed (less likely), the market could rally.

In summary, I see this move as the bond market pricing in 3 more 25 basis point rate hikes this year.

I put this chart together the other day:

That will put the effective Fed funds in the range of 5.50%

However, there is still an open debate on whether that pushes to 5.75% by July or September given the exceptionally strong inflation and job prints of late.

The Pivot Debate

- how long will the Fed hold rates in the range of 5.50%; and secondly

- at what point will they eventually pivot?

My consistent view (based on the data I’ve seen) is I don’t see a rate cut in 2023.

Many do… but I don’t.

However, I do think rate cut probabilities increase as we get further into 2024.

And the reason is we are simply not seeing any real pain yet.

For example – we are not seeing pain with:

- Households and their relentless desire to spend (with money they don’t have);

- Companies and reducing their workforces; and lastly

- Zero pain with stock prices.

Given this… why would the Fed choose to cut rates with core inflation more than double their target?

They have no need to.

Now many will argue the Fed are over-tightening – making another policy mistake.

Of course they are!

The yield curve tells us that.

But I also think they are not worried about making that ‘mistake’.

My view has always been the Fed will also choose a recession if it means eliminating unwanted sticky (wage) inflation.

The “bigger mistake” (from their lens) is unacceptably high (systemic) wage inflation (e.g.,4%+).

That leads to sustained unwanted inflation for longer.

And maybe we start to see some signs of genuine pain once rates press 5.0% to 5.25%?

I don’t know… but there are limited signs so far.

Putting it All Together

Bond markets finally got the memo there is more work ahead for the Fed.

They were slow on the uptake.

This is why the 10-year trades back above 4.0% and is likely to trade higher.

However, there are those who are still leaning dovish (i.e. equities).

Let me offer this:

Equities have been wrong on a dovish Fed for 12+ months.

They keep wanting (or hoping) to hear news of rate cuts… but it’s not coming.

Not yet.

At some point – the doves will get it right when Powell believes they have convincingly won the inflation fight.

But it’s not now.

And it’s not likely in the next 6 months.

“Recent data suggest that consumer spending isn’t slowing that much, that the labor market continues to run unsustainably hot and that inflation is not coming down as fast as I had thought”

Even if data to be released later this month were to show hiring and inflation cooling again, Waller said, he would still favor raising the Fed’s rate to a range between 5% to 5.5%, up from about 4.6% now.

And if the economic figures were to “continue to come in too hot,” he said, the Fed’s key rate “will have to be raised this year even more to ensure that we do not lose the momentum that was in place” before the robust January economic reports.

Are equities pricing this in?

Not yet.